Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mixed. China and Hong Kong rallied more than 2%; India, South Korea and Taiwan also did well. Indonesia and Malaysia did poorly. Europe is mostly up. Belgium and Russia are up more than 1%; London, Austria and Prague are also doing well. Futures here in the States point towards a down open for the cash market.

My public list at stockcharts.com is here. If you’re a sub, vote if you want me to continue posting.

The dollar is up. Oil is up, copper is flat. Gold and silver are down. Bonds are down.

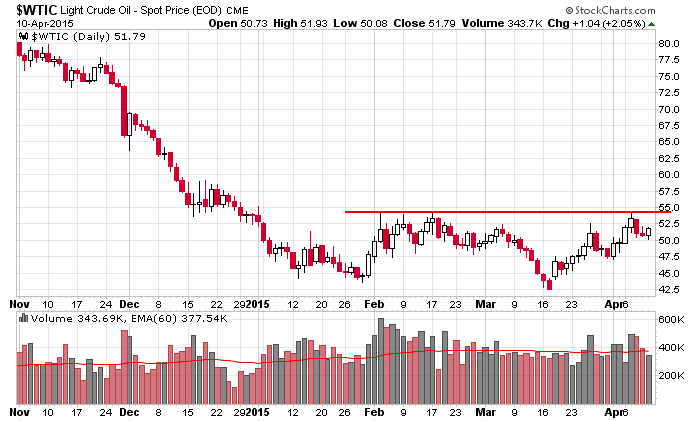

The big story heading into this new week is oil. There are many stocks either in the process of breaking out or that have already broken out – the entire group is going to move up or fizzle. I doubt it’ll just sit here. We’ll either get a lot of plays from the group, or all the stocks will fall on their faces.

Here’s the oil chart. It’s been basing all year and could easily rally into the 60’s if resistance is taken out with force. Yeah I know the fundamentals are weak, but there are so many oil bears out there, short covering alone could boost the commodity for a couple weeks.

Earnings season picks up a little this week, but we there aren’t too many reports.

There’s a lot of econ news out this week, including: PPI, CPI, retail sales and housing numbers. So we’ll get a glimpse of inflation and how strong consumers are.

