Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. China dropped 2.2%, and Hong Kong fell 0.7%. Singapore and India moved up about 0.5%. Europe is currently mixed. Russia is up 1.7%, and Austria and Greece are up 1%. There are no big losers. Futures here in the States point towards a down open for the cash market.

The dollar is up a small amount. Oil is up, copper is down. Gold and silver are up. Bonds are down.

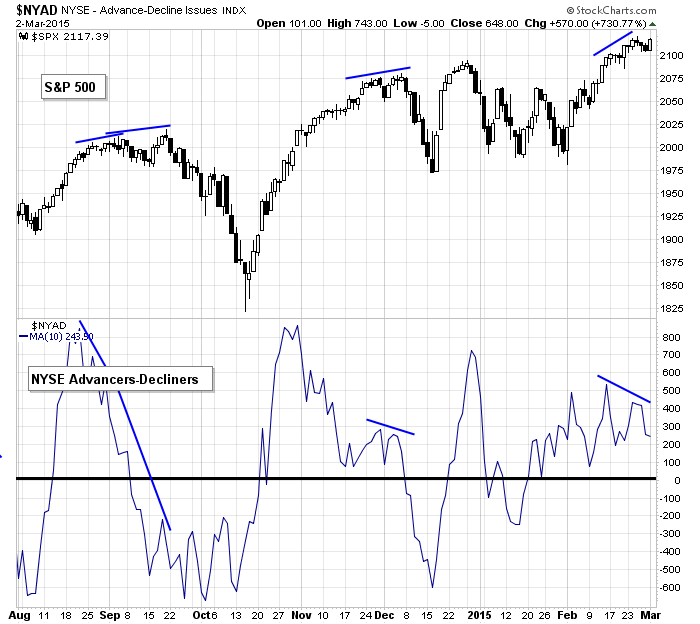

The market posted decent gains yesterday…several indexes high new highs…but beneath the surface some breadth indicators are lagging. This suggests a lack of participation and is likely to lead to a correction if they don’t immediately right themselves. I wouldn’t look for a big move down or one that lasts a long time…just a simple pullback to get the bears (are there still bears left) excited and plant seeds of doubt in the minds of bulls.

Here’s an example. It’s the 5-day MA of the NYSE AD line vs. the S&P 500. The market has pushed to a new high while the AD line put in a lower high. On average advancers are beating decliners, but they’re not dominating and there isn’t any momentum.

Oil remains range bound and could provide either a big boost or big drag on the market.

My stance remains the same. Intermediate and long term I like the market. But in the near term, the upside is limited unless the breadth indicators right themselves soon. More after the open.

Stock headlines from barchart.com…

Nomura downgraded Micron (MU +1.86%) to ‘Neutral’ from ‘Buy.’

Navistar (NAV -0.58%) reported a Q1 EPS loss of -52 cents, a smaller loss than consensus of -$1.09.

Lumber Liquidators (LL -25.13%) was upgraded to ‘Buy’ from ‘Neutral’ at Janney Capital.

Dick’s Sporting (DKS +2.46%) reported Q4 EPS of $1.30, above consensus of $1.22.

Best Buy (BBY +1.39%) reported Q4 EPS of $1.48, higher than consensus of $1.35.

AutoZone ({=AZO reported Q2 EPS of $6.51, better than consensus of $6.38.

Nortek (NTK +2.27%) reported Q4 EPS of 29 cents, well above consensus of 19 cents.

CBOE Holdings (CBOE -0.92%) reported that total options and futures volume at CBOE Holdings during February was 88.5 million contracts, down -17% m/m and -22% y/y.

Nabors Industries (NBR -2.11%) reported Q4 adjusted EPS of 33 cents, below consensus of 39 cents.

McDermott (MDR +4.40%) surged 20% in after-hours trading after it reported Q4 EPS of 3 cents, much better than consensus of a -6 cent loss, and then raised guidance on fiscal 2015 revenue to $3.3 billion-$3.6 billion, stronger than consensus of $2.79 billion.

Mylan (MYL +0.98%) reported Q4 adjusted EPS of $1.05, right on consensus, although Q4 revenue of $2.08 billion was better than consensus of $2.07 billion.

Herman Miller (MLHR +0.74%) lowered guidance on 2015 revenue to $2.118 billion-$2.153 billion, below consensus of $2.170 billion.

Caesar’s (CZR +3.96%) slid over 4% in after-hours trading after it reported a Q4 EPS loss of -$7.00, more than four times consensus of a -$1.65 loss.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

Auto sales

8:30 Gallup US ECI

8:55 Redbook Chain Store Sales

8:15 PM Janet Yellen speech

Notable earnings before today’s open: ACW, AZO, BBEP, BBY, BNS, DKS, INSY, JD, KATE, NAV, PRIM, RIGL, SSI, TEDU, TPH

Notable earnings after today’s close: ABM, AMBA, AMRN, ASNA, AVAV, BOBE, BV, CDXS, CECO, EGL, GERN, LRE, REGI, SWHC, TIVO, TNET, VEEV, ZLTQ

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 3)”

Leave a Reply

You must be logged in to post a comment.

Agree with Jason… A pull back is in the future. I want to see it before going long again.

As long as the PC ratio is over 1 it won’t happen.