Good morning. Happy Friday.

The Asian/Pacific markets closed with a lean to the downside. Japan rallied 1.4%, followed by South Korea (up 0.8%) and China (up 0.7%). India fell 1.5%, followed by Australia (down 0.5%). Europe currently leans to the downside, but other than Russia and Greece (down 1.7% and 1.2%), movement is minimal. Prague is up; London, Germany and France are down. Futures here in the States point towards a down open for the cash market.

Click here to join our email list.

The dollar is up. Oil and copper are down. Gold is up, silver is flat. Bonds are down.

The biggest up days take place within downtrends. That’s what happened yesterday. A moderate gap up got follow through buying, and the biggest up day since the beginning of February was recorded. Such days are relatively easy because the supply/demand imbalance shifts too far to one side. Short covering and momentum buying can easily push the market up for a few days. Now the question is whether 1) it was a 1-day move, 2) the beginning of a dead cat bounce within a newly-established short term downtrend or 3) the beginning of a rally that takes us to new highs.

Charts of individual stocks improved yesterday, and most of the indicators would be supportive of a move up…although not all of them hit extreme levels. Health care providers in particular look good.

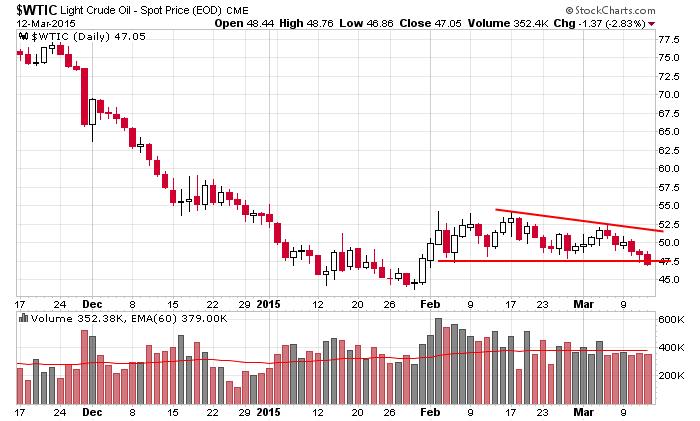

Yesterday oil penetrated a support level…today it’s down another buck. Many oil stocks have been struggling.

I wouldn’t consider today to be extremely important (unless we get a big move), but early next week will tell us if yesterday was just a 1-day blip or the beginning of something meaningful. More after the open.

Stock headlines from barchart.com…

Intel (INTC -4.73%) was upgraded to ‘Buy’ from ‘Hold’ at Canaccord.

Genesco (GCO -7.79%) was downgraded to ‘Neutral’ from ‘Buy’ at Sterne Agee.

Children’s Place (PLCE +8.81%) was downgraded to ‘Neutral’ from ‘Buy’ at Citigroup.

Worldwide PC shipments are expected to drop 4.9% in 2015, compared to a previous forecast of 3.3%, reports DigiTimes, according to the IDC Worldwide Quarterly PC Tracker.

Piper Jaffray said February video game software sales rose 7% y/y and maintains its ‘Overweight’ ratings on Activision Blizzard (ATVI -0.09%) , Electronic Arts (EA -0.05%) , GameStop (GME +0.51%) and Take-Two (TTWO +0.20%) .

General Motors (GM +1.72%) will recall approximately 64,000 2011-13 Chevrolet Volts for a software update to limit how long the car can be left idling.

Kronos Worldwide (KRO +1.76%) reported Q4 EPS of 17 cents, better than consensus of 14 cents.

Mobileye (MBLY +0.75%) was upgraded to ‘Buy’ from ‘Neutral’ at Goldman Sachs.

Laurene Powell Jobs Trust reported a 7.7% passive stake in Disney (DIS +4.16%) .

Ulta Salon (ULTA +2.01%) jumped 7% in after-hours trading after it reported Q4 EPS of $1.35, higher than consensus of $1.27.

