Good morning. Happy Friday.

The Asian/Pacific markets closed mixed. Taiwan dropped 1.2%, followed by Japan (down 1.0%). Australia rallied 0.7%, followed by Singapore and Indonesia (up 0.5%). Europe is currently mixed. Austria is down 1%, and Prague is down 0.8%. France and Germany are up 0.5%. Futures here in the States point towards a flat open for the cash market. This is after they were up about 10 points overnight.

My public list at stockcharts.com is here. If you’re a sub, vote if you want me to continue posting.

The dollar is flat. Oil is down, copper is down. Gold and silver are down. Bonds are up.

Yesterday the market got news from the Middle East Saudi Arabia and its allies had launched an attack against Yemen. This sent futures down a bunch, and the weakness continued for the first 45 minutes of the day. But then the market shook off the news, and although it closed down, losses were not very big. Having the ability to brush off potentially bad news is a sign the market is pretty strong.

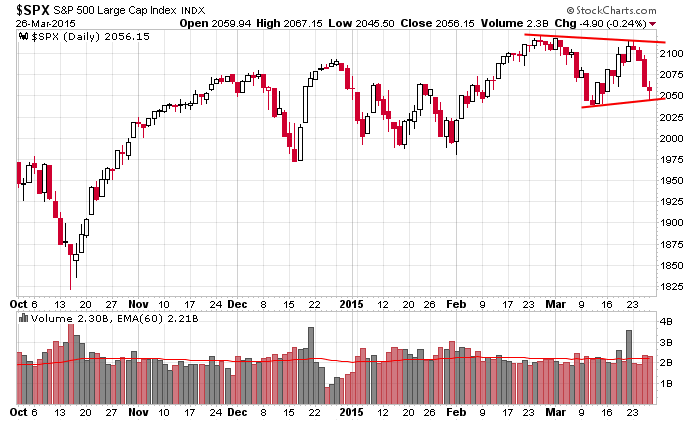

Here’s an update of the daily S&P chart. The upward-sloping support trendline isn’t confirmed until today’s close…as long as yesterday’s low isn’t taken out. The market is what I’ve said it is…neural. Other than a little extra push at the end of February, we’ve had lots of ups and downs and no follow through in either direction. No move has lasted long or gone very far. Shoot for little wins. It’s harder work than nailing big moves, but you gotta take what the market gives you. Lots of little wins add up.

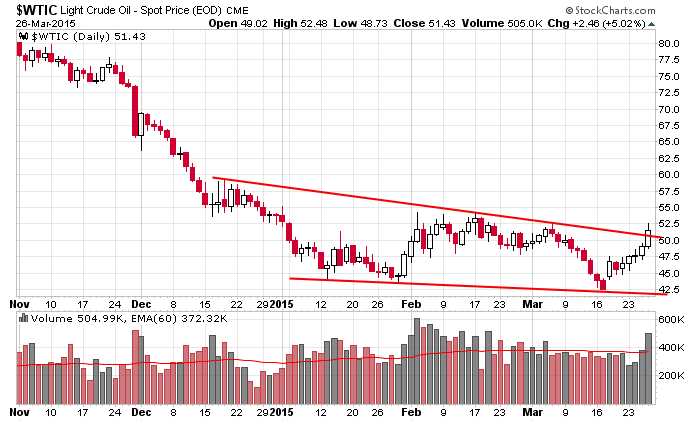

Here’s oil. It’s been up five straight days and six of the last seven. It’s trying to take out its down-sloping trendline, but as I’ve stated several times, there’s still lots of resistance overhead between 52.5 and 55.0. A 5% pop is nothing to brush off, but crude has a lot more proving to do before I become a believer. If you trade oil to the long side, don’t assume trades will be long term swing trades. The group has to prove itself first.

It’s Friday. Circle the wagons. Determine what’s worth keeping over the weekend. Rest up and be ready for next week…which could be a dud if the market continues to be range bound.

Stock headlines from barchart.com…

American Eagle (AEO +1.01%) was downgraded to ‘Sell’ from ‘Neutral’ at Goldman Sachs.

Finish Line (FINL +2.18%) reported Q4 adjusted EPS of 88 cents, better than consensus of 85 cents.

Conn’s (CONN -0.56%) was upgraded to ‘Overweight’ from ‘Neutral’ at Piper Jaffray.

ArcelorMittal (MT -2.72%) was downgraded to ‘Sell’ from ‘Neutral’ at Citigroup.

Carnival Cruise Lines (CCL +0.05%) rose over 1% in after-hours trading after it said it will add nine new cruise ships to its fleet over a four-year period from 2019-2022.

Charles Schwab (SCHW +1.95%) was initiated with an ‘Outperform’ at RBC Capital with a price target of $38.

UBS has a ‘Buy’ rating and $110 price target on McDonald’s (MCD -0.51%) and says it sees the new direction of McDonald’s management creating significant cost reduction potential.

SanDisk (SNDK -18.45%) was downgraded to ‘Hold’ from ‘Buy’ at Evercore ISI.

Corvex Management reported a 7.2% stake in Signet Jewelers (SIG +6.02%) .

F5 Networks (FFIV -0.59%) was initiated with a ‘Buy’ at Guggenheim with a price target of $130.

Yahoo! (YHOO +0.61%) rose nearly 2% in pre-market trading after it was initiated with an ‘Overweight’ at Morgan Stanley with a price target of $55.

Restoration Hardware (RH +1.01%) reported Q4 EPS of $1.02, better than consensus of $1.01.

GameStop (GME -2.56%) fell nearly 6% in after-hours trading after it reported Q4 adjusted EPS of $2.15, less than consensus of $2.17, and then lowered guidance on fiscal 2015 EPS to $3.60-$3.80, below consensus of $4.04.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 GDP Q4

8:30 Corporate Profits

9:55 Reuters/UofM Consumer Sentiment

3:45 PM Janet Yellen speech

Notable earnings before today’s open: BBRY, CCL, FINL

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 27)”

Leave a Reply

You must be logged in to post a comment.

” The deceleration in real GDP growth in the fourth quarter primarily reflected an upturn in

imports, a downturn in federal government spending, a deceleration in nonresidential fixed investment,

and a larger decrease in private inventory investment that were partly offset by accelerations in PCE and in state and local government spending”. …BEA release.

The economy is slowing 2.18% from 5% 4 Qtr 2014. Expect confusion for a quarter or more. Little progress in market prices. Maybe down for a while.

Today in SFO Janet Speaks. God only knows what she is saying now. Nothing good. Still invested but mostly ETFs:: QQQ, IWM,Spy. And a few dividends. A few bonds. Cheers.

I love this daily read. Great swing traders fascinate me.

On another note this range has to break.

yes ,Jasons down to earth comments are always a realistic bright spot of the day

because of my impatient mind set ,i have to be a day trader,as i find it hard to buy/hold

thus i have to work harder and know what the buyer/sellers are doing every minute of the day

currently massive japanesse funds have been reshuffling for their end year causeing much up/down

but i feel the previouse 7 year up trend may have reversed with a lower secoundary high

a lower high for the weekly would help

i am watching the 2058 spx mean mark