Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. China rallied 2.2%, and Japan moved up 1.1%. India dropped 0.9%, Taiwan 0.8% and Australia 0.5%. Europe is currently mostly up, but gains are small. Russia is up 0.9%, and Italy is up 0.7%. Greece is down almost 2%. Futures here in the States point towards an up open for the cash market.

The dollar is up. Oil is down, copper is up. Gold and silver are up. Bonds are up.

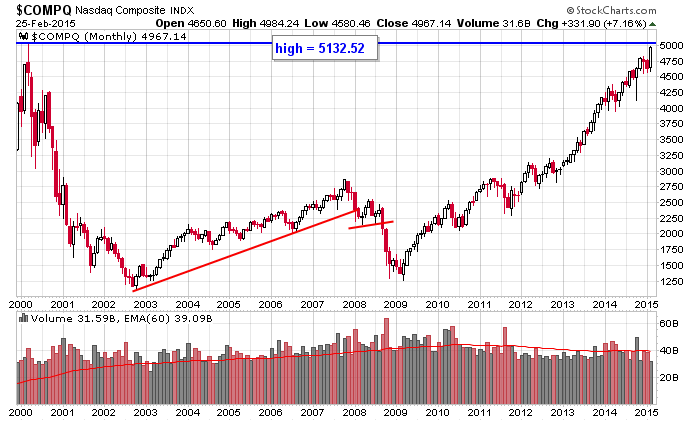

The indexes hit new highs again yesterday. I’m still of the opinion the Nas is being pulled up to its all-time high. It’s that invisible hand thing. The market is obsessed with it, and barring something totally expected happening in the world, that high needs to be taken out. Here’s the monthly going back to 2000. Besides the proximity to the high, the other obvious note is that despite pretty much being flat over the last 15 years, the Nas spent about 11 years moving up and only 4 moving down. Sure the market falls faster than it moves up, but when it moves up, it moves up for years at a time.

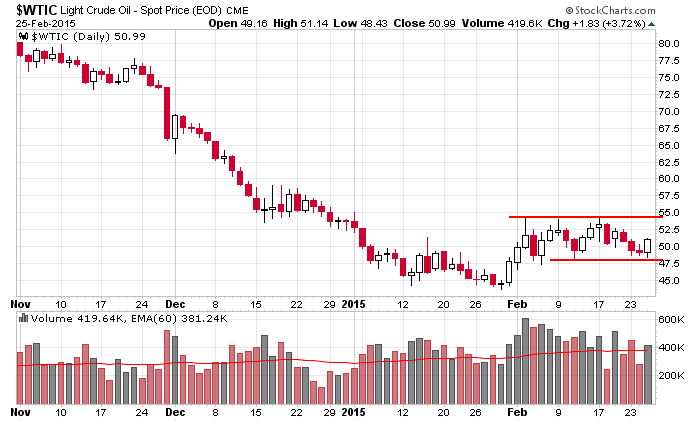

Oil bounced off the bottom of its consolidation pattern yesterday. Long term I can see it legging down again, but I keep coming back to it in the near term because the group is very big, and there are dozens of high-volume tradeable stocks. Whether crude breaks out or breaks down, there will be many great set-ups to be had. Don’t fall asleep at the wheel. Build your list. Be ready to go. We could get a round of 20% moves coming soon.

On another note, we’re getting payback. After a couple months of extreme volatility and huge intraday movement, the intraday ranges have been tiny lately. Make the necessary adjustments. Don’t force your style on a market that has changed. More after the open.

Stock headlines from barchart.com…

Kohl’s (KSS +1.33%) reported Q4 EPS of $1.83, better than consensus of $1.80.

Carter’s (CRI +1.34%) reported Q4 adjusted EPS of $1.32, stronger than consensus of $1.27.

State Street (STT -1.66%) was downgraded to ‘Neutral’ from ‘Outperform’ at Credit Suisse.

Southwest Gas (SWX -0.90%) reported Q4 EPS of $1.26, higher than consensus of $1.24.

