Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly down. Japan, Hong Kong and China each dropped more than 1%; Malaysia, New Zealand, South Korea and Taiwan also did poorly. Europe is currently mixed. Greece is up 2.5%, and Russia and Switzerland are up about 1.05%. Austria and Prague are down 0.7-0.8%. Futures here in the States point towards an up open for the cash market.

The dollar is up. Oil is flat, copper is down. Gold and silver are down. Bonds are down.

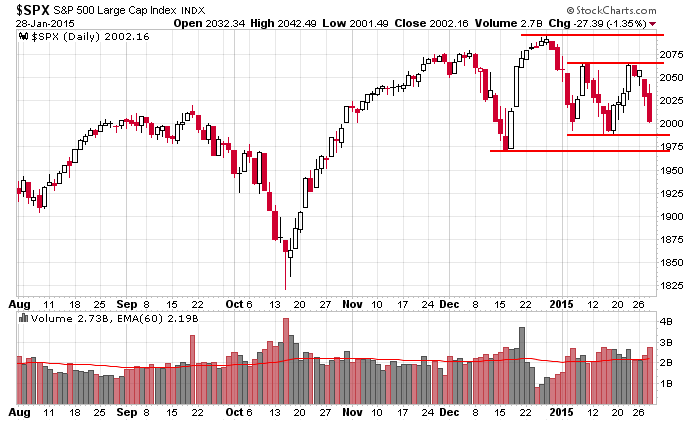

Here’s the S&P daily. Nothing has changed. A couple weeks ago I said: there are lots of gaps…lots of reversals…rallies get sold, dips get bought…nothing sticks, so we have to be content with quick trades and small gains. This remains the case. The market moves up, and the bulls get excited, the market moves down and the bulls get scared. Have a strong opinion, wait, you’ll be right…and then wait a little longer and you’ll be wrong. Such is life as a trader while the market trades range bound. Adjust your style a little or sit out. It’s the height of stupidity to force a style on a market without paying attention to what the market is offering.

The S&P is down about 57 this month, so the January indicator, which states “as January goes, so goes the rest of the year” is not going to give the bulls a positive signal.

Don’t force things right now. Simple as that.

Stock headlines from barchart.com…

McDonald’s (MCD -0.88%) rose more than 3% in after-hours trading after it was announced that CEO Don Thompson will retire and Steve Easterbrook will replace him.

IDEX Corp. (IEX -0.52%) reported Q4 EPS of 77 cents, weaker than consensus of 87 cents, and then lowered guidance on fiscal 2015 EPS to $3.65-$3.75, below consensus of $3.82.

Murphy Oil (MUR -7.23%) reported Q3 EPS of 39 cents, above consensus of 30 cents

Kirby (KEX -3.97%) reported Q4 EPS of $1.19, higher than consensus of $1.15.

Helmerich & Payne (HP -6.49%) was downgraded to ‘Sell’ from ‘Neutral’ at Citigroup with a price target of $55.

Tetra Tech (TTEK -2.34%) reported Q1 EPS of 41 cents, more than consensus of 35 cents.

Cabot (CBT -2.01%) reported Q1 EPS of 69 cents, better than consensus of 65 cents.

Ameriprise (AMP -2.03%) reported Q4 operating EPS of $2.30, higher than consensus of $2.22.

CACI (CACI +0.05%) reported Q2 EPS of $1.01, below consensus of $1.06.

Swift Transport (SWFT -1.77%) reported Q4 adjusted EPS of 55 cents, more than consensus of 48 cents.

Hologic (HOLX unch) reported Q1 EPS of 39 cents, better than consensus of 36 cents, and then raised guidance on fiscal 2015 EPS outlook to $1.54-$1.57 from $1.50-$1.54, higher than consensus of $1.54.

Lam Research (LRCX -0.54%) reported Q2 EPS of $1.19, higher than consensus $1.13.

Citrix (CTXS -1.53%) rose over 4% in after-hours trading after it reported Q4 EPS of $1.10, stronger than consensus of $1.03.

Las Vegas Sands (LVS -1.60%) climbed over 2% in after-hours trading after it reported Q4 adjusted EPS of 92 cents, more than consensus of 81 cents.

Qualcomm (QCOM -1.09%) fell over 9% in after-hours trading after it reported Q1 adjusted EPS of $1.34, better than consensus of $1.25, but then lowered guidance on fiscal 2015 adjusted EPS view to $4.75-$5.05 from $5.05-$5.35, below consensus of $5.21.

Facebook (FB +0.61%) reported Q4 EPS of 54 cents, higher than consensus of 48 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Initial Jobless Claims

9:45 Bloomberg Consumer Comfort Index

10:00 Pending Home Sales

10:30 EIA Natural Gas Inventory

11:30 Results of $35B, 5-Year Note Auction

1:00 PM Results of $29B, 7-Year Note Auction

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: ABT, AIT, ALLY, ALV, ALXN, APD, BABA, BAX, BC, BEAV, BMS, BX, CAH, CAM, CELG, CHKP, CL, CLFD, CMS, COH, COP, CRR, CSH, DGX, DHX, DOW, DST, EMC, EPD, F, GLOP, HAE, HAR, HGG, HOG, HP, HSY, HUB.B, ITG, IVZ, JBLU, KELYA, KEM, KMT, LLL, LRN, LSTR, MD, MJN, MMYT, MTH, NDAQ, NOC, NOK, NYCB, OSTK, OXY, PENN, PHM, POT, PSX, PSXP, RCI, RCL, RDS.A, RGLD, RGS, RTN, RYL, SHW, SILC, SWK, SXC, TCB, TDY, TKR, TMO, TWC, UBSI, VIAB, VLO, VLY, VRTS, WCC, WILN, WRLD, XEL, ZMH

Notable earnings after today’s close: ABAX, ALGN, AMZN, AVNW, BCR, BIIB, BRCM, BXP, CB, COHR, CORT, CPHD, CPSI, CTCT, DECK, EFII, ELX, ELY, EMN, EPAY, FICO, GDOT, GIMO, GOOG, HA, HBI, HLIT, INVN, ISBC, IXYS, JDSU, LEG, MCHP, MITK, MTW, N, NATI, NEU, NFG, NGVC, PCCC, PFG, PFPT, PKI, PMCS, QLGC, RHI, RVBD, SFG, SWI, SYNA, TFSL, TUES, UIS, V, VR, WERN

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers