Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. Japan and China rallied more than 1%; Australia, India and Taiwan also posted solid gains. Europe is currently mixed. Norway (up 1.5%) and London (up 1%) are leading; Greece (down 0.6%) is lagging. Futures here in the States point towards a moderate gap up open for the cash market.

Click here to join our email list.

The dollar is down. Oil is up, copper is up. Gold and silver are up. Bonds are up.

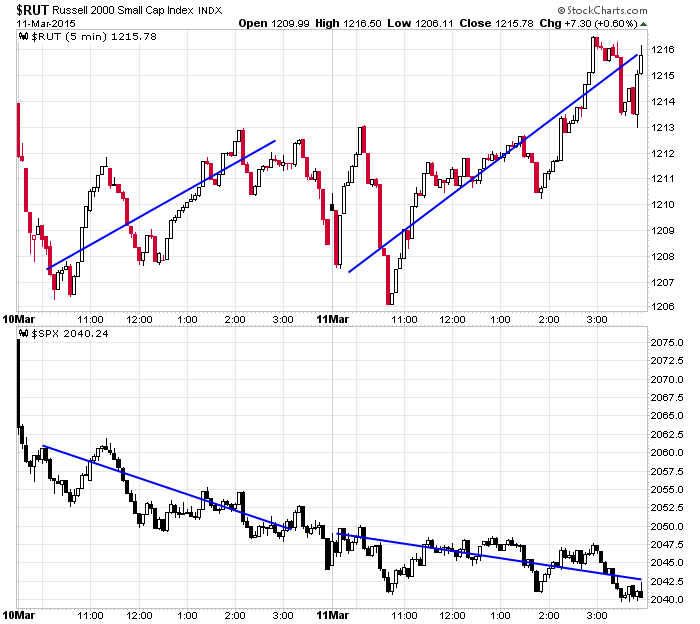

The last two days the small caps have tried to move up, but the large caps kept pushing down. The divergence was obvious and messed with day traders who closely monitor the movement of the indexes relative to each other. It’s a little piece of evidence Wall St. is confused right now. The indexes are near no-man’s land – about the midpoint of their recent high and low. And we don’t have many good set ups to play. This is not a time to place big bets. Day traders can continue doing their thing, but swing traders would be wise to lighten up and be patient.

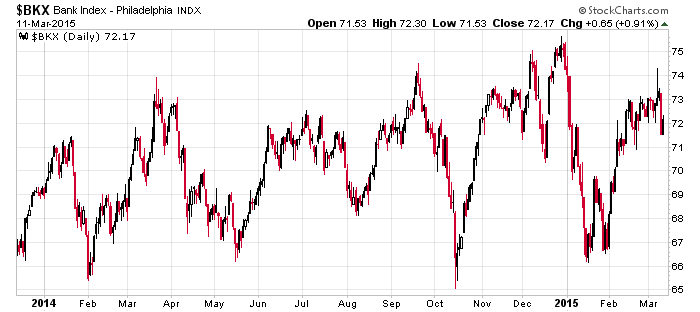

Several banks (Citigroup, Morgan Stanley, State Street, JP Morgan, Bank of America) announced buybacks today. I doubt the buybacks can break the banking group out of its range, but they certainly will aid a little should the market head south.

The overall trend remains up, but near term things are much more iffy (they’ve been like this the last 1-1/2 weeks). We’ve been laying low (since the divergences formed between the indexes and breadth indicators) and will remain patient. More after the open.

Stock headlines from barchart.com…

Citigroup (C +2.15%) rose 3% in pre-market trading after it announced a $7.8 billion share buyback plan.

Morgan Stanley (MS +0.20%) gained over 2% in pre-market trading after it announced a $3.1 billion share repurchase plan.

Lumber Liquidators (LL +10.65%) lowered guidance on Q1 revenue to $253.6 million-$265.6 million, below consensus of $275.98 million.

The Children’s Place (PLCE -0.41%) reported Q4 adjusted EPS of 94 cents, higher than consensus of 93 cents, but then said it sees fiscal 2015 same-store-sales flat to up 1% as it lowered guidance on fiscal 2015 adjusted EPS to $3.15-$3.30, below consensus of $3.41.

Men’s Wearhouse (MW +0.33%) rose over 5% in after-hours trading after it reported a Q4 adjusted EPS loss of -3 cents, a smaller loss than consensus of -7 cents.

State Street (STT +1.51%) announced a $1.8 billion share buyback program.

JP Energy (JPEP +2.19%) reported a Q4 EPS loss of -51 cents, weaker than consensus of a 1 cent profit.

JPMorgan Chase (JPM +0.47%) announced a $6.4 billion share repurchase program.

Bank of America (BAC +2.03%) announced a $4 billion share repurchase program.

The Federal Reserve objected to the capital plans of Deutsche Bank Trust Corporation (DB +1.35%) and Banco Santander’s (SAN +0.15%) Santander Holdings USA on qualitative concerns.

Scientific Games (SGMS -1.56%) reported a Q4 EPS loss of -55 cents, a smaller loss than consensus of -60 cents.

1-800-Flowers.com (FLWS +2.18%) was initiated with a ‘Buy’ at B. Riley with a price target of $15.

JetBlue (JBLU +0.94%) reported its traffic in February increased 10.0% from February 2014.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Initial Jobless Claims

8:30 Retail Sales

8:30 Import/Export Prices

9:45 Bloomberg Consumer Comfort Index

10:00 Business Inventories

10:30 EIA Natural Gas Inventory

1:00 PM Results of $13B, 30-Year Note Auction

2:00 PM Treasury Budget

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: BONT, CMN, CRME, CSTM, CVGW, DG, GCO, GLP, HOV, JASO, KIRK, LEAF, MTN, PGEM, PLCE, PWE, QIWI, RICE, SMRT, SNSS, TLP

Notable earnings after today’s close: ANAC, ARO, ATHX, EGY, FF, FTD, FXCM, GST, HIL, IRET, IRG, JMBA, KRO, KTOS, LOCO, MED, OMED, PPHM, RMAX, TEAR, ULTA, ZUMZ

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 12)”

Leave a Reply

You must be logged in to post a comment.

Small caps are doing better than large. PC ratio has been over 1 for days. Confusing at best. Small caps are up almost 1% in premarket while large are barely up. Normally I would short the open… Not today.

daytrading is a special skill and definitly no for everyone

one has to be set up for daytrading and have all charts open at once ,including europe

one index can stall the other indexs or led the others

special indicators and trading plan is essential

personally i think we will have a correction up here [lower high or even new highs ]

but thats not daytrading and i dont have a bias daytrading