Good morning. Happy Friday.

The Asian/Pacific markets closed mixed. India led with a 1.7% gain; Australia, China and New Zealand also closed up. Singapore and South Korea dropped. Europe currently leans to the downside. Greece is down 3%, followed by Norway (down 0.8%) and Belgium (down 0.6%). Italy is up 0.6%. Futures here in the States point towards a down open for the cash market.

The dollar is down. Oil is up, copper is down. Gold and silver are down. Bonds are down.

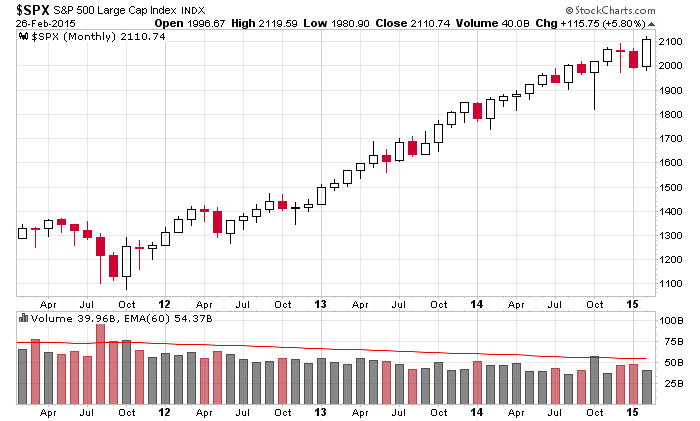

Today’s the last day of February, and despite there being less trading days than any other month, the market will post its biggest monthly gain in several years. We tend to get big up months off lows, but here we’re getting a huge up month in the process of hitting new highs. Here’s the SPX monthly. Other than a dip in October, there hasn’t been a noticeable pullback in several years.

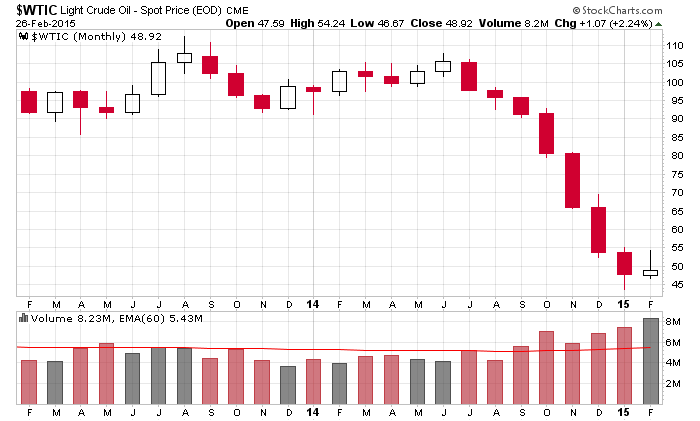

As long as oil doesn’t drop $1.07 today (it’s up $1.00 as of this writing), it’ll post its first up month since topping last June. But it’s hardly a convincing performance because the commodity is 10% off its February high.

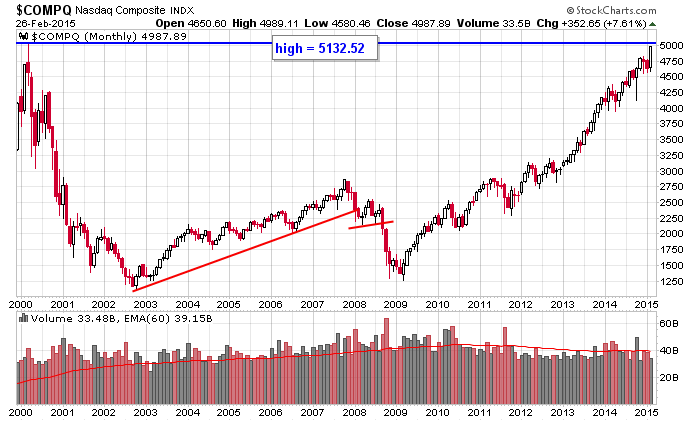

The Nas is about 12 points from 5K and 145 points from its all-time high. I’d be very surprised if the high wasn’t taken out. It’s just gotten happen. The invisible hand of the market will make sure of it.

