Good morning. Happy Tuesday.

The Asian/Pacific markets closed with a lean to the upside. Indonesia rallied 1.5%, followed by Australia (up 0.8%), Taiwan (up 0.7%) and Korea and Malaysia (up 0.5%). Japan and China each dropped 1%. Europe is currently mostly down. London is down 1.3%, followed by Amsterdam (down 0.9%), Germany (down 0.8%) and France and Italy (down 0.7%). Greece is up 1.3%. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is up. Oil is down, copper is down. Gold is up a small amount, silver down. Bonds are up.

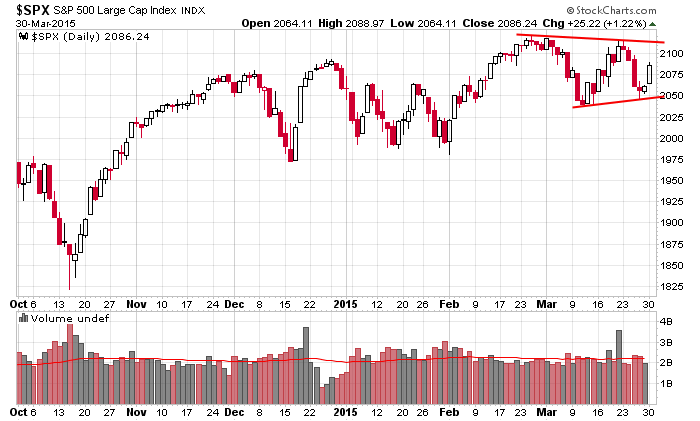

Yesterday was a solid up day for the market, but most of the indexes remain in consolidation mode. In fact the S&P 500 is as neutral as can be given its lower high, higher low and month-long triangle pattern forming (see below). Rallies get sold, dips get bought. No move lasts very long or goes very far. This is the state of things; this has been the state of things since the beginning of November. Other than a little extra push at the end of February, the market has not built momentum in either direction.

Today is the last day of the month and quarter. Similar to options expiration, in the past, these days could be counted on to bring buyers to the table but that tendency broke down years ago. I don’t see any reliable pattern to trade that centers strictly around periods like this.

Context is always important when you trade/invest – easily one of the most important variables you can consider. Context right now is a strong overall uptrend but a completely neutral market over the last couple months. Forcing a particular trading style on a market that isn’t conducive to that style is death for a trader. Recognize what animal you’re dealing with. More after the open.

Stock headlines from barchart.com…

Schlumberger (SLB +1.40%) was downgraded to ‘Market Perform’ from ‘Outperform’ at Wells Fargo.

Credit Suisse reiterates its ‘Outperform’ rating on UnitedHealth (UNH +2.53%) and raised its price target on the stock to $135 from $120.

Reliance Steel (RS +2.83%) was upgraded to ‘Outperform’ from ‘Neutral’ at Credit Suisse.

D.R. Horton (DHI +2.11%) was upgraded to ‘Positive’ from ‘Neutral’ at Susquehanna.

SAIC (SAIC +2.47%) reported Q4 EPS of 75 cents, better than consensus of 71 cents.

Priceline (PCLN +1.29%) was upgraded to ‘Buy’ from ‘Hold’ at Stifel.

Horizon Pharma (HZNP +18.20%) was upgraded to ‘Overweight’ from ‘Neutral’ at Piper Jaffray.

Sensient (SXT +1.37%) was initiated with a ‘Buy’ at BB&T with a price target of $81.

Tesla (TSLA +3.01%) rose over 1% in after-hours trading after Bloomberg reported that March China sales were up 130%-150% month-over-month.

Gabelli reported a 5.56% stake in Jason Industries (JASN +0.29%) .

Teck Resources (TCK +10.17%) slid nearly 5% in after-hours trading after it said it is not in talks with Antofagasta regarding a possible merger.

HCP (HCP +3.94%) was upgraded to ‘Buy’ from ‘Neutral’ at UBS.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:55 Redbook Chain Store Sales

9:00 Fed’s Lacker: U.S. Economic Outlook

9:00 S&P Case-Shiller Home Price Index

9:45 Chicago PMI

10:00 Consumer Confidence

10:00 State Street Investor Confidence Index

Notable earnings before today’s open: CONN, DANG, MOV, SAIC, VTNR

Notable earnings after today’s close: DCO, LNDC, PRGN, RGSE, SNX

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Mar 31)”

Leave a Reply

You must be logged in to post a comment.

“Forcing a particular trading style on a market that isn’t conducive to that style is death for a trader”

Amen!

one look at the chart and one does see a pattern

unless the feb highs are broken to the up side,then we have a wave 1 down

a wave 2 up up to lower high and now start of wave 3 impulsive fast wave down

with small wave 1 down of larger 3 now small corrective wave 2 up of larger 3

with gigantic wave 3 of larger wave 3 to come

it is noted that this current small wave 2 is definitly corrective with much up /down OVERLAP

ie chop –only suitable for daytrader style

it is also noted that if feb highs are broken to up side it could be a fast exhaustive move

designed by the bears to kill all the bull and change trend permantly bringing in the age of the bear

for the next 10 years

it is also noted from oct 14 low we have a wave 3 up a corrective 3 month sideways wave 4

and a wave 5 up to feb high

thus giving us a 5 wave terminal event and from 1988 this feb high ends a large jaws of death broadening megaphone

the marsians will be invading earth any day now to led the bears to victory

it is now almost 5 am on 1st april where i am

and with todays action and no lower high taken out ,then i am expecting a full marsian invasion

at 8.30 am on 3rd april

would that be 830am your time or usa est?