Good morning. Happy Thursday. Happy early Easter and Passover. The market is closed tomorrow, so today is the last trading day of the week.

The Asian/Pacific markets closed mostly up. Japan and Taiwan rallied better than 1%; Australia and Hong Kong also did well. Europe is currently mixed, but movement is small. Only Greece (down 1%) has moved much from its unchanged level. Futures here in the States point towards a down open for the cash market.

My public list at stockcharts.com is here. If you’re a sub, vote if you want me to continue posting.

The dollar is down. Oil is down, copper is down. Gold and silver are down. Bonds are up.

It’s rare important economic news is released while the market is closed, yet this will be the case tomorrow when the latest employment figures are announced (actually the employment data is always released when the market is closed, but then the market opens an hour later). So as of today’s close, unless you trade futures and can quickly hedge tomorrow morning, you’ll be stuck with your positions until Monday. Is this a big deal? No, not at all. The unemployment rates is already low enough to support the Fed raising rates, so the number shouldn’t have any effect on the market other than perhaps a quick knee-jerk reaction. For trend traders like us, little blips here and there can be mostly ignored – they get faded most of the time anyways.

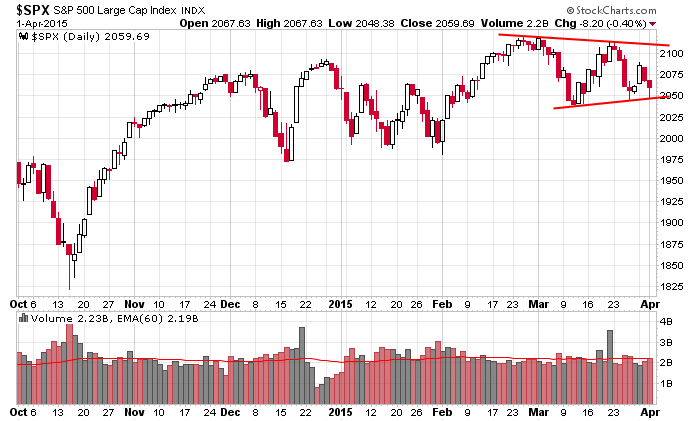

Here’s a reminder of the daily SPX chart. A lower high and a higher low creates a symmetrical triangle pattern. The 1-month pattern suggests consolidation…the 5-month action suggests consolidation. We’ve had lots of good trades because when money flows around the market, there are always a handful of groups that standout as leaders. Focusing on the best stocks within the out-performing groups produces solid gains, even when the market trades in a range.

That’s it for now. No big bets here. The pattern above will resolve and we’ll get a trending move or more range bound movement that could last all summer. Have a great day. Enjoy your long weekend.

Stock headlines from barchart.com…

Stryker (SYK -1.16%) was downgraded to ‘Underweight’ from ‘Equal Weight’ at Barclays.

Garmin (GRMN -0.95%) was downgraded to ‘Neutral’ from ‘Buy’ at Goldman Sachs.

Dick’s Sporting (DKS -0.37%) was upgraded to ‘Positive’ from ‘Neutral’ at Susquehanna.

Credit Suisse maintained its ‘Outperform’ rating on Vail Resorts (MTN -0.96%) and raised their price target on the stock to $115 from $105.

CarMax (KMX -0.90%) reported Q4 EPS of 67 cents, higher than consensus of 60 cents.

WWE (WWE -2.93%) announced that WrestleMania 31 broke records for viewership, attendance, social and digital media engagement and merchandise sales.

Transocean (RIG +0.34%) said it sees a Q1 charge of $90 million-$110 million from disposal of the GSF Aleutian Key and Sedco 707 oil rigs.

Air Lease (AL +0.66%) was initiated with an ‘Outperform’ at Macquarie with a price target of $48.

Micron (MU unch) jumped over 4% in after-hours trading after it reported Q2 adjusted EPS of 81 cents, better than consensus of 73 cents. Micron they shed its gains and fell 1% after it lowered guidance on Q3 revenue to $3.85 billion-$4.05 billion, below consensus of $4.29 billion.

Macerich (MAC -6.64%) was upgraded to ‘Neutral’ from ‘Underperform’ at Credit Suisse.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:30 Challenger Job-Cut Report

8:30 Janet Yellen

8:30 International Trade

8:30 Gallup US Payroll to Population

8:30 Initial Jobless Claims

9:45 Bloomberg Consumer Comfort Index

10:00 Factory Orders

10:30 EIA Natural Gas Inventory

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: KMX, PERY, SEAC

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers