Good morning. Happy Monday. Hope you had a great weekend.

The Asian/Pacific markets closed mostly up. Hong Kong, Singapore, Australia, India, Malaysia and Taiwan each rallied more than 1%. Europe is currently up across-the-board. Germany, Austria, Belgium, Amsterdam, Norway and Prague are up more than 1%. Futures here in the States point towards a positive open for the cash market.

The dollar is down 0.05%. Oil is down, copper is down. Gold is up, silver is down.

VIDEO: Divergence Between Oil and Oil Stocks Helps Spot Opportunity

The entire world is feeding off last week’s US strength. Indonesia and Brazil are the only markets I see not posting a gain. Lots of optimism out there…and why not? The world’s largest and strongest market just completed a huge up week that saw the S&P 500 rally 100 points in three days. Most of the indexes are pretty close to a new high.

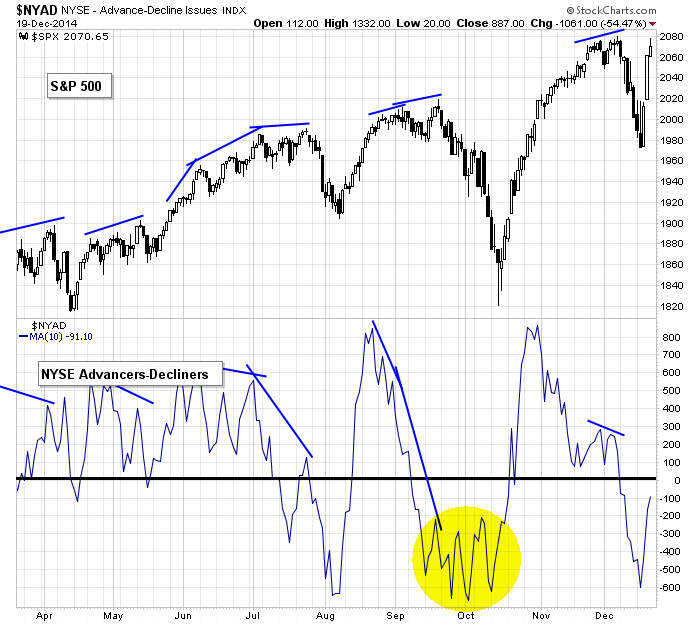

The breadth indicators moved nicely off their lows. How they act going forward will tell us what kind of legs this bounce is likely to get. If they move towards their highs, that would be a sign of strength and would likely lead to a semi-sustained rally going forward. But if they struggle, if they move up and then chop around without getting sustained support, that would be a sign of weakness that will likely lead to the market dropping back.

Here’s an example…the S&P vs. the 10-day of the NYSE AD line. If the AD line moves up to the 600-800 area, we’ll get a continuation of the newly-formed uptrend, but if it struggles to get much above 0, the market’s upside will be very limited. More after the open.

Stock headlines from barchart.com…

BlackBerry (BBRY -0.79%) was upgraded to ‘Buy’ from ‘Hold’ at TD Securities.

Tesco (TESO +4.78%) lowered guidance on Q4 EPS excluding items to 10 cents-15 cents, well below consensus of 32 cents.

Seagate (STX +1.17%) and Western Digital ({=WDC were both downgraded to ‘Neutral’ from ‘Buy’ at Longbow.

Time Warner (TWX +0.65%) was initiated with an ‘Outperform’ at Pacific Crest with a price target of $99.

Finish Line (FINL -19.20%) was downgraded to ‘Neutral’ from ‘Buy’ at Janney Capital.

Gilead (GILD +2.76%) dropped 4% in pre-market trading after Express Scripts said it will offer AbbVie’s just approved hepatitis C regimen Viekira Pak at a “significant discount” starting Jan. 1, while excluding competing drugs from Gilead and Johnson & Johnson,

ARAMARK (ARMK +0.95%) was upgraded to ‘Top Pick’ from ‘Outperform’ at RBC Capital.

Yahoo reported a 16.7% passive stake in Hortonworks (HDP +1.66%).

Raytheon (RTN +0.76%) was awarded a $2.4 billion government contract for 10 PATRIOT fire units with spares for the State of Qatar.

Harvey Partners reported 5.0% passive stake in Oil-Dri Corporation of America (ODC -0.16%) .

Adage Capital Partners reported an 18.84% passive stake in Advaxis (ADXS +15.43%) .

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Chicago Fed National Activity Index

10:00 Existing Home Sales

1:00 PM Results of $27B, 2-Year Note Auction

Notable earnings before today’s open: BBRY, KMX, CCL, FINL, PAYX

Notable earnings after today’s close: SCS

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Dec 22)”

Leave a Reply

You must be logged in to post a comment.

Up to the end of the year they got to look good ay end of year. Dividend rate is declining according to IBD; hate that. But what about 2015?? I think it is too soon to know, but if I were guessing, I would be invested in the core: RSP,QQQ,IWM, then some of Jason’s best ideas we keep 3-4 on the stove; our office believes in Leavitt Bros to keep things moving when the core is dragging. Oil could move to 40, but not without some attempts to rally to 60. Use puts? I may try that. Best of the season to all.

PS: Weather brightening off the Mexican coast but we keep guns on the main deck; too many people who live dangerously out here in the current. If its not one damned thing, it is another.