Good morning. Happy Friday.

The Asian/Pacific markets closed with mostly solid gains. Japan dropped 0.4%, but Australia (up 2.2%), Hong Kong (up 1.1%), India and China (up 1%) did great along with Indonesia, Malaysia, New Zealand and South Korea. Europe is currently posting across-the-board gains. Greece is up 5.3%, followed by Russia, Italy and Norway, which are up more than 1%, and Spain, Prague, Stockholm, Amsterdam, Belgium, London, Germany and France, which are also doing very well. Futures here in the States point towards an up open.

The dollar is up. Oil and copper are up. Gold and silver are up. Bonds are down.

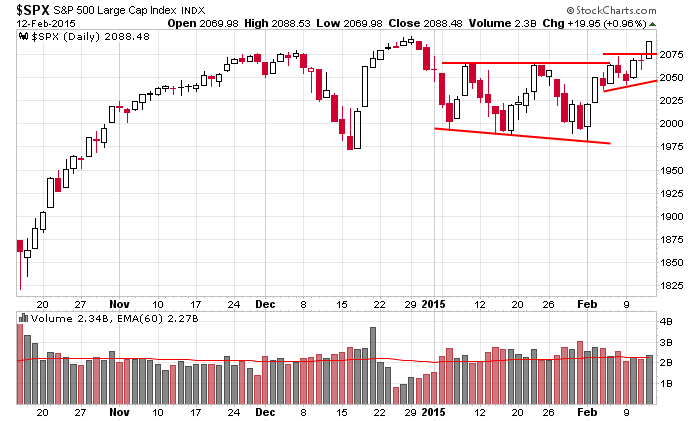

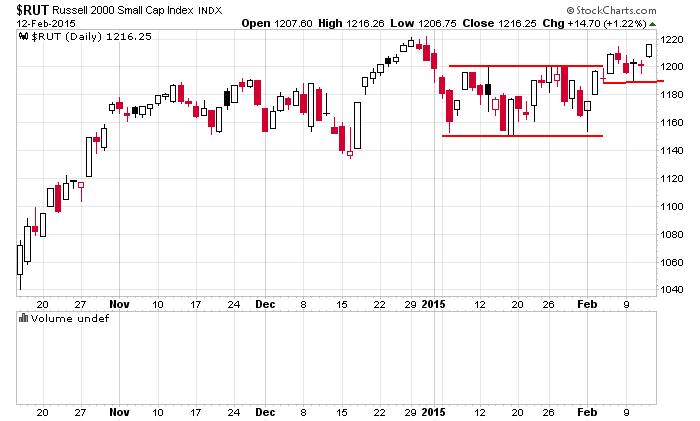

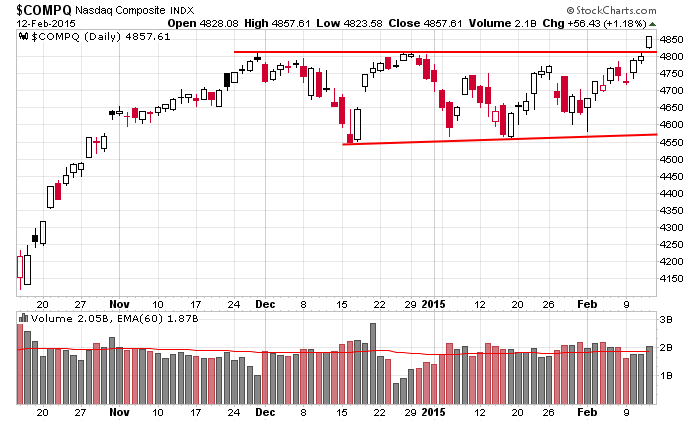

Let’s do a refresh of the index charts posted yesterday.

The S&P 500 broke out from the little ascending triangle pattern and is now a stone’s throw from its all-time high established in December. I can’t say volume is convincing, but the price action is very encouraging. It’s not in the clear yet. We’ll find out soon how strong the bulls really are.

The Russell 2000 small caps are mirroring the large caps…a breakout from a consolidation period, and the all-time high sits just above. Two weeks ago when the small caps resisted making a lower low, a subtle hint was offered that strength was brewing.

And finally the Nasdaq, which did breakout to a new high. This is the index’s highest level since 2000.

