Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly down. Hong Kong, Japan, Australia, India and Indonesia posted noticeable losses. China moved up 0.5%. Europe currently leans to the downside. Stockholm, Norway and Russia are down more than 1%; Austria and Greece are also down. There are no big winners. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is up. Oil is up, copper is up. Gold and silver are down. Bonds are mixed.

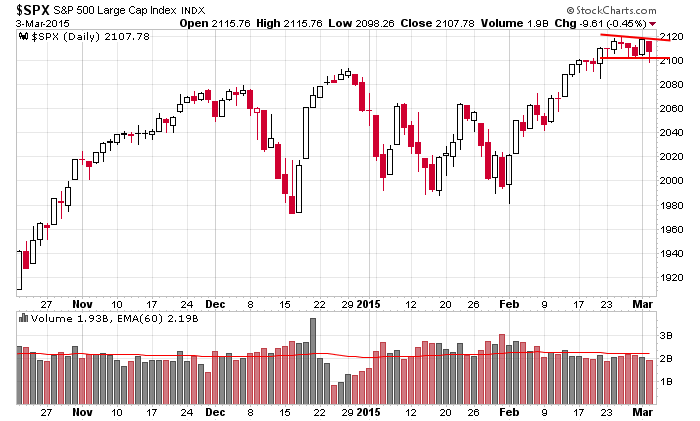

The market, per the indexes, has been pretty boring lately. In fact the S&P has traded in a 22-point range the last seven days. Compared to December, January and the first half of February where the S&P would easily move 20-30 points per day, the current ranges are tiny. Rallies are getting sold and dips are getting bought.

At the end of last week I started saying the upside was limited, both in terms of time and price, unless the breadth indicators, which had started diverging from the price action, quickly improved. It hasn’t happened so far, but the market hasn’t moved down much. Perhaps it will correct with time rather than a price drop. We’ll see. Until we get some downside movement that enables the charts to reset or enough time passes to enable the breadth indicators cycle down, all new long trades should have a short leash.

Here’s the S&P. There’s nothing wrong with the overall price action. But building gains on top of gains is tough, so I’d like to see a dip before an attempt to move higher begins.

No big bets right now. The market is in good shape overall, but in the near term I’m neutral.

Stock headlines from barchart.com…

Alcoa (AA +1.54%) and Century Aluminum (CENX -1.44%) were both downgraded to ‘Neutral’ from ‘Buy’ at BofA/Merrill Lynch.

Dick’s Sporting Goods (DKS +1.05%) was downgraded to ‘Hold’ from ‘Buy’ at Needham.

Best Buy (BBY +1.42%) was upgraded to ‘Neutral’ from ‘Underperform’ at Wedbush.

Halyard Health (HYH -0.92%) reported Q4 adjusted EPS of $1.59, well above consensus of 77 cents.

Trina Solar (TSL +1.19%) reported Q4 EPS of 13 cents, right on consensus, although Q4 revenue of $705.04 million was higher than consensus of $642.88 million.

AutoZone (AZO +0.36%) was upgraded to ‘Neutral’ from ‘Underperform’ at Sterne Agee.

VWR (VWR -0.76%) reported Q4 adjusted EPS of 43 cents, higher than consensus of 37 cents.

McDonald’s (MCD -0.26%) was upgraded to ‘Outperform’ from ‘Sector Perform’ at RBC Capital.

ABM Industries (ABM -0.16%) reported Q1 adjusted EPS of 38 cents, better than consensus of 34 cents, and then raised guidacne on fiscal 2015 adjusted EPS view to $1.75-$1.85, above consensus of $1.75.

Air France-KLM (AFLYY +0.91%) was downgraded to ‘Neutral’ from ‘Buy’ at Goldman Sachs.

Cascade Investment reported a 7.9% stake in Strategic Hotels (BEE -1.82%) .

Engility Holdings (EGL -1.40%) reported Q4 adjusted EPS of 67 cents, less than consensus of 69 cents.

Bob Evans (BOBE +0.27%) plunged over 15% in after-hours trading after it reported Q3 EPS of 60 cents, below consensus of 70 cents, and then lowered guidance on fiscal 2015 EPS view to $1.40-$1.60 from $1.90 to $2.10, weaker than consensus of $1.97.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

8:15 ADP Jobs Report

8:30 Gallup U.S. Job Creation Index

9:00 Fed’s Evans: U.S. Economy and Monetary Policy

9:45 PMI Services Index

10:00 ISM Non-Manufacturing Index

10:30 EIA Petroleum Inventories

1:00 PM Fed’s George: U.S. Economy

2:00 PM Fed’s Beige Book

Notable earnings before today’s open: AEO, AMED, ANF, ARQL, ATHM, BF.B, DSX, GTXI, HYH, INXN, LXRX, MTLS, PETM, SCMP, SOL, SSP, TOUR, TSL, W

Notable earnings after today’s close: ALIM, ALSK, BIOL, BREW, CPE, DAR, ERJ, GEF, GTY, HRB, JONE, PEIX, POWR, PPO, PQ, RNDY, SMTC, SPOK, SQNM, VSLR, WTI

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 4)”

Leave a Reply

You must be logged in to post a comment.

Yes, neutral seems logical. The ADP employment is a little light (20K) Wednesday AM, but OK. What is likely? If employment were to keep slipping Jo Ellis’s Book says it could lead to a drop in GDP and the markets, but that is months from now, or is it? I have ridden small caps for a few bucks, VBK and BA for manufacturing. My dividends are standing still. My boat is in the yard after some idiot brought it home beaten up by a trip to Mexico,…. and I need money or a job of some kind to pay off the Port Townsend yards. Faith is needed for Friday jobs to keep hopes rising. Best to all.

SPX 2086 should be all the wave 4 correction possibly a back test

2066 now seems unlikly

next small wave 5 up to new highs

then the bears take over for 10 years under the control of the marsians