Good morning. Happy Tuesday.

The Asian/Pacific markets closed up across-the-board. China rallied 2.5% and Japan moved up 1.3%. Indonesia and Malaysia also did well. Europe is currently posting big gains. Amsterdam and Norway are up more than 2%; Spain, Italy, Austria, Stockholm, Switzerland, Germany, France and London are each up more than 1%. Futures here in the States point towards an up open for the cash market.

My public list at stockcharts.com is here. If you’re a sub, vote if you want me to continue posting.

The dollar is up. Oil is down, copper is up. Gold and silver are down. Bonds are mixed.

We entered yesterday with the bulls needing to step up and defend their turf. Several indexes were near the bottoms of their ranges, and with a big gap down expected, there was some, but not a lot, of wiggle room. Defend their turf is exactly what they did. Right out of the gate buyers went to work, and it only took about 20 minutes for the indexes to go positive.

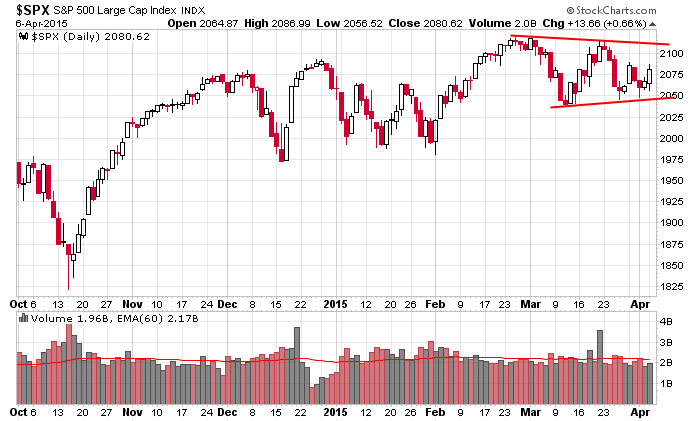

The rally felt good, but it only functioned to put the S&P back in the middle of its range. It’s entirely possible the market breaks out to the upside, but until it happens, I still think we need to keep things shorter term. I’m not talking about day trading; I’m just saying lots of 5-10% wins add up quickly. Here’s the daily S&P.

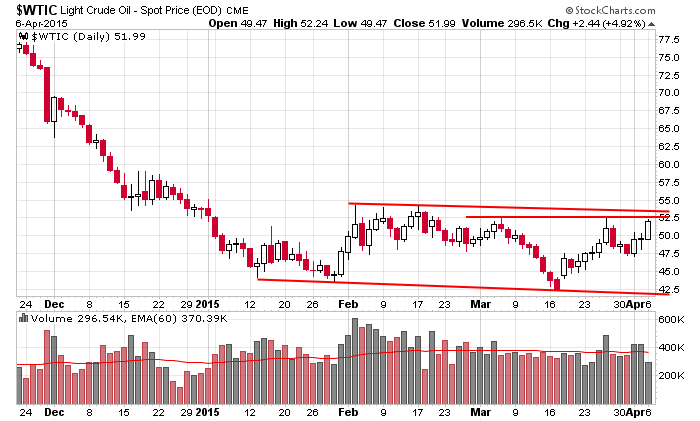

Oil had a great day yesterday. We have a handful of oil stocks on the Long List that are doing well. Here’s the daily. It too has the potential to bust out and run, but until it happens, don’t assume it will. You can plan for it, but have a plan B in case resistance holds strong.

Things have been changing quickly lately. Negative one day, positive the next. Make adjustments. More after the open.

Stock headlines from barchart.com…

International Speedway (ISCA +0.74%) reported Q1 non-GAAP EPS of 33 cents, which was better than the consensus of 29 cents.

Starbucks’ (SBUX +0.14%) losses on its European division have raised suspicions among European regulators, according to WSJ

An affiliate of Berkshire Hathaway (BRK.A -0.10%) acquired 20 million shares of Axalta (AXTA +1.43%) worth $560 million from The Carlyle Group.

Domino’s Pizza (DPZ -0.18%) CEO said on CNBC that he believes a wage hike may be necessary.

A. Schulman (SHLM +0.52%) reported fiscal Q2 adjusted EPS of 39 cents, just under the consensus of 40 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Gallup US ECI

8:55 Redbook Chain Store Sales

10:00 Job Openings and Labor Turnover Survey

1:00 PM Results of $24B, 3-Year Note Auction

3:00 PM Consumer Credit

Notable earnings before today’s open: GBX, SCHN

Notable earnings after Monday’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 7)”

Leave a Reply

You must be logged in to post a comment.

Bids worldwide. Ok for a while maybe the end of June. Holding core etfs, dividend stocks, and a few bonds. Suspect APRIL is strong into June and Jump arrives. The facts are BLS is playing with employment data. Same in EU. I like Jasons recommendations for steady plays. Best to all.

Dull market.. Never short.

lower double top to end corrective wave 2 up

wave 3 down to celebrate the robot invasion