Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly down. India dropped more than 2%; Japan, Australia and South Korea fell more than 1%. Europe is currently down across-the-board. Greece is down more than 3%, Stockholm and Amsterdam more than 2% and London, France, Germany, Italy, Spain, Austria, Switzerland and Prague more than 1%. Futures here in the States point towards a big gap down open for the cash market.

My public list at stockcharts.com is here. If you’re a sub, vote if you want me to continue posting.

The dollar is down. Oil and copper are up. Gold and silver are up. Bonds are down.

The big news overnight is Saudi Arabia and its allies have launched an attacked on Yemen. This has sent markets around the world down and oil up.

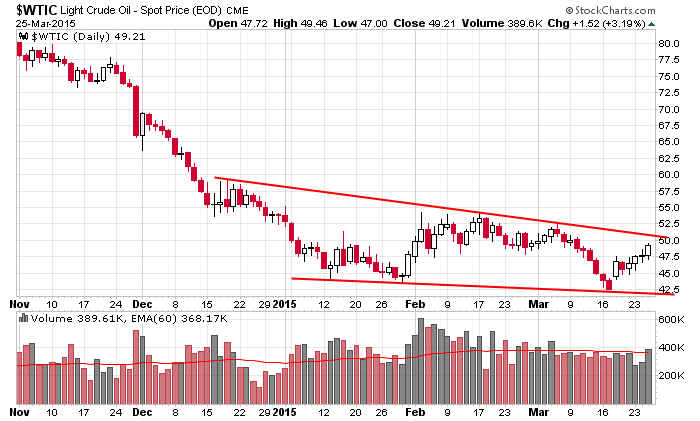

I’ve profiled oil a few times recently. It’s been moving up and is now attempting to bust out of its large falling wedge pattern. It traded as high as $52.48 overnight but has backed off. Fear of some supply disruptions from the Middle East are the reason for the pop since yesterday’s close, but it’ll take much more than that to sustain a move up. There’s lots of overhead supply to deal with, and unless things escalate in the Middle East, fear of too much supply and zero storage capacity will again surface. If you go long, don’t assume we’re in the beginning stage of an extended run. Here’s the daily crude chart as of yesterday’s close.

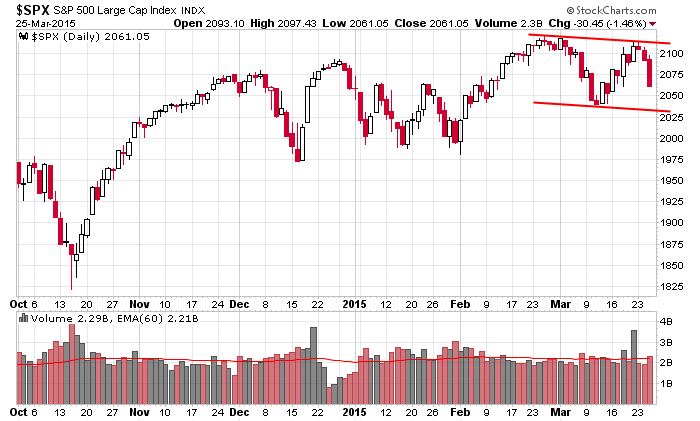

And here’s the daily S&P chart I’ve been posting. Again, other than a little extra push at the end of February, there have been lots of ups and downs, and no move has lasted long or traveled very far. That means we need to be ahead of the curve taking profits and not assume anything will be a longer term hold. Lots of little wins adds up. Today’s open will be right at support.

News trumps the charts, so at least in the very near term, whether things escalate or die down in the Middle East may determine if stocks continue to sell off or rebound. More after the open.

Stock headlines from barchart.com…

SanDisk (SNDK -4.21%) lowered Q1 revenue guidance to $1.3 billion from $1.4 billion-$1.45 billion, below consensus of $1.44 billion.

ConAgra Foods (CAG +0.90%) reported Q3 EPS of 59 cents, higher thah consensus of 52 cents.

Accenture PLC (ACN -1.34%) reported Q2 EPS of $1.08, better than consensus of $1.07.

Charles Schwab (SCHW -1.95%) was upgraded to ‘Overweight’ from ‘Underweight’ at Barclays.

Dr Pepper Snapple (DPS -0.57%) and Con-way (CNW -1.50%) were both upgraded to ‘Buy’ from ‘Hold’ at Stifel.

lululemon (LULU -3.70%) reported Q4 EPS of 78 cents, higher than consensus of 73 cents, but then lowered guidance on fiscal 2015 EPS to $1.85-$1.90, below consensus of $2.06.

ASML ({=ASML was downgraded to ‘Sell’ from ‘Hold’ at Deutsche Bank.

Man Group reported a 5.6% passive stake in 1-800-Flowers.com (FLWS -4.83%) .

LifePoint (LPNT -2.30%) was downgraded to ‘Neutral’ from ‘Buy’ at Mizuho.

Red Hat (RHT -1.37%) reported Q4 EPS of 43 cents, above consensus of 41 cents.

Verint Systems (VRNT -1.08%) reported Q4 EPS of $1.19, better than consensus of $1.15, but thenlowered guidance on fiscal 2015 EPS to $3.55-$3.75, below consensus of $3.76.

PVH Corp. (PVH +0.43%) reported Q4 EPS of $1.76, higher than consensus of $1.73, but then lowered guidance on fiscal 2015 EPS to $6.75-$6.90, below consensus of $7.37.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

4:35 Fed’s Bullard: U.S. Economy and Monetary Policy

8:30 Initial Jobless Claims

9:00 Fed’s Lockhart: U.S. Economy and Monetary Policy

9:45 PMI Services Index Flash

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

11:00 Kansas City Fed Mfg Survey

1:00 PM Results of $29B, 7-Year Note Auction

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: ACN, CAG, CMC, CMGE, CVGW, DANG, FRED, LULU, MEA, NEOG, SCHL, SIG, SPCB, WGO

Notable earnings after today’s close: CARA, GME, REED, RH

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 26)”

Leave a Reply

You must be logged in to post a comment.

I think todays gap down may be a nice time to go long for a short pop.

I want to see 4800 on the NASDAQ before I get serious.

gerty,chief of the quad witches,has now changed into magical japanesse zig zag BEAR

and he is causing much volitility as he sells everything for japanesse new year

next week he may be bold bull ,secretly working for the world cental banks plung protection crew