Chemtura (CHMT -1.06%) reported Q4 adjusted EPS of 10 cents, better than consensus of 7 cents.

Babcock & Wilcox (BWC -1.70%) reported Q4 adjusted EPS of 64 cents, well above consensus of 44 cents.

DryShips (DRYS +4.08%) reported Q4 EPS of 2 cents, well below consensus of 4 cents.

Yelp (YELP -0.30%) gained 2% in after-hours trading after it was initiated with an ‘Overweight’ at Morgan Stanley with a price target of $62.

LinkedIn (LNKD +1.79%) was initiated with an ‘Overweight’ at Morgan Stanley with a price target of $310.

Sprouts Farmers Markets (SFM +1.23%) reported Q4 adjusted EPS of 12 cents, above consensus of 9 cents.

Avago (AVGO -0.44%) rose over 5% in after-hours trading after it reported Q1 EPS of $2.09, higher than consensus of $1.94, and then said it will acquire Emulex ELX for $8 per share in an all-cash transaction valued at approximately $606 million.

L Brands (LB +1.03%) fell nearly 2% in after-hours trading after it reported Q4 EPS of $1.89, better than consensus of $1.80, but then lowered guidance on fiscal 2015 EPS to $3.45-$3.65, below consensus of $3.83.

Salesforce.com (CRM +1.52%) reported Q4 EPS of 14 cents, right on consensus.

Whiting Petroleum (WLL +0.57%) reported Q4 adjusted EPS of 44 cents, weaker than consensus of 49 cents.

AmSurg (AMSG -0.42%) reported Q4 adjusted EPS of 77 cents, above consensus of 73 cents, and then raised guidance on fiscal 2015 revenue to $2.44 billion-$2.47 billion, higher than consensus of $2.39 billion.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Consumer Price Index

8:30 Initial Jobless Claims

8:30 Durable Goods

9:00 FHFA House Price Index

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

11:00 Kansas City Fed Mfg Survey

1:00 PM Results of $29B, 7-Year Note Auction

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: ACIW, ACTA, AES, AKRX, AMCX, AMWD, ANSS, ARCC, BDBD, BIN, BUD, CCG, CHS, CNP, CNSL, CRI, CWEI, CYBX, DDD, EME, EXH, EXLP, FCH, FIG, FRO, GCAP, GOGO, HAWK, HEES, HSC, HSNI, ICON, IQNT, IRDM, ITC, KOP, KSS, LKQ, LPI, LTM, MBLY, MDXG, MGLN, MITL, MRGE, NTI, NTLS, NXST, NXTM, OGE, ONE, RHP, SDRL, SEAS, SFY, SHLD, SNAK, SNH, SNMX, SRE, SRPT, TASR, TD, TICC, TWI, VAC, VC, VICL, WAC, WNR, XCRA, ZEUS

Notable earnings after today’s close: ABTL, ADSK, AEGR, AHT, AIRM, AL, APEI, ARUN, AVD, BCEI, BIO, BLOX, CERS, CLNE, CROX, CSU, CUBE, DGI, ECOL, ECPG, ENOC, ENV, EVC, EVHC, GPS, HLF, HPTX, IM, IMMR, JCP, KBR, KND, LYV, MAIN, MDRX, MENT, MITT, MNST, MTZ, MVNR, NMBL, NOG, NVAX, OLED, OUT, OVTI, PE, PEGA, PFMT, PKT, PODD, PSIX, RBA, RMTI, ROST, RP, RPTP, RRMS, SB, SBAC, SEMG, SGM, SPLK, SRC, SREV, SWN, SZYM, TPC, TUBE, TUMI, TWOU, UHS, UIL, UNXL, VGR, WIFI, WTR, WTW

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 26)”

Leave a Reply

You must be logged in to post a comment.

Looking at the drop from 2 to 3 yesterday I get a sense the market is near the end of the up leg.

spot on

one more down and up to complete the multi decade trend

of course Jasons view of new multi year nas high for nas is very bearish

and even a slight push to new high gives us a multi decade bearish mega phone jaws of death and a trend reversal

time –april 1st