Good morning. Happy Friday.

The Asian/Pacific markets closed mostly down. India dropped 1.7%, followed by China (down 1.6%), Singapore (down 0.8%) and Taiwan (down 0.7%). Indonesia rallied 0.5%. Europe currently leans to the upside, but there are no 1% movers. Greece, Amsterdam, London, France and Germany are down; Austria, Belgium, Stockholm and Russia are up. Futures here in the States point towards a big gap down open for the cash market.

The dollar is flat. Oil is up, copper is up. Gold and silver are up. Bonds are up across-the-board.

I have today earmarked as being somewhat important. Yesterday the S&P bounced off a support level and rallied 32 and closed near its high of the day. Follow through to the upside would increase the odds the market would continue up and test the January high early next week, but failure to follow through would hint the bears were taking over. Well, the S&P is going to gap down about 20 at today’s open. Closing up for the month of January is already off the table, but an up day today would have at least painted a decent picture going forward. It’s not going to happen without some heavy lifting by the bulls.

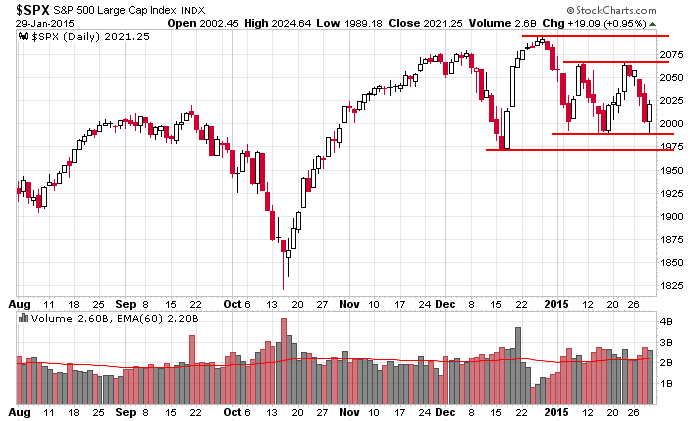

Here’s the daily S&P 500. Two big swings in December have been followed by a couple smaller swings in January. The song remains the same. On a short term basis the market has been very trendy, but no move has lasted more than a week. Up a handful of days, down a handful of days. The bulls get excited. The bears get excited. And here we are with one more trading day in January, and the S&P is virtually unchanged from the beginning of November.

Trade, but shoot for small gains. This is not a time to back up the truck and go all in. Be content with 5-10% moves. More after the open.

Stock headlines from barchart.com…

Weyerhaeuser (WY -0.45%) reported Q4 EPS of 27 cents, below consensus of 29 cents.

Mattel (MAT -0.33%) reported Q4 EPS of 52 cents, well below consensus of 91 cents.

Eli Lilli (LLY +1.61%) reported Q4 EPS of 75 cents, better than consensus of 73 cents.

Eastman Chemical (EMN -0.01%) reported Q4 adjusted EPS of $1.64, higher than consensus of $1.52.

Unisys (UIS -1.21%) reported Q4 EPS of $1.60, well above consensus of $1.27.

Leggett & Platt (LEG +1.30%) reported Q4 adjusted EPS of 41 cents, less than consensus of 45 cents, and then lowered guidance on fiscal 2015 EPS to $1.90-$2.10, below consensus of $2.10.

Acuity Brands (AYI +0.16%) coverage resumed with a ‘Buy’ at Stifel witha price target of $185.

C.R. Bard (BCR +1.02%) reported Q4 adjusted EPS of $2.29, higher than consensus of $2.24.

JDSU (JDSU -2.43%) fell 5% in after-hours trading after it reported Q2 EPS of 15 cents, below consensus of 16 cents.

Hanesbrands (HBI +1.44%) reported Q4 adjusted EPS of $1.46, more than consensus of $1.43.

Biogen (BIIB +0.59%) reported Q4 EPS of $4.09, above consensus of $3.78, and then raised guidance on fiscal 2015 EPS to $16.60-$17.00, better than consensus of $16.37.

Broadcom (BRCM +0.83%) rose 3% in after-hours trading after it reported Q4 adjusted EPS ex-SBC of 90 cents, higher than consensus of 87 cents.

Visa (V +0.67%) climbed over 3% in after-hours trading after it reported Q1 EPS of $2.53, better than consensus of $2.49, and then announced a four-for-one stock split.

Principal Financial (PFG +0.29%) reported Q4 EPS of $1.09, higher than consensus of $1.04.

Manitowoc (MTW +0.89%) reported Q4 adjusted EPS of 27 cents, below consensus of 32 cents.

Google (GOOG +0.13%) reported Q4 EPS of $6.88, weaker than consensus of $7.11.

Amazon.com (AMZN +2.59%) jumped 11% in after-hours trading after it reported Q4 EPS of 45 cents, well above consensus of 17 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 GDP Q4

8:30 Employment Cost Index

9:45 Chicago PMI

9:55 Reuters/UofM Consumer Sentiment

3:00 PM USDA Ag. Prices

Notable earnings before today’s open: ABBV, AVY, BEN, BERY, BZH, CNX, CVX, GHM, HMC, IDXX, IMGN, INGR, IR, KCG, LEA, LLY, LM, MA, MAN, MAT, MGIC, MO, MOG.A, MOSY, NS, NVO, NWL, OFG, PCAR, SAIA, SPG, TSN, TYC, WY, XRX

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 30)”

Leave a Reply

You must be logged in to post a comment.

The song remains the same… Led Zeppelin???

the hindinberg is about to blow up –a bad omen

lower double top or a double bottom

if not having fun as a day trader then buy lower third of range sell top third

PONSI–the old shell game –under which shell is the debt now

has the world debt been passed to the ECB shell

the currency game debt is hurting a lot of soverigns and will blow up the world

how much does a cup of coffee in Switzerland cost

has QE done anything for japan or usa they are still many trillions bankrupt noe ecb and europe