Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. Malaysia rallied 1%; Hong Kong fell 0.4%. Everything else stayed relatively close to home. Europe is currently mostly up. Greece is up 2.3%, followed by Italy (up 0.7%) and Belgium (up 0.5%). Austria is down 0.4%. Futures here in the States point towards an up open for the cash market.

My public list at stockcharts.com is here. If you’re a sub, vote if you want me to continue posting.

The dollar is down. Oil is up 18 cents; copper is down. Gold and silver are up. Bonds are up.

Yesterday was a very quiet day. Even with a last-minute sell-off from the indexes, there was very little movement from Friday’s closes. A true coffee day. The S&P moved sideways most of the day; the small caps slowly moved up, but again, there was very little net change.

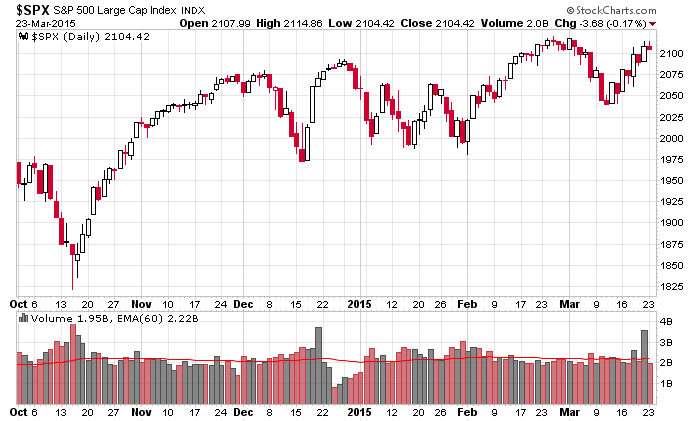

Here’s the daily S&P 500. Lots of up and down movement the last five months. Other than a little extra push at the end of February, no rallied has lasted very long or gone very far. Because of this we’ve had more shorter term trades that have only lasted a week instead of longer term ones that have lasted a month or more. It is what it is. We can’t call our pitches here. We take what the market gives. If it gives up 5-10% moves that last a week (like we have gotten from the health care plan stocks), then we’ll say thanks and take it.

Stock headlines from barchart.com…

RW Baird upgraded Cummins (CMI -0.01%) to ‘Outperform’ from ‘Neutral’ and raised its price target to $166 from $155.

L Brands (LB +0.02%) was initiated with a ‘Buy’ at Topeka with a price target of $106.

Estee Lauder (EL -0.78%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Wells Fargo.

Hartford Financial (HIG -0.26%) coverage resumed with a ‘Buy’ at Goldman Sachs with a price target of $49.

McCormick & Co. (MKC +0.44%) reported Q1 EPS of 70 cents, higher than consensus of 64 cents.

IHS Inc. (IHS -0.16%) reported Q1 adjusted EPS of $1.36, right on consensus, but then lowered guidance on fiscal 2015 adjusted EPS to $5.77-$5.97 from $6.10-$6.30, below consensus of $6.18.

HD Supply (HDS -0.98%) reported Q4 EPS of 11 cents, better than consensus of 10 cents.

Fluor (FLR +1.03%) was awarded an engineering contract for a new Chinese polysilicon plant in Yulin, Shaanxi Province, China, that will have an anticipated total investment of more than $1 billion.

Starboard reported a 13.1% stake in Insperity (NSP -3.55%).

Carl Icahn reported a 10.98% stake in Chesapeake (CHK +3.67%).

The U.S. FDA approved Abiomed’s (ABMD +2.38%) Impella 2.5 System, a miniature blood pump system intended to help certain patients maintain stable heart function and circulation during certain high-risk percutaneous coronary intervention procedures.

American Water (AWK -0.76%) coverage was resumed with a ‘Buy’ at Janney Capital with a price target of $62.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Consumer Price Index

8:55 Redbook Chain Store Sales

9:00 FHFA House Price Index

9:45 PMI Manufacturing Index Flash

10:00 New Home Sales

10:00 Richmond Fed Mfg.

1:00 PM Results of $26B, 2-Year Note Auction

Notable earnings before today’s open: GIII, HDS, IHS, MKC

Notable earnings after today’s close: CBK, SCS, SONC, TRQ

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 24)”

Leave a Reply

You must be logged in to post a comment.

I have not got a buy signal since Jan 6… It has been a long time since I have gone three months without one.