Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. Japan (up 1.9%) and India (up 1%) led, followed by China (up 0.5%) and Hong Kong (up 0.4%). Singapore and New Zealand (down 0.7%) lagged, followed by Malaysia (down 0.6%) and Australia (down 0.4%). Europe is up across-the-board. Greece is up 4.4%; Italy, Russia, Prague, Stockholm and Austria are up more than 2%; Norway, Spain, Germany and France are up more than 1%. Futures here in the States point towards a big gap up for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are up. Bonds are down.

Politics is in the news today. The top two stories are the two big ones (Russia/Ukraine and Greece). A ceasefire between Russia and Ukraine will start Feb 15 (why don’t they just start right now), after the conclusion of a meeting between Russia, Ukraine, Germany and France. Finance ministers in Europe have decided to put off decisions on Greece’s bailout terms until next week. I guess agreeing to delay this is better than accepting an agreement can’t be made. And as a bonus, Sweden’s central bank has cut its main interest rate into negative territory and announced a bond-buying program.

TSLA is down 16 bucks, or almost 8%, in premarket trading. Their earnings missed estimates, but Elon Musk predicted the company will have a market cap of $700B in 10 years. I’ll go out on a limb and say that ain’t gonna happen, but he can dream.

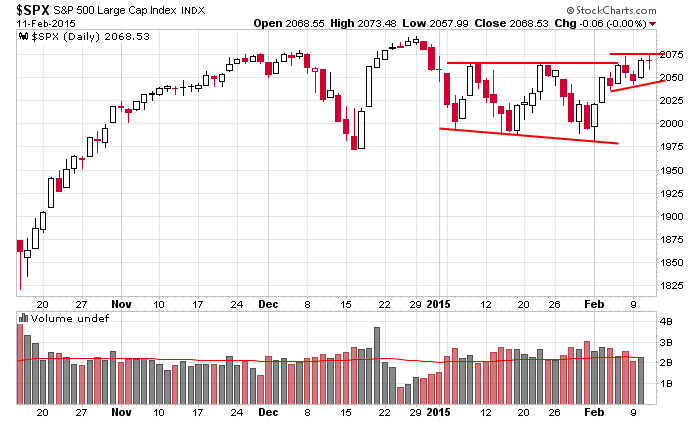

Here’s the daily S&P 500. January horizontal resistance was taken out, and now a little ascending triangle pattern is forming. The bulls would have liked to see some follow through, but at least the breakout didn’t completely fail. By itself there is nothing wrong with this picture.

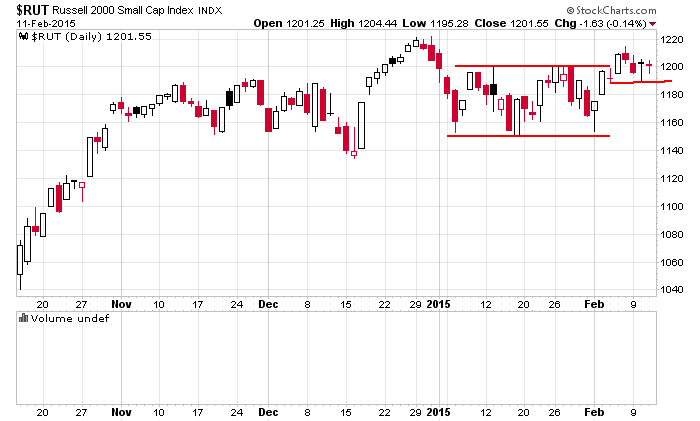

Here’s the Russell small caps. Pretty much the same picture. Near-term resistance isn’t as clearly defined as above, but the set up is still there – little consolidation coming after a larger range resolved up.

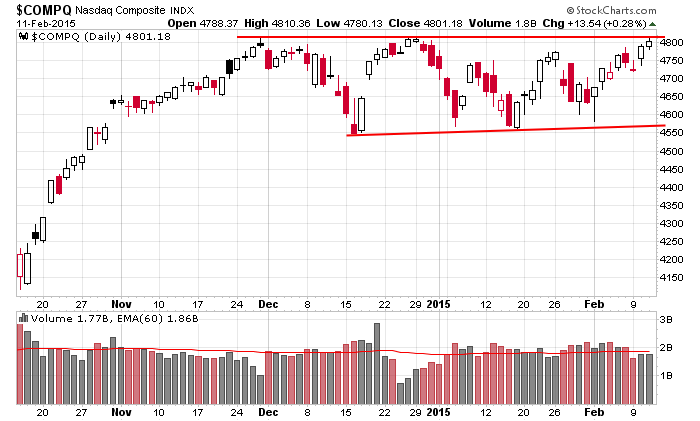

Here’s the Nasdaq. Yes the ups and downs within a range are frustrating for those of us who do better trading multi-month trends, but there is nothing wrong here. A solid rally has been followed by a couple months of rest – perfectly normal for a healthy market.

