Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. Indonesia, Malaysia, Hong Kong, China and Taiwan did well. Europe is currently mostly up. Russia is up 2.8%, Italy 1.3% and Prague 1.2%. Spain, Austria, Stockholm and London are also doing well. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is down. Oil is up, copper down. Gold and silver are down.

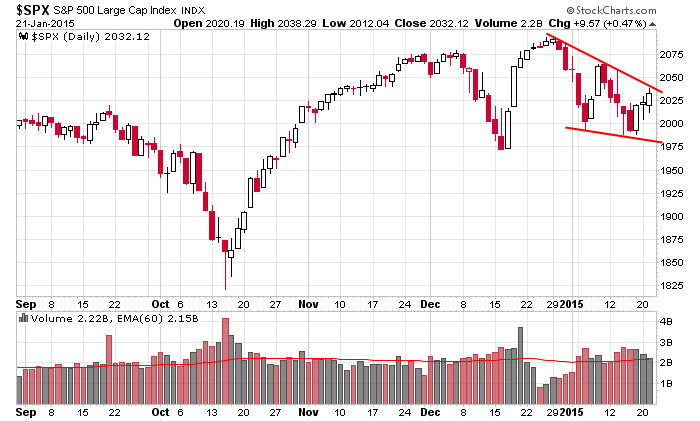

Here’s the S&P 500. A falling wedge within a consolidation pattern. The price action is getting squeezed by converging trendlines, which act to build pressure and energy into the underlying. If you knew nothing other than this chart, you’d recognize the market is flat since the beginning of November, and if this pattern could resolve up, a run to the high is doable.

But there are problems. The best performing groups right now are: utilities, REITs and gold. These aren’t the groups the bulls want leading the charge. Also, several indicators are pointing in the bears’ direction and would not be supportive of a rally here – despite the three consecutive up days and an impending gap up today. And finally the small caps have started to lag lately. That’s fine in the near term, but it can’t last in the long run.

So the S&P is going to attempt to break out from the pattern shown, but there’s isn’t much support to be had from secondary sources.

Be careful. More after the open.

Stock headlines from barchart.com…

Netflix (NFLX +17.34%) was initiated with a ‘Buy’ at Pivotal Research with a price target of $550.

Travelers (TRV -0.78%) reported Q4 EPS of $3.07, well above consensus of $2.54.

Verizon Communucations (VZ +0.15%) reported Q4 EPS of 71 cents, below consensus of 72 cents.

Endo (ENDP -1.51%) climbed over 3% in after-hours trading after it was announced that it will replace Covidien (COV -0.90%) in the S&P 500 as of the close of trading on Jan 26.

eBay (EBAY -0.56%) rose nearly 3% in after-hours trading after it reported Q4 adjusted EPS of 90 cents, better than consensus of 89 cents.

Kinder Morgan (KMI +0.43%) reported Q4 EPS of 8 cents, wel below consensus of 34 cents.

Ingersoll-Rand (IR +1.20%) was initiated with a ‘Buy’ at UBS with a price target of $80.

3M Company (MMM +0.37%) was initiated with a ‘Buy’ at UBS with a price target of $195.

General Electric (GE +0.80%) was initiated with a ‘Buy’ at UBS with a price target of $30.

Tyco (TYC unch) was initiated with a ‘Sell’ at UBS with a price target of $40.

United Rentals (URI +3.66%) moved up over 1% in after-hours trading after it reported Q4 adjusted EPS of $2.19, higher than consensus of $2.07.

Discover (DFS -0.05%) fell over 3% in after-hours trading after it reported Q4 adjusted EPS of $1.19, less than consensus of $1.30.

F5 Networks (FFIV -0.24%) reported Q1 adjusted EPS of $1.55, better than consensus of $1.49.

SanDisk (SNDK +2.08%) rose 1% in after-hours trading after it reported Q4 EPS $1.30, higher than consensus of $1.27, and then said it will expand its stock repurchase program by $2.5 billion.

American Express (AXP +0.47%) reported Q4 EPS of $1.39, better than consensus of $1.38.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Initial Jobless Claims

9:00 FHFA House Price Index

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

11:00 EIA Petroleum Inventories

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: ALK, AVT, BBT, BKU, BPOP, COV, CP, CY, DLX, FBC, FCS, FNB, GMT, HBAN, JCI, JNS, KEY, LUV, NTCT, ORI, PCP, QSII, SBNY, TDY, TRV, TZOO, UAL, UNP, VZ, WBS, XRS

Notable earnings after today’s close: ALTR, ASB, CE, COF, CYN, DGII, EGHT, ETFC, FII, HBHC, HXL, INFN, ISRG, KLAC, MSCC, MXIM, PLCM, RMD, SBUX, SIVB, SWKS, WAL

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers