Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed. China, India, South Korea and Taiwan did well; Australia, Malaysia and Hong Kong fell. Europe is currently mostly down. Greece is down almost 4%, and Norway is down 1.6%. Spain, Stockholm, Switzerland, London and France are also weak. Russia is up 1.8%. Futures here in the States point towards a slight down open for the cash market.

The dollar is down slightly. Oil is down, copper is up. Gold and silver are up. Bonds are up.

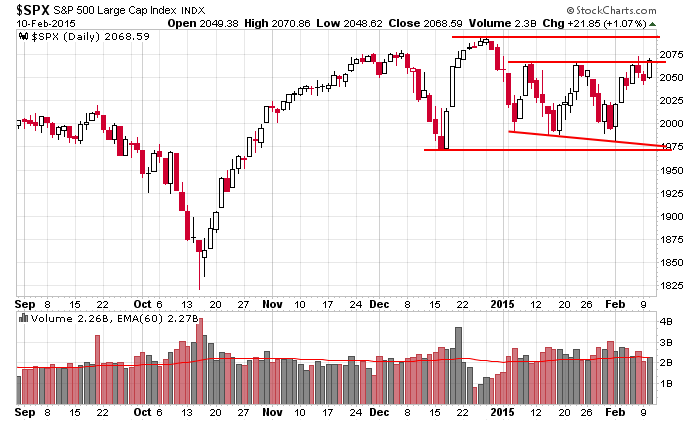

Last week the indexes tried to break out from a 5-week consolidation period, but prices quickly retraced back into the pattern. After two down days, the S&P managed to close above resistance on average volume. Follow through would be nice [for the bulls], but a stronger resistance level sits above at the December high.

In my opinion this is a key time. For the last three months rallies have gotten sold and dips have gotten bought. The market has been trendy…but only for a several days at a time.

Right now the market is attempting to build gains on top of gains. Instead of turning around and dropping after traveling from a low to a high, it’s trying to continue up. It’s possible a change in character is underway, but it has some proving to do. It’s either more of the same stuff we’ve had the last three months, or we’ll get a legit run to the high…and that’s when the fun really begins. More after the open.

Stock headlines from barchart.com…

PepsiCo (PEP +2.10%) reported Q4 EPS of $1.12, better than consensus of $1.08.

Time Warner (TWX +0.34%) reported Q4 EPS of 98 cents, higher than consensus of 93 cents.

Genworth (GNW -0.89%) reported a Q4 EPS loss of -84 cents with charges, a much bigger loss than consensus of -13 cents.

Service Corp. (SCI +0.61%) reported Q4 EPS ex-items of 37 cents, better than consensus of 36 cents.

Pier 1 Imports (PIR +1.19%) sank over 20% in after-hours trading after it lowered guidance on fiscal 2015 EPS to 80 cents-83 cents, well below consensus of $1.00.

Rush Enterprises (RUSHA +1.01%) reported Q4 EPS of 60 cents, higher than consensus of 52 cents.

National General (NGHC +1.77%) reported Q4 EPS of 30 cents, well above consensus of 23 cents.

Team Health (TMH -1.55%) reported Q4 adjusted EPS of 56 cents, better than consensus of 52 cents.

NCR (NCR +2.07%) reported Q4 non-GAAP EPS of 88 cents, above consensus of 78 cents.

Andersons (ANDE -0.37%) reported Q4 EPS of 89 cents, well below consensus of $1.08.

FMC Technologies (FTI +0.05%) reported Q4 EPS with items of 72 cents, below consensus of 79 cents.

Western Union (WU +4.43%) reported Q4 EPS of 42 cents, higher than consensus of 34 cents, and then announced a new $1.2 billion share repurchase plan.

Cerner (CERN +0.81%) reported Q4 adjusted EPS of 47 cents, right on consensus, although Q4 revenue of $926.03 million was better than consensus of $904.33 million.

Akamai (AKAM +2.05%) climbed 4% in after-hours trading after it reported Q4 EPS of 70 cents, better than consensus of 63 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

8:00 Fed’s Fisher: Monetary Policy

10:30 EIA Petroleum Inventories

1:00 PM Results of $24B, 10-Year Bond Auction

2:00 PM Treasury Budget

Notable earnings before today’s open: ACCO, AFSI, AOL, ARMH, BGCP, CSTE, EEFT, EZCH, GNRC, HSIC, LO, LPX, MDLZ, MOS, MRKT, OC, PAG, PEP, RTI, TRI, TWX, USAK, VOYA, WBAI, WCG, WEC, WIX, WOOF, ZTS

Notable earnings after today’s close: ABCO, ACHC, AEM, AMAT, AMBR, AUY, BIDU, CAKE, CJES, CPA, CRAY, CSCO, CSOD, CTL, CVA, CXW, CYS, DDR, DIOD, EFC, EFX, EXL, FET, FEYE, FORR, GAS, HIVE, HNI, HOS, IO, ITRI, LPSN, MET, NSIT, NTAP, NTWK, NU, NVDA, OII, PNRA, PPC, QDEL, REG, SCSS, SKX, SLF, SPRT, STMP, SWM, TAL, TCX, TRIP, TSLA, TSO, TTGT, WFM, ZEN, ZU

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 11)”

Leave a Reply

You must be logged in to post a comment.

“Right now the market is attempting to build gains on top of gains. Instead of turning around and dropping after traveling from a low to a high, it’s trying to continue up”

Agree but my guess is that if it does break out to the upside which I believe it will then all of the easy money will have been made long. I would not expect another buying opportunity until April.

Sell enough calls and you will just have cash.

4th attempt failure—–???