Aeropostale (ARO -6.80%) slid 4% in after-hours trading after it reported Q4 adjusted EPS of 1 cent, better than consensus of a -3 cent loss, but then lowered guidance on Q1 EPS to a loss of -61 cents to -53 cwnts, a larger loss than consensus of -36 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Producer Price Index

9:55 Reuters/UofM Consumer Sentiment

Notable earnings before today’s open: ANN, BKE, EBIX, HIBB, PETX, RGEN, SPPI, TA

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 13)”

Leave a Reply

You must be logged in to post a comment.

I have been wrong but I don’t see much upside here. I did raise my target on the NASDAQ to 47500 where I would think of going long. Anything here is a forced trade and forced trades lead to losses.

Wow I meant 4700 on the NASDAQ.

The pain of finding out that traders like a poor performing economy and a Fed that says the big banks are will managed so dividends and other emoluments are OK to pass out – no FED rate increases anytime soon (so buy stocks). Meanwhile, The ECB is buying bonds to inject money in the EU; that is hard to not like. EU stocks will rise, hell maybe some US stks too. Look at Japan – experts at the QE. The whole thing shows that US/EU & Japan traders are desperate….. but I am holding on until Janet does her thing.I suspect the economy is moving to a recession or maybe a hiatus – nothing happens . Caution is justified, the debt levels are going to prevent much recovery in US growth. the Fed wants some inflation – to avoid deflation. Be cautious these jerks made this mess and they might get crazy looking for ways to pay down their fed debt. How about interest on bank deposits, or a wealth tax, or maybe a bail-in where they just take your money from you bank a/c. On the edge of madness. Exercise a lot , paint the house.

how about DEFAULT

all ponsies end with INPLOSION–no more debt

japan currency is heading to zero as is euro with euro madness

all actions have a equal and opposing reaction

power to the people -stop the tax payer bail out of the banks

bankrupt the financial system and start again

this could be a wave 2 abc correction with small c up to come ,followed by large fast wave 3 down

or

a 3 thrust down followed by a fast up or down

What seems to be evident, is that the big money -or smart money, is moving overseas.Savvy investors like George Soros and Warren Buffett have been making bets on Europe based on recent 13-F filings. And who can blame them, that is astuteness at its best. The weak euro makes euro zone equities comparatively more attractive than U.S stocks. Inflows into European equities since mid-January have been a sizable $27 billion. But outflows in the second half of last year were $48 billion , suggesting the $21 billion gap means there is still notable potential for further inflows,according to Barclays. Food for thought.

Also, SP500 and Dow seem to be in exhaustive mode,rightfully so. Dow is made up of multi-national companies. According to RBC, roughly 45% of revenue from S&P500 companies is generated from overseas markets. The Fed is in a major dilemma. Potential rate hike while the rest of the major global economies are easing. All eyes and ears will tune in on Wednesday,March 18 at 2pm for the FOMC meeting announcement.

look at the incrediable german DAX now heading for 12000 and proping up the nas 100

its a ponsi bubble just waiting for a crash

all a result of the currency wars

what happens when the usd turns or does it go up forever and destroys usa

will the fed let that happen

Well, that is the dilemma, by not raising rates, it comes with its own set of risks, mainly in the unintended consequence of creating a new asset bubble. Keep in mind with cheap oil prices, consumers will feel that extra cash in their pockets, which can convince people to spend, another form of stimulating the economy. Small caps maybe mid-cap stocks should benefit.

the fed is actually bankrupt now

as is the economy that saw nothing of the QE money

same as greece

look at sales figures, stock inventories ,housing starts,wages

yet we are suppost to beleive the fed induced fantasy jobs reports

that fraud

You can argue about the artificial stimulation packages via the Fed’s QE over the years, but traders and/ or investors didn’t fight the Fed on that regard. People like Glen Beck, Peter Schiff and many others who implored to dump your dollars , buy gold,canned foods, build underground homes, were dead wrong. I would anticipate sales figures to pick up significantly. Stock inventories (depends big caps VS small caps), housing markets (also depends new home sales VS home prices,which has risen for homeowners,meaning positive equity for many). Wages, many big companies are looking to raise em’, several states are pushing for higher minimum wages. The thing is numbers don’t lie.