Good morning. Happy Wednesday.

The Asian/Pacific markets closed with a lean to the downside. Japan and Indonesia fell 0.9%, Taiwan dropped 0.8% and South Korea lost 0.6%. China rallied 1.7%, followed by India (up 1.1%) and Hong Kong (up 0.7%). Europe is currently mostly up. France, Austria, Russia and Italy are up more than 1%, Germany, London, Belgium and Prague are also doing well. Futures here in the States point towards a moderate gap down open for the cash market.

My public list at stockcharts.com is here. If you’re a sub, vote if you want me to continue posting.

The dollar is up. Oil is up a small amount, copper is down. Gold is up, silver is down. Bonds are up.

This is what S&P futures did overnight (the white line is yesterday’s close). First they plunged 25 points…then they rallied all the way back…now they’re down about 8 points – huge movement that isn’t obvious if you only look at the current quote first thing in the morning.

Yesterday was an inside day. That’s where all the day’s movement takes place within the high and low of the previous day. It’s a sign of indecision and dampening forcefulness and tends to build a little pressure into the market, but today’s gap down will diffuse that pressure.

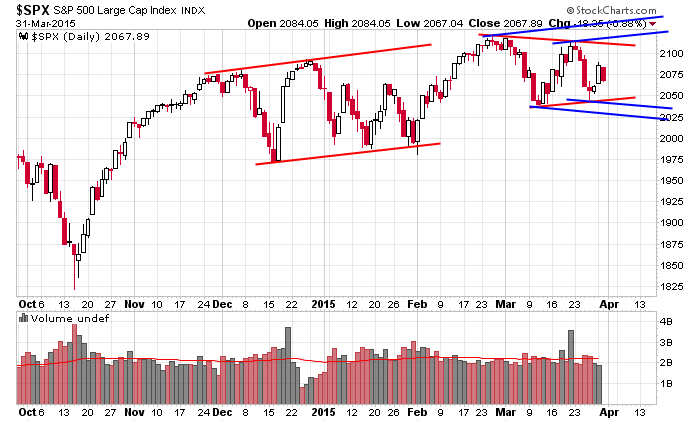

Here’s the daily S&P 500. I’m running out of things to talk about because the market has been in consolidation for so long. Rallies get sold, dips get bought. No move lasts long, so we need to be content with lots of little gains instead of some meatier longer term trades. But no worries…little gains add up. The blue lines below show levels I’ll be eyeing when the triangle pattern resolves.

GoDaddy (GDDY) is going public today. Etsy (ETSY) is starting its road show.

That’s it for now. Don’t churn your account.

Stock headlines from barchart.com…

American Airlines (AAL -1.60%), Delta Air Lines (DAL -1.32%) and United Continental (UAL -1.38%) were all downgraded to ‘Hold’ from ‘Buy’ at Deutsche Bank.

Hewlett-Packard (HPQ -1.30%) was upgraded to ‘Buy’ from ‘Hold’ at Jefferies.

Pier 1 Imports (PIR +0.65%) was downgraded to ‘Underweight’ from ‘Equal Weight’ at Morgan Stanley.

Esperion (ESPR +0.61%) was initiated with a ‘Buy’ at UBS with a price target of $140.

Willbros Group (WG -3.22%) reported a Q4 EPS loss of -72 cents with items, weaker than consensus of a profit of 6 cents, and then lowered guidance on fiscal 2015 revenue to $1.40 billion to $1.60 billion, below consensus of $1.83 billion.

Burlington Stores (BURL +0.13%) filed to sell 12.49 million shares of common stock for holders.

Dyax (DYAX -1.76%) surged over 40% in after-hours trading after it announced positive results from its Phase 1b clinical trial of DX-2930 being developed for the prevention of hereditary angioedema.

Allstate (ALL +0.31%) was initiated with an ‘Outperform’ at Credit Suisse with a price target of $84.

Aon plc (AON -2.02%) was initiated with an ‘Underperform’ at Credit Suisse with a price target of $95.

UTi Worldwide (UTIW -1.91%) reported a Q4 EPS loss of -$1.02, much weaker than consensus of -8 cents.

SYNNEX (SNX -1.10%) reported Q1 EPS of $1.46, below consensus of $1.52, and then lowered guidance on Q2 EPS to $1.50-$1.56, weaker than consensus of $1.59.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

Fed’s Lacker: Monetary Policy

Auto sales

7:00 MBA Mortgage Applications

8:15 ADP Jobs Report

8:30 Gallup U.S. Job Creation Index

9:45 PMI Manufacturing Index

10:00 ISM Manufacturing Index

10:00 Construction Spending

10:30 EIA Petroleum Inventories

Notable earnings before today’s open: AYI, IKGH, MON

Notable earnings after today’s close: MU, PRGS, SIGM

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 1)”

Leave a Reply

You must be logged in to post a comment.

Like the chart on the futures. Makes me wonder if something bigger is coming. Kinda reminds me of the flash crash.

Seems odds. If someone wanted out, why do it during the overnight session when volume is so low?

its cherry bloosum time in japan,it has hugh govt pension funds allowed to trade shares now and have been moving international markets

its also end japan financial year and bad govt data was release at start of asian trading

as was growth in china barely getting into positive at 50.1 growth

markets are scared with international reporting season coming up ,usd hurting

profits have been downgraded so as the can again beat estimate

markets have peaked insto funds know this and its getting harder to maintain the PONSI in shares

yes i caught the move down in asia,but havnt gone long this time as imo we could go much lower

notice on Jasons chart ,the futures tested the march low in asia trade this morning a break of that would indicate powerfull wave 3 of 3 had started

come on bulls ,i am waiting to reload short