Good morning. Happy Wednesday.

The Asian/Pacific markets closed with a lean to the upside. Hong Kong rallied 3.8%, followed by China, Japan, Australia, India and South Korea, which each moved up 0.6-0.8%. Taiwan and Indonesia dropped. Europe is currently mixed. Belgium is up 1.1%, followed by London and Austria. Russia is down 1.1%, followed by Greece and Amsterdam. Futures here in the States point towards a slight up open for the cash market.

My public list at stockcharts.com is here. If you’re a sub, vote if you want me to continue posting.

The dollar is down. Oil is down, copper is down. Gold and silver are down. Bonds are up.

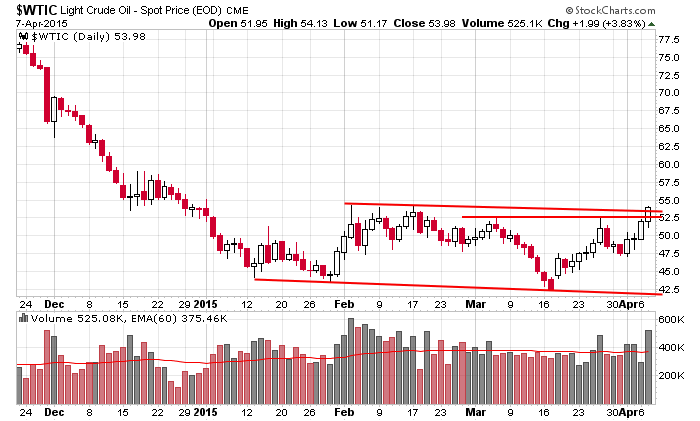

Crude continues to march higher. Yesterday it closed near its highest level since late-December. This despite Saudi Arabia raising its output to 10.3M barrels/day in March, its highest output in 12 years. Here’s the daily chart.

The Nikkei, the major index in Japan, has rallied to its highest level in 15 years after the BOJ (Bank of Japan) voted to maintain its current asset purchase program.

Earnings season here in the US kicks off with Alcoa’s (AA) report after the close.

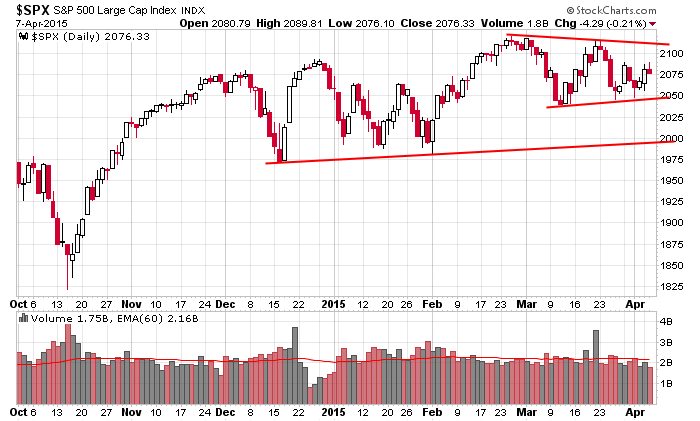

Here is an update of the daily S&P. Rallies get sold, dips get bought. The market has made no net progress since the beginning of December. Pick your spots and don’t overstay your welcome. Yeah we’d like to hold for several weeks or months and nail big moves, but this is the market we have to trade. Lots of little wins add up. Don’t over-analyze or think too much.

Stock headlines from barchart.com…

Shell (RDSN LN) announced an agreement to take over BG Group (BG LN) for about $70 billion in cash and shares in the largest oil and gas deal in at least a decade, with particularly attractive assets in Australian LNG and Brazilian deep water oil.

Rite Aid (RAD -1.70%) reported Q4 EPS ex-items at 12 cents, better than the consensus of 7 cents.

IMAX ({=IMAX) and Disney (DIS -0.19%) renewed their exhibition agreement with a new multi-picture deal.

Kinder Morgan (KMI +0.05%) was downgraded to Buy from Conviction Buy at Goldman Sachs.

New Residential (NRZ +2.99%) was added to the Top Picks list at FBR Capital.

Dave & Buster’s (PLAY -1.45%) rallied 1% in after-hours trading on better than expected earnings results.

Regulus Therapeutics (RGLS -2.68%) rallied 10% in after-hours trading after one of its products was selected as clinical candidate by AstraZeneca (AZN +0.24%)

OHR Pharmaceutical (OHRP +8.37%) rallied 2% in after-hours trading after a report that Broadfin purchased a 6.1% stake in the company.

Pentair (PNR -1.87%) fell 4% in after-hours trading after lowering its Q1 guidance.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

8:30 Fed’s Evans: U.S. Economy

10:30 EIA Petroleum Inventories

1:00 PM Results of $21B, 10-Year Bond Auction

2:00 PM FOMC minutes

Notable earnings before today’s open: FDO, GPN, MSM, RAD, RPM

Notable earnings after today’s close: AA, APOG, BBBY, DDC, MG, PIR, WDFC

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 8)”

Leave a Reply

You must be logged in to post a comment.

I don’t know about this market. Small caps dropped yesterday like a Jack Morris sinker.