Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed. Hong Kong moved up 0.5%; other up markets posted small gains. China and Indonesia dropped 0.8%, followed by Taiwan (down 0.7%). Europe is currently mostly down. Russia is down 1.2%, followed by Italy (down 1%), France (down 0.9%), Germany and Spain (down 0.8%) and Amsterdam (down 0.7%). Greece is up 3.7%. Futures here in the States point towards a flat open for the cash market.

My public list at stockcharts.com is here. If you’re a sub, vote if you want me to continue posting.

The dollar is down. Oil is up, copper down. Gold and silver are up. Bonds are up.

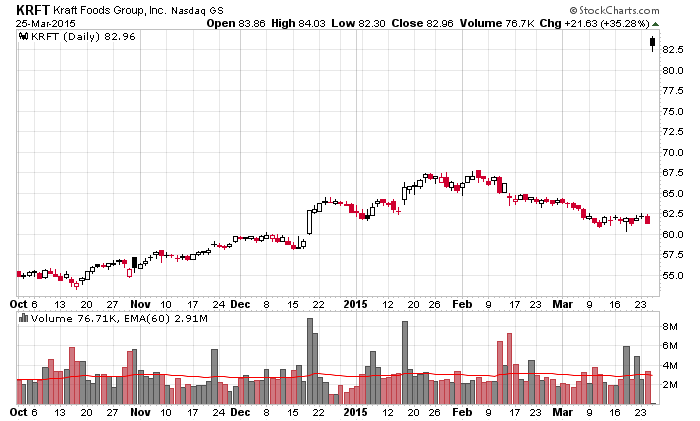

The big news out this morning is Kraft (KRFT) is merging with Heinz to create the third largest food company in the US. Heinz is privately owned by a private equity group, but Kraft is publicly traded and is up 35% in premarket trading. Here’s the chart – an incredible move for a stock that typically moves very slowly.

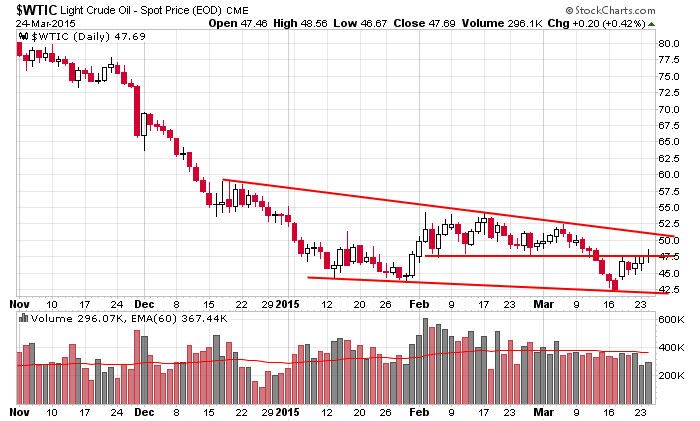

Since dropping to a new low last week, oil has moved up 4 of 5 days. The gains haven’t been huge, so the total bounce is still relatively small. In my eyes crude is still trending down and has a lot more work to do if this is going to reverse. Any oil stock trade to the long side is short term until crude officially starts trending up.

The personality of the S&P has remained the same. Lots of ups and down, and other than a little extra push at the end of February, no move has lasted long or traveled too far. Be ahead of the curve taking profits. It’s great to nail big moves, but lots of little wins add up.

Stock headlines from barchart.com…

Kraft Foods Group (KRFT -1.27%) surged 16% in pre-market trading after saying it will merge with H.J. Heinz.

Starwood (HOT -2.28%) was downgraded to ‘Neutral’ from ‘Buy’ at SunTrust.

Tesla (TSLA +1.05%) was downgraded to ‘Underperform’ from ‘Outperform’ at CLSA.

Finish Line (FINL +0.41%) was downgraded to ‘Neutral’ from ‘Buy’ at B. Riley.

Leidos (LDOS -2.20%) reported Q4 EPS of 69 cents, higher than consensus of 48 cents, but then lowered guidance on fiscal 2015 EPS to $2.20-$2.45, below consensus of $2.53.

Merck (MRK -0.17%) announced a new $10 billion share repurchase program.

ING Groep (ING +1.20%) was downgraded to ‘Neutral’ from ‘Buy’ at Goldman Sachs.

Ultragenyx (RARE -2.65%) was initiated with a ‘Buy’ at CRT Capital with a price target of $90.

Cepheid (CPHD -2.08%) announced it has received Emergency Use Authorization from the FDA for Xpert Ebola, a molecular diagnostic test for Ebola Zaire Virus that delivers results in less than two hours.

Wells Fargo initiated United Rentals (URI +0.25%) with an ‘Outperform’ rating and a $110-$115 valuation range.

Steelcase (SCS -2.16%) reported Q4 adjusted EPS of 21 cents, better than consensus of 20 cents.

Park City Group (PCYG +0.57%) filed to sell 1 million shares of common stock.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

8:30 Durable Goods

10:30 EIA Petroleum Inventories

11:30 Results of $13B, 2-Year FRN Auction

1:00 PM Results of $35B, 5-Year Note Auction

Notable earnings before today’s open: APOL, DXLG, FRAN, LDOS, LNN, PAYX, YGE

Notable earnings after today’s close: FIVE, FNV, FUL, OTIV, PSUN, PVH, RHT, TGB, VRNT, WOR

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 25)”

Leave a Reply

You must be logged in to post a comment.

The Feb orders suggest a 2% is more likely than 3%. Everything was down over estimates. In general this appears seasonal. In any case, it cools the Feds plans probably. It also shows how little we know about economics and national accounting.

Hard to tell if we have market problems coming. Georg Verba’s indicator says no recession coming. I am keeping SPY, IWM,QQQ and small caps, some bonds, and my dividend portfolio. What will happen? Not much probably, appears we have Fed problems-still. Raise rates .25% and leave town for six months, then do it again.

Best to all. Jason us making some great moves, keep and eye on him.

be ahead of the curve

take profits early–many fast trades –makes much profits in this choppy market

its the nature of the beast–no bull no bear

thats what world wide central banks plunge protection teams have provided us with