Options expire this week, so let’s check out the open-interest on SPY, QQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

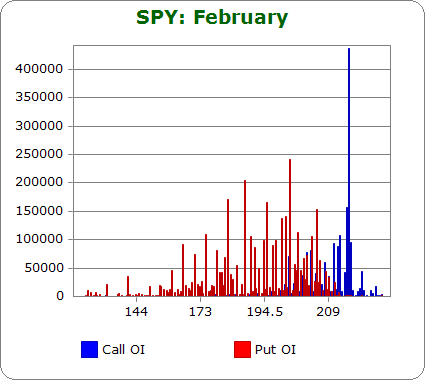

SPY (closed 210.08)

Puts out-number calls 2.1-to-1.0.

Call OI is highest between 210 and 216, with a huge spike at 215.

Put OI is highest in 5-point increments between 165 and 190 and then is steadily heavy up to 206.

There is no overlap between the highest open-interest regions – calls are heavy above 210 and puts are highest below 206. A close somewhere in the middle would cause a lot of pain, and with no overlap, there’s no sense pinpointing an exact level. Today’s close was at 210.08 – at the top of the range. A move up from here would enable some call buyers to make money, we need so flat or down trading the rest of the week to accomplish max pain.

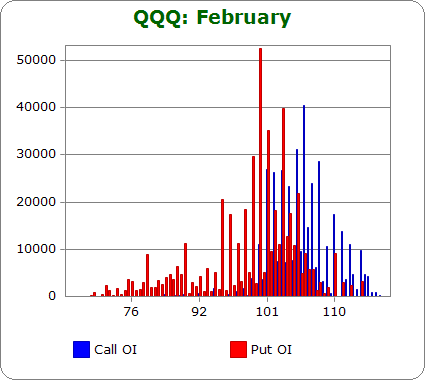

QQQ (closed 106.96)

Puts out-number calls 1.4-to-1.0.

Call OI is highest between 101 and 108.

Put OI is highest between 95 and 105.

There’s definite overlap between call and put OI between 101 and 105. The total open-interest in this region between the two is approx. the same, so a close somewhere near the middle (103-ish) would cause the most pain (without knowing where or when the options were purchased). Today’s close was at 106.96 – way above the max pain level. This isn’t a surprise; QQQ is sitting at its highest level in 15 years. A big move down is needed to cause max pain. Without it, call buyers are going to cash in this month.

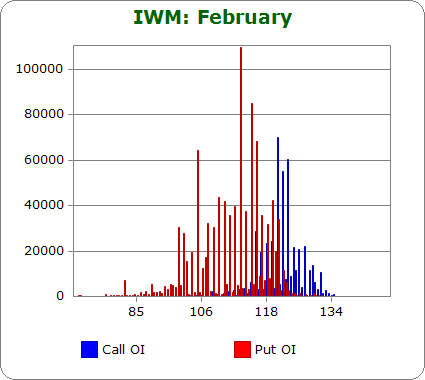

IWM (closed 121.71)

Puts out-number calls 2.2-to-1.0.

Call OI is highest at 120, 121 and 122.

Put OI is highest between 105 and 120 with a big spikes at 105, 113, 115 and 116.

There’s no overlap between the two regions of highest OI, but the two zones do share 120 as a common strike. A close there would cause most calls and puts to expire worthless and would therefore be max pain for option buyers. Today’s close was at 121.71 – too high. A move down is needed.

Overall Conclusion: If the invisible hand of the options market worked to cause max pain among option buyers, a move down is needed. SPY can sit were it is, but IWM needs to move down, and QQQ needs to move down a bunch. Otherwise call buyers will make money this month.

4 thoughts on “Using Put/Call Open-Interest to Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

like the graphics. very easy to understand.

Your analysis (max pain) seems to assume that the existence

of OI is caused primarily by BUYERS. There is a

counterparty on every position. How do we know

that the dominant “causers” (pardon me, George W!)

are in fact buyers and not sellers? Depending on the

time period you look at, according to the CBOE about

75-85% of all options expire worthless. Professionals

tend to do better than individuals, so who is the

driving force in creating all the huge open interest?

Don

Don I’m not sure there’s a buyer for every seller and a seller for every buyer. When a big bank comes in and buys 10,000 call options, is there really another bank on the other side at all times. If this was the case, wouldn’t the open-interest be 0? My impression is the exchange itself acts as a buyer to all sellers and a seller to all buyers and then hedges itself. I don’t know, but I’d be very surprised if buyers and sellers were exactly equal.

Buy and Sell volume is the same . . .

AND the number of long positions and the number of short positions on a given instrument is the same.

BUT . . volume does NOT equal the number of open positions at any given time.

THAT number (current open positions) is the Open Interest.

The reason Max Pain is a theory is because most amateurs are LONG the position and most professionals are SHORT that positions.

The professionals can manipulate the market to their favorite price area because they are the Market Makers .. without whom all of this Stock Trading would not be possible.

here’s a good example:

http://i.investopedia.com/inv/dictionary/terms/openinterest.gif

Never short the market when the PC is over .85 or under .4.