Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. Singapore rallied 1%, followed by South Korea (up 0.6%) and New Zealand (up 0.5%). Hong Kong dropped 1.6%, and Indonesia fell 0.5%. Europe is currently mostly down. Spain, Italy, Russia and Greece are down more than 1%. London and Austria are down about 0.5%. Futures here in the States point towards a slight down open for the cash market.

My public list at stockcharts.com is here. If you’re a sub, vote if you want me to continue posting.

The dollar is flat. Oil is up, copper is down. Gold and silver are down. Bonds are up.

Big news from Europe is that Greece is seriously considering defaulting on its debt. One official said if the IMF doesn’t release bailout cash, defaulting is their only option. European stocks are mostly down, but they’re not getting killed. Most notable are Italy and Spain – two countries that are watching the situation in Greece very closely because they may be next in line needing a bailout. The market in Greece is down 1.6% – notable but not a disaster. A default may be in the numbers; if it wasn’t the Greek market may be down 10%.

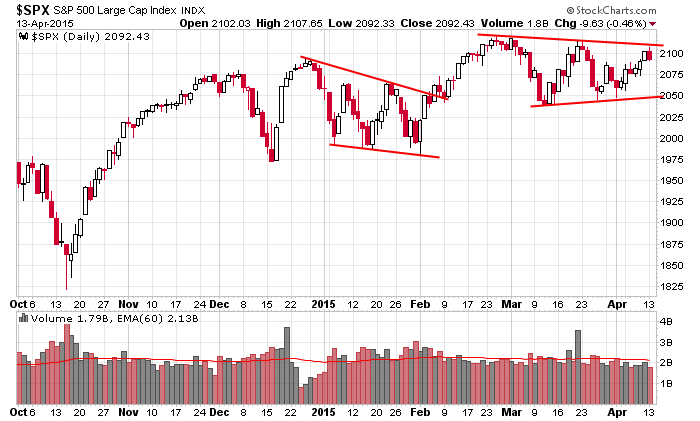

Here’s an update of the daily S&P chart. Such a pretty pattern, but until it resolves, you can’t assume anything. Rallies get sold, dips get bought. Nothing lasts very long. My overall bias is up, but my near-term bias is more neutral. Trade, but be ahead of the curve taking profits. Unfortunately this isn’t a time to take positions and sit back with loose stops. Lots of little wins add up.

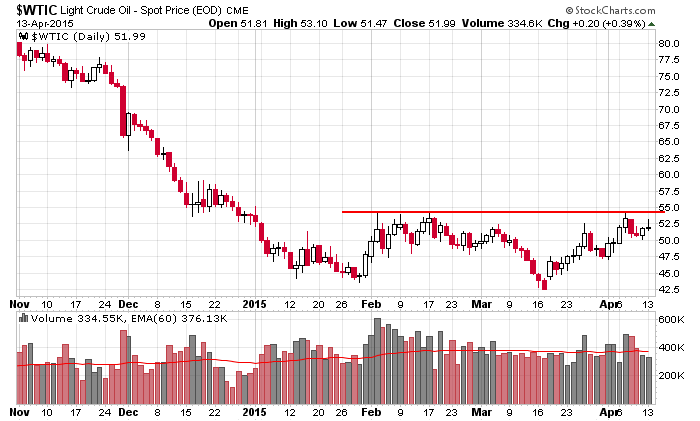

Oil rallied early yesterday but closed well off its high. Overall nothing changed, so the group remains super interesting. Some groups don’t have good prospects for movement or they don’t have enough components to give us trades. Oil has the potential to breakout and run 20% or fall flat on its face…and the group is huge – some stocks could rally a bunch, others could get crushed. With lots of potential in both directions, it’s worth following.

That’s it for now. Let’s see how the indexes handle getting rejected by resistance yesterday.

Stock headlines from barchart.com…

JPMorgan Chase (JPM +0.60%) reported Q1 EPS of $1.61, better than consensus of $1.41.

Fastenal (FAST +0.02%) reported Q1 EPS of 43 cents, higher than consensus of 42 cents.

Urban Outfitters (URBN +0.25%) were upgraded to ‘Outperform’ from ‘Market Perform’ at BMO Capital.

Qualcomm (QCOM -0.62%) and Western Digital (WDC -0.41%) were both upgraded to ‘Buy’ from ‘Neutral’ at BofA/Merrill Lynch.

Ulta Salon (ULTA +0.21%) was initiated with a ‘Buy’ at Evercore ISI.

Molson Coors (TAP -1.63%) was initiated with a ‘Positive’ at Susquehanna with a price target of $97.

Pep Boys (PBY -0.10%) reported an unexpected Q4 EPS loss of -50 cents with items, well below consensus of a 3 cent profit.

Norfolk Southern (NSC -1.39%) dropped over 4% in after-hours trading after it lowered guidance on Q1 EPS to $1.00, below consensus of $1.27.

Scripps Networks (SNI +0.80%) was downgraded to ‘Neutral’ from ‘Overweight’ at Piper Jaffray.

AMC Networks (AMCX +0.20%) was initiated with an ‘Overweight’ at Piper Jaffray with a price target of $90.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:30 NFIB Small Business Optimism Index

8:30 Producer Price Index

8:30 Retail Sales

8:55 Redbook Chain Store Sales

10:00 Business Inventories

Notable earnings before today’s open: FAST, JNJ, JPM, SJR, WFC

Notable earnings after today’s close: CSX, INTC, LLTC

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 14)”

Leave a Reply

You must be logged in to post a comment.

buy now.