Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up. Japan, Australia and Indonesia led with gains greater than 0.95%. Singapore and India also did well. Europe is currently mostly up. Stockholm, Russia, Italy and Greece are up more than 1%; Spain, Austria, Amsterdam and France are also doing well. Futures here in the States point towards a slight down open for the cash market.

The dollar is up. Oil is down, copper is up. Gold is down, silver up. Bonds are up.

The market posted small gains yesterday and several indexes hit new highs, but volume was light and the energy behind the moves was not robust.

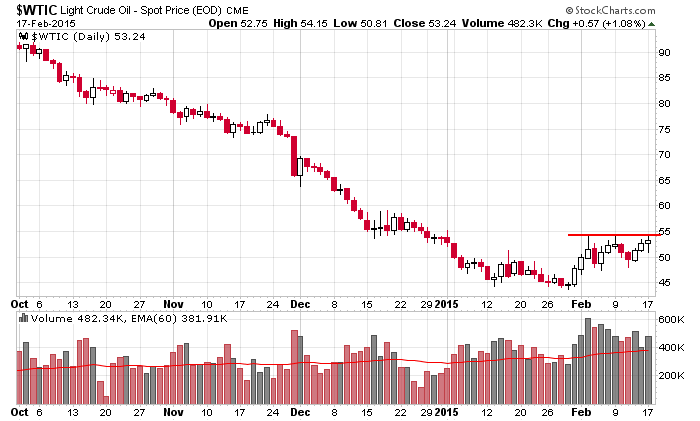

In my opinion, the most interesting chart out there is oil. Crude has been basing for six weeks and has formed a resistance level just under $55. If it can breakout the entire oil group will leg up, which would greatly help the market. Not that it needs help. It’s done incredible well without oil participating. Imagine if oil carried its own weight?

Otherwise it’s business as usual. The market has done well lately, and several indexes are sitting at or near all-time highs. It’s possible we’re in the beginning stages of a leg up, but there’s work to do. The bulls can’t rest much. Yeah they have a nice cushion, but if they want to put some distance between the current levels and the 3-month range, they need to keep the pressure on. We haven’t crossed that threshold which would tell me an intermediate term uptrend is solidly in place.

Greece is probably going to be taken off the table soon. Earnings season is winding down. FOMC minutes come out today – they’ll shed some light on how realistic it is for the Fed to raise rates this summer. From a technical standpoint, the market is doing just fine. More after the open.

Stock headlines from barchart.com…

Duke Energy (DUK -0.56%) reported Q4 EPS of 87 cents, below consensus of 88 cents.

Allegion PLC (ALLE -0.17%) reported Q4 EPS of 76 cents, better than consensus of 68 cents.

Exxon Mobil (XOM -0.34%) fell over 2% in pre-market trading after Berkshire Hathaway announced it had exited its $3.7 billion investment in the company.

Owens & Minor (OMI -1.00%) reported Q4 adjusted EPS of 49 cents, below consensus of 50 cents, and then lowered guidance on fiscal 2015 EPS to $1.90-$1.95, at the low end of consensus of $1.95.

Valmont (VMI +0.85%) reported Q4 adjusted EPS of $1.62, less than consensus of $1.65.

Terex ({=TEX reported Q4 adjusted EPS of 72 cents, higher than consensus of 68 cents.

CF Industries (CF -0.89%) fell over 2% in after-hours trading after it reported Q4 EPS of $4.82, below consensus of $5.08.

Norwegian Cruise Line (NCLH -0.71%) reported Q4 adjusted EPS of 36 cents, less than consensus of 37 cents.

KAR Auction (KAR -0.11%) reported Q4 adjusted EPS of 40 cents, better than consensus of 29 cents.

Flowserve (FLS +0.46%) reported Q4 EPS of $1.16, above consensus of $1.13.

Analog Devices (ADI +3.09%) reported Q1 EPS of 63 cents, better than consensus of 61 cents.

Jack in the Box (JACK +1.19%) rose over 3% in after-hours trading after it reported Q1 EPS of 93 cents, higher than consensus of 87 cents, and then raised guidance on fiscal 2015 EPS to $2.85-$2.97, above consensus $2.84.

AMC Entertainment (AMC +0.91%) reported Q4 EPS of 30 cents, well above consensus of 20 cents.

Agilent (A +0.92%) reported Q1 EPS of 41 cents, right on consensus, but then lowered guidance on fiscal 2015 EPS to $1.67- $1.73, on the low side of consensus at $1.73.

Fossil (FOSL +0.89%) reported Q4 EPS of $3.00, below consensus of $3.07, and then lowered guidance on fiscal 2015 EPS to$5.45-$6.05, well below consensus of $7.54.

Rackspace (RAX -0.28%) reported Q4 EPS of 26 cents, above consensus of 19 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

8:30 Producer Price Index

8:30 Housing Starts

8:55 Redbook Chain Store Sales

9:15 Industrial Production

2:00 PM FOMC minutes

4:00 PM Treasury International Capital

Notable earnings before today’s open: ALLE, ANGI, BCRX, CNK, CONE, CRTO, DORM, DUK, DX, DXYN, ELOS, ENBL, ENZY, FLR, GEO, GRMN, H, HL, HLT, HUN, I, MDCO, MZOR, NI, NOR, SABR, SBGI, SIR, SONS, WAB, XRAY, YNDX

Notable earnings after today’s close: ABX, ACT, AMTG, ARII, ARRS, ASGN, AVG, AXLL, BGS, BJRI, CAR, CDE, CSLT, CVG, CW, CYNI, DENN, DTLK, ELNK, EOG, EQC, ETE, ETP, EXAM, FNF, HSTM, HT, IAG, IPI, KEG, KEYW, LHO, LOPE, MANT, MAR, MHLD, MIC, MRO, NVMI, OGS, OIS, PAAS, PCYC, PKD, REXX, RGP, SBRA, SCTY, SIX, SNPS, SSS, STR, SUN, SUNE, SXL, TERP, THRX, TILE, TRN, TS, UAM, WES, WGP, WMB, WPZ, XPO, YUME

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 18)”

Leave a Reply

You must be logged in to post a comment.

Time to ride the pine.

market looks sick, bkx even sicker..