Bias remains to the upside…but keep managing positions wisely.

Stock headlines from barchart.com…

CBOE Holdings (CBOE -1.63%) was downgraded to ‘Neutral’ from ‘Buy’ at BofA/Merrill Lynch.

FedEx (FDX -0.59%) was upgraded to ‘Outperform’ from ‘Neutral’ at Credit Suisse.

Universal Health (UHS +3.02%) reported Q4 EPS of $1.71, better than consensus of $1.50.

Southwestern Energy (SWN -5.79%) reported Q4 adjusted EPS of 52 cents, higher than consensus of 50 cents.

MasTec (MTZ -0.96%) reported Q4 adjusted EPS of 40 cents, above consensus of 38 cents.

Bio-Rad (BIO +0.91%) reported Q4 EPS of $1.34, higher than consensus of $1.18.

Tutor Perini (TPC -0.73%) reported Q4 EPS of 56 cents, weaker than consensus of 71 cents, and then lowered guidance on fiscal 2015 EPS to $2.20-$2.50, well below consensus of $2.89.

Mentor Graphics (MENT -2.73%) reported Q4 EPS of $1.09, better than consensus of $1.07.

Ingram Micro (IM -0.04%) reported Q4 EPS of 98 cents, less than consensus of 99 cents.

Herbalife (HLF +3.45%) reported Q4 adjusted EPS of $1.41, better than consensus of $1.22, but then lowered guidance on fiscal 2015 adjusted EPS to $4.10-$4.50, well below consensus of $5.08.

J.C. Penney (JCP +1.45%) dropped over 11% in after-hours trading after it reported Q4 adjusted EPS of 0 cents, well below consensus of 11 cents.

Monster Beverage (MNST +0.77%) gained over 4% in after-hours trading after it reported Q4 EPS of 72 cents, well above consensus of 59 cents.

Autodesk (ADSK -1.61%) reported Q4 EPS of 25 cents, above consensus of 24 cents, but then lowerd guidance on fical 2016 EPS to $1.05-$1.20, below consensus of $1.32.

Ross Stores (ROST +0.60%) jumped nearly 5% in after-hours trading after it reported Q4 EPS of $1.20, higher than consensus of $1.11, and then announced a new $1.4 billion stock repurchase program.

The Gap (GPS +0.20%) rose nearly 3% in pre-market trading after it reported Q4 EPS of 75 cents, better than consensus of 74 cents, and then announced a $1 billion share repurchase program.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

Fed’s Williams at Monetary Policy forum

Fed’s Loretta at Monetary Policy forum

Stanley Fischer at Monetary Policy forum

8:30 GDP Q4

9:45 Chicago PMI

9:55 Reuters/UofM Consumer Sentiment

10:00 Pending Home Sales

3:00 PM Farm Prices

Notable earnings before today’s open: AAON, CAS, CNCE, CST, CVT, DCIX, DFRG, GDP, GLOG, GVA, HMSY, HPT, HTH, HZNP, ISIS, KERX, LBY, NRF, NRG, NWN, NYLD, PNM, POM, PTCT, RDC, SJI, TTI, WMC, XLS

Notable earnings after today’s close: CNL, TCAP

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Feb 27)”

Leave a Reply

You must be logged in to post a comment.

End of window dressing today. The movement is toward trying to find out of the 2.2% GDP leads to anything be sides new cars. No Fed action, rate increase for a time, 2016 maybe, employment is the current Fed objective. Suspect another rally attempt to test sentiment, if it is low on volume, we do very little.

Look at the Pharma. I took on XBI recently and VRX suggests health care may be a live play. Whole market is setting up for a correction, down, tears…etc. Get short for next week. Cheers