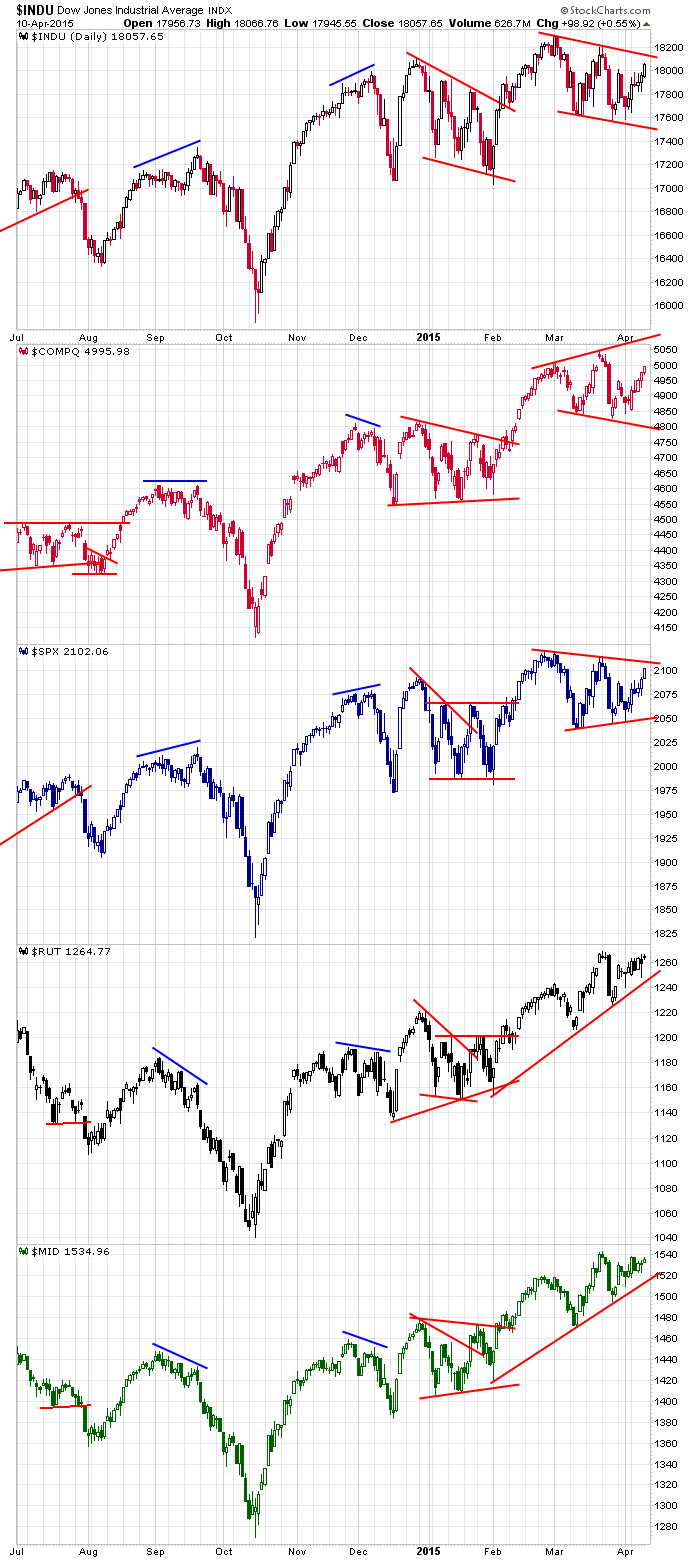

Here are the daily index charts. Several of them are near their highs or near resistance. Along with oil, the market is set up to bust out and run. This week has the potential to be a big one…if things fall into place. Have a plan. Have a plan B. More after the open.

Stock headlines from barchart.com…

British Petroleum (BP +0.46%) was downgraded to ‘Neutral’ from ‘Buy’ at BofA/Merrill Lynch.

Marathon Oil (MRO +1.43%) was upgraded to ‘Buy’ from ‘Neutral’ at BofA/Merrill Lynch.

Netflix (NFLX +3.43%) was upgraded to ‘Buy’ from ‘Neutral’ at UBS who also raised their price target on the stock to $565 from $370.

Sempra Energy (SRE -0.05%) was upgraded to ‘Buy’ from ‘Neutral’ at Goldman Sachs with a price target of $130.

Helmerich & Payne (HP -1.15%) was downgraded to ‘Hold’ from ‘Buy’ at Jefferies.

Freeport McMoRan (FCX -2.56%) was upgraded to ‘Buy’ from ‘Neutral’ at Citigroup.

BHP Billiton (BHP -0.04%) and Rio Tinto (RIO -1.61%) were both downgraded to ‘Neutral’ from ‘Buy’ at Citigroup.

UPS (UPS +0.09%) will invest $1.06 billion in a Europe expansion, according to Reuters.

Grainger (GWW -0.06%) may be 10%-20% undervalued, according to a weekend article by Barron’s.

Avon (AVP -1.86%) “could still pay off” with a doubling of its stock price in coming years, according to a weekend column by Barron’s.

Accenture (ACN -0.82%) may rally by 26% over next three years, according to a weekend article by Barron’s.

Newmont Mining (NEM +0.45%) may rally by 55%, according to a weekend article by Barron’s.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

2:00 PM Treasury Budget

Notable earnings before today’s open: CBSH

Notable earnings after today’s close: LAYN, OZRK, PBY, TPLM

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 13)”

Leave a Reply

You must be logged in to post a comment.

,I like AA,-target-$15.5 ,thx

Ashamed but moving 50% capital to a balanced fund.But am too old to do more than play Jason’s ideas which are looking pretty good recently; but not too many either. Still in market ETFs covering the front: SPY, IWM QQQ. The play is up 1.2% after last week but its a poor strategy too. The dividends are up 3.2% AND rendering ~ +4% dividend. The first derivative for SPY is saying it is likely a fast move up into April/ May. I think a slow down into fall(JULY) to Oct first. when we will run up again. TRYING to ignore HSI, ASHS is doubled in 42 days. What does it all mean? Recently learning about TRIX and HuLL as pointers. Not sure if its worth the time. Best to all.

king slim bear eats complacent fat bull in a 5 wave down reversal structure

in insto talk –sell into strengh