My bias remains to the upside, but no big bets until these big consolidation patterns form.

Stock headlines from barchart.com…

Cisco (CSCO -2.04%) jumped over 6% in pre-market trading after it reported Q2 EPS of 53 cents, better than consensus of 51 cents.

Whole Foods Markets (WFM +0.91%) rose more than 2% in pre-market trading after it reported Q1 EPS of 46 cents, higher than consensus of 45 cents.

Oceaneering (OII -0.57%) fell over 3% in after-hours trading after it reported Q4 EPS of 99 cents, right on consensus, but then lowered guidance on fiscal 2015 EPS to $3.10-$3.50, well below consensus of $3.92.

Baidu (BIDU -2.17%) dropped 9% in after-hours trading after it reported Q4 EPS of $1.61, below consensus of $1.65.

Tesla (TSLA -1.61%) slid over 7% in after-hours trading after it reported a Q4 adjusted EPS loss of -13 cents, much weaker than consensus of 31 cents.

Equifax (EFX unch) reported Q4 EPS of $1.02, higher than consensus of $1.01.

Tesoro (TSO -0.92%) reported Q4 EPS of $1.46, below consensus of $1.51.

NVIDIA (NVDA -0.67%) jumped 5% in after-hours trading after it reported Q4 EPS of 43 cents, well above consensus of 29 cents.

Northeast Utilities (NU -2.51%) reported Q4 EPS ex-items of 72 cents, higher than consensus of 69 cents.

C&J Energy (CJES -0.95%) reported Q4 adjusted EPS of 54 cents, stronger than consensus of 43 cents.

Catalent (CTLT +5.16%) reported Q2 adjusted EPS of 44 cents, well above consensus of 34 cents.

NetApp (NTAP +0.89%) slid over 5% in after-hours trading after it reported Q3 EPS of 75 cents, less than consensus of 77 cents.

MetLife (MET +0.76%) reported Q4 operating EPS of $1.38, above consensus of $1.36.

Applied Materials (AMAT -0.08%) reported Q1 adjusted EPS of 27 cents, right on consensus, although Q1 revenue of $2.36 billion was above consensus of $2.33 billion.

Insight Enterprises (NSIT +0.54%) reported Q4 adjusted EPS of 55 cents, below consensus of 58 cents.

Skechers (SKX +5.15%) reported Q4 EPS of 43 cents, right on consensus, although Q4 revenue of $569.7 million was better than consensus of $542.75 million.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Initial Jobless Claims

8:30 Retail Sales

9:45 Bloomberg Consumer Comfort Index

10:00 Business Inventories

10:30 EIA Natural Gas Inventory

1:00 PM Results of $16B, 30-Year Note Auction

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: AAP, AAWW, AB, ACOR, ANR, APA, AVP, BG, BWA, CAB, CCE, COR, CPLA, CS, CVE, DBD, DPS, FAF, FLO, GNC, HE, HERO, HIMX, HSP, IFF, INCY, JAH, K, LMNS, LNCE, LPNT, MANU, MDWD, MFA, MFC, MHFI, MINI, MPEL, MPW, NCI, NLSN, NNN, NRP, NWE, PDS, PNK, Q, RDN, RTIX, RWLK, RYN, SCOR, SHPG, SKYW, SNI, SON, SPW, STC, THS, TIME, TU, VG, VNTV, WD, WSO, WWAV, WWE

Notable earnings after today’s close: AEL, AIG, AIZ, ALNY, BCOR, BYD, CBS, CGNX, COLM, CUZ, CYBR, DLR, DVA, EGN, ELLI, GRPN, INT, INWK, IRWD, JCOM, KING, KN, KRFT, LBTYA, LOGM, MGI, MOBL, MTSN, NR, OTC:PFIE, PRO, QLIK, RBCN, RGC, RSG, SFLY, SSNC, SSTK, TCO, TNGO, VCRA, WAGE, WWWW, ZNGA

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 12)”

Leave a Reply

You must be logged in to post a comment.

what is the matter with greece but better still what is the matter with the insane imf–ecb–germany

from a relatively small debt some 5 years ago ,that a default on could have been easy handled greece debt has blown out to something greece can never handle

and the ones to blame for this is the imf/ecb/germany forcing money on willing greece

now greece is saying no more austerity–it doesnt work –no more debt/we cant pay

come on banks/imf/ecb/germany –take a haircut and kick greece out of europe

it would be better for greece and i and many other tourists will visit greece with their depreciated drackmars