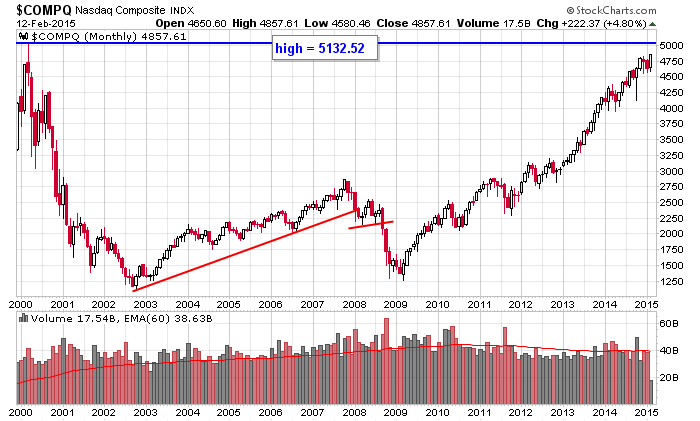

Let’s back the chart way up and see where the Nasdaq has been. Here’s the monthly going back to late 1999. The index is less than 300 points from its all-time high. It only took 15 years to get back here. 🙂 Many stocks that help put in that high back in 2000 don’t exist any more. Many others, such as INTC, YHOO and CSCO are still well below their 2000 peaks, but still others such as PCLN and AMZN have recovered and are near all-time highs. And of course new stocks such as GOOG, TSLA, FB and LNKD have helped. And while I’m at it, AAPL is up a massive amount. The sum of all this – some stocks never recovered, some stocks recovered some, others recovered everything plus some and new listings – puts the Nas within about 5% of its all-time high.

My bias remains to the upside. The indicators told me to favor the upside this entire week, and I don’t typically ignore them. Don’t get cocky. Resistance lies overhead for most of the indexes, but so far, so good. The market is in pretty good shape.

Stock headlines from barchart.com…

CBS (CBS +1.80%) gained nearly 4% in pre-market trading after it reported Q4 EPS of 77 cents, more than consensus of 76 cents.

King Digital (KING +4.24%) soared over 15% in after-hours trading after it reported Q4 adjusted EPS of 57 cents, well aboove consensus of 47 cents.

Campbell Soup (CPB -0.23%) slid 4% in after-hours trading after it lowered guidance on fiscal 2015 EPS outlook to $2.32-$2.38, less than consensus of $2.45.

ConAgra (CAG +0.69%) fell 3% in after-hours trading after it lowered guidance on fiscal 2015 EPS to $2.13-$2.18, below consensus of $2.26.

Boyd Gaming (BYD +4.36%) reported Q4 adjusted EPS of 0 cents, better than consensus of a -4 cent loss.

Regal Entertainment (RGC +0.14%) reported Q4 EPS of 30 cents, above consensus of 29 cents.

Shutterfly (SFLY +0.92%) reported Q4 adjusted EPS of $2.57, more than consensus of $2.51.

Kraft Foods (KRFT +1.69%) reported Q4 EPS ex-items of 75 cents, higher than consensus of 73 cents.

DaVita (DVA +0.58%) reported Q4 continuing operations EPS of 96 cents, better than consensus of 89 cents.

AIG (AIG +0.38%) fell over 2% in after-hours trading after it reported Q4 EPS of 97 cents, below consensus of $1.05.

Groupon (GRPN -1.58%) reported Q4 adjusted EPS of 6 cents, twice as much as consensus of 3 cents.

Columbia Sportswear (COLM +3.91%) jumped over 5% in after-hours trading after it reported Q4 EPS of 79 cents, higher than consensus of 67 cents, and then raised guidance on fiscal 2015 EPS to $2.10-$2.20, above consensus of $2.07.

American Equity (AEL +0.56%) reported Q4 EPS of 63 cents, better than consensus of 54 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Import/Export Prices

9:55 Reuters/UofM Consumer Sentiment

Notable earnings before today’s open: BAM, CPN, DTE, EXC, HPY, IPG, ITT, MT, NGLS, POR, RRGB, RUTH, SJM, TRW, VFC, VTR, WBC

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 13)”

Leave a Reply

You must be logged in to post a comment.

Look At the import/export pricing today, down, as a clue to where the global economy is moving. Debt levels in most economies suggest that prices must fall to allow debt payments. This trend is led by government central banks which in difficultly. The Fed knows a token rate hike is need psychologically, not on an accounting basis. Most Americans need to ask themselves about this trend and how it affects each of us. We are lending in Japan, but with little conviction that we will get the capital back as the terms provide. Things are changing. Best to all.

thank you for your very prescient comments. . .

Agree

I suspect the NASDAQ will soon be looking at all time highs before the next buy signal.