Good morning. Happy Thursday.

The Asian/Pacific markets closed with a lean to the downside. Hong Kong, China and Malaysia each dropped about 1%; Singapore fell 0.6%. Europe is currently mostly up. France, Amsterdam, Austria, Norway, Prague and Russia are up 0.8% or more. Only Greece (down 0.5%) is down. Futures here in the States point towards an up open for the cash market.

The dollar is up. Oil is up, copper down. Gold and silver are up. Bonds are mixed.

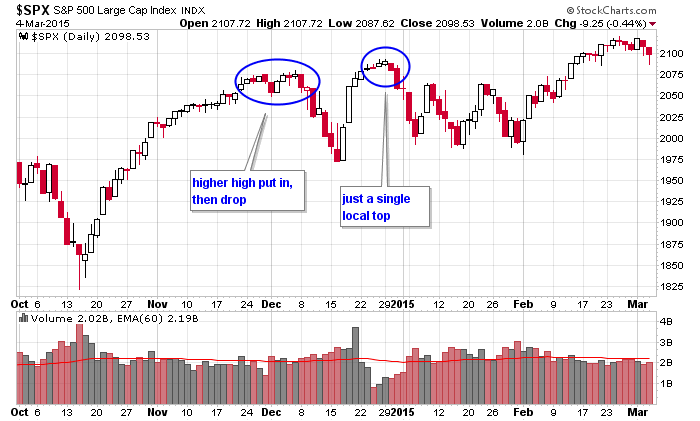

The market dropped again yesterday but for the second straight day closed off its low. Over the weekend I made the case that the upside was limited unless the breadth indicators quickly righted themselves. Several were diverging from the indexes, suggesting a lack of participation. This development doesn’t mean a top is in place, and we’ll get a long and extended move down. It just means the market needs to rest (via a pullback or time) before attempting to move higher. So far we’ve gotten an up day on Monday and down days on Tuesday and Wednesday. The net has been a down week, but nothing for the bulls to be concerned about. I guess you can say everything is right on queue, but the next couple weeks could still go a couple different ways.

1) The market can pull back right now. Nothing special here…just a simple correction that takes the S&P down for a week or two before falling enough to attract buyers. This is what happened during most of the December/January consolidation period.

2) Another new high can be put in place that is then followed by a correction. The new high would likely come with across-the-board divergences and would lure in some bulls would have been sitting on the sidelines. This happened at the end of November/beginning of December.

Unless the indicators quickly right themselves and move up, I do think a pullback is coming.

Here’s the daily S&P.

Stock headlines from barchart.com…

Costo Wholesale (COST -0.14%) reported Q2 EPS of $1.25, more than consensus of $1.18.

Abercrombie & Fitch (ANF -15.51%) was downgraded to ‘Neutral’ from ‘Buy’ at Nomura.

Exxon Mobil (XOM -0.50%) was downgraded to ‘Hold’ from ‘Buy’ at Evercore ISI.

McDonald’s (MCD +0.51%) was downgraded to ‘Neutral’ from ‘Overweight’ at Piper Jaffray.

Joy Global (JOY -1.95%) reported Q1 EPS of 25 cents, less than consensus of 36 cents, and then lowered guidance on fiscal 2015 adjusted EPS view to $2.50-$3.00 from $3.10-$3.50, well below consensus of $3.20.

Sprouts Farmers Markets (SFM -1.22%) filed to sell 15.85 million shares of common stock for holders.

Darling (DAR -0.23%) rose over 4% in after-hours trading after it reported Q4 EPS of 42 cents, double consensus of 21 cents.

Pharmacyclics (PCYC +6.33%) jumped over 7% in pre-market trading after AbbVie agreed to buy the company fpr $21 billion.

Alon USA Partners (ALDW -0.06%) reported Q4 EPS of 67 cents, better than consensus of 60 cents.

Bristol-Myers Squibb (BMY +6.06%) announced that the FDA has approved its Opdivo injection, for intravenous use, for the treatment of patients with metastatic squamous non-small cell lung cancer.

Coca-Cola Bottling (COKE -2.00%) reported Q4 EPS of 32 cents, higher than one estimate of 13 cents.

H&R Block (HRB -0.86%) reported a Q3 adjusted EPS loss of -13 cents, a smaller loss than consensus of -17 cents.

Roundy’s (RNDY -0.25%) reported Q4 adjusted EPS of 7 cents, more than twice consensus of 3 cents.

Earnings and Economic Numbers from seekingalpha.com…

Thursday’s economic calendar

Chain Store Sales

7:30 Challenger Job-Cut Report

8:30 Initial Jobless Claims

8:30 Gallup US Payroll to Population

8:30 Productivity and Costs

9:45 Bloomberg Consumer Comfort Index

10:00 Factory Orders

10:30 EIA Natural Gas Inventory

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before Thursday’s open: ACRE, AMRC, AXAS, BKCC, BRLI, BTE, CECE, CIEN, CNQ, COST, CSIQ, CTCM, CVGW, DATE, EXK, GTN, JOY, KR, MEI, NAVB, PRFT, SFE

Notable earnings after Thursday’s close: ADUS, ALDW, ALJ, ATSG, CKP, COO, DMD, DMND, EBS, ERII, ESL, FNSR, FRM, GALE, HCI, ICEL, MNTX, SKUL, TFM, THO, VMEM, WX, YY, ZQK

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 5)”

Leave a Reply

You must be logged in to post a comment.

Nice chart work… I have to agree with Jason.. A pullback of some kind is coming. Not a major bloodbath just a nice chance to go long.

The ECB says it will buy bonds monthly in the EU, that will stimulate the purchase of US equities by EU banks/investors. Overall it will not what a more direct QE would to US markets but it it a net positive. In the longer run the employment data and Spending were disappointing, I will buy a hold position in new dividend stocks. Be conservative, but I will be invested. Best

social mood in europe is changing

why should greek tax payers take on more debt just to bail out its banks

the greek public see none of the bail out money and have no duty to save greek banks

greece should default on its debt and bankrupt the banks

the ecb or imf are banks let them bail out the greek spanish portugees or italian banks if they want to with their money

power to the people bring back the french revolution

the world financial system is corupt ,a ponsi and should be prosecuted by corupt judges

and allowed to fail

power to the people

im bored

i want volitility