Good morning. Happy Friday.

The Asian/Pacific markets are up across-the-board. Japan, Hong Kong, Singapore, Australia, Indonesia, Malaysia and Taiwan are each up more than 1%. Europe is up across-the-board. Greece is up 6.4%, France and Germany more than 2%, Spain, Belgium, Amsterdam, Switzerland, Prague and Russia more than 1%. Futures here in the States point towards an up open for the cash market.

The dollar is up 1% – a big move. Oil is flat, copper is down. Gold and silver are down.

The European Central Bank (ECB) is going to do more than the 50 billion euro recommended a couple days ago. It’s going to do 60 billion per month until September 2016. Markets around the world love the news. The US market rallied big yesterday, and Asia and Europe are up big today.

Yesterday the euro fell vs. the US dollar by its biggest margin in many months. Today it’s down another 1.7%.

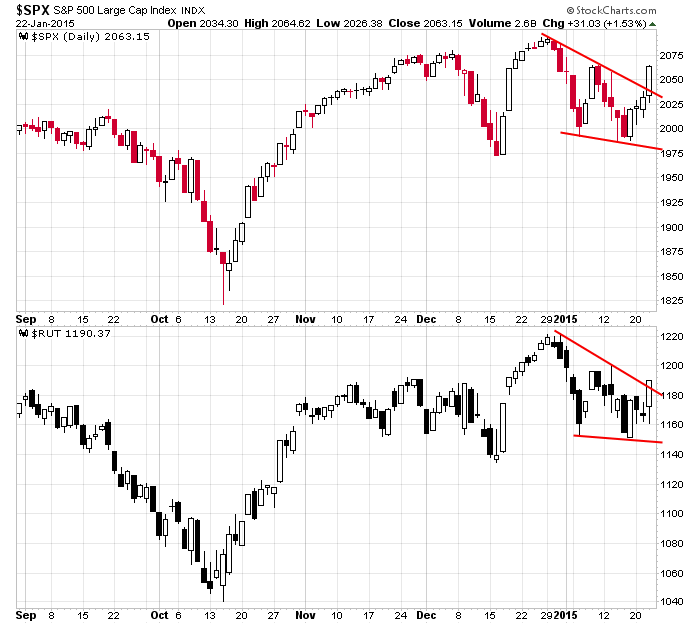

Here are the SPX and RUT – falling patterns within an overall uptrend with converging trendlines hints at a potential move up. The S&P has broken out…the Russell is in the process. After lagging for a couple days, it’s nice to see the small caps catch up.

Last week we got 4 of 5 down days. This week all up days. The market has been very trendy lately…a handful of up days, a handful of down days. Rallies get sold, dips get bought. Only once in the last six weeks has an up or down day not been preceded or followed by an up or down day. Everything is happening in a cluster.

The swings were getting smaller…hinting at a forceful big move coming. It looks like that move is to the upside. The indexes are much improved. Some indicators have improved. Some key groups have strengthened. There are reasons to be skeptical (gold, utilities, REITs are leading), but I certainly wouldn’t fight the market if it wanted to move up. Overall we’re still in 6-year uptrend, and the bulls aren’t going to just hand the market over to the bears.

Stock headlines from barchart.com…

General Electric (GE +1.00%) reported Q4 EPS of 56 cents, higher than consensus of 55 cents.

LinkedIn (LNKD +2.62%) was upgraded to ‘Strong Buy’ from ‘Market Perform’ at Raymond James.

J.B. Hunt (JBHT +2.67%) was downgraded to ‘Hold’ from ‘Buy’ at Deutsche Bank.

Honeywell International (HON +0.14%) reported Q4 EPS of $1.43, better than consensus of $1.42.

Chesapeake (CHK -1.26%) was upgraded to ‘Outperform’ from ‘Neutral’ at Credit Suisse.

State Street ({=STT reported Q4 EPS of $1.37, better than consensus of $1.27.

KLA-Tencor (KLAC +2.22%) fell over 5% in after-hours trading after it lowered guidance on Q3 EPS to 63 cents-87 cents, far below consensus of 98 cents.

D. E. Shaw & Co reported a 5.0% passive stake in Western Refining (WNR +3.23%) .

Altera (ALTR +1.32%) reported Q4 EPS of 36 cents, better than consensus of 35 cents.

Skyworks (SWKS +2.63%) reported Q1 EPS of $1.26, higher than consensus of $1.19.

E-Trade (ETFC +2.86%) rose over 4% in after-hours trading after it reported Q4 EPS ex-items of 26 cents, better than consensus of 23 cents.

Capital One (COF -1.31%) reported Q4 EPS of $1.73, less than consensus of $1.74.

ResMed (RMD +2.93%) reported Q2 EPS of 64 cents, higher than consensus of 62 cents.

Hexcel (HXL +1.75%) reported Q4 EPS of 54 cents, right on consensus.

Intuitive Surgical (ISRG +1.40%) reported Q4 EPS of $4.92, well above consensus of $4.38.

Starbucks (SBUX +1.78%) reported Q1 EPS of 80 cents, right on consensus.

Maxim Integrated (MXIM +0.43%) reported Q2 EPS ex-items of 33 cents, better than consensus of 30 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

9:45 PMI Manufacturing Index Flash

10:00 Existing Home Sales

10:00 Leading Indicators

Notable earnings before today’s open: BK, COL, FHN, FNFG, GE, HON, KMB, KSU, MCD, PB, STT, SYF

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers