Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. Taiwan rallied almost 2%, followed by South Korea (up 1.4%). Hong Kong, India, Malaysia and New Zealand dropped 0.4 – 0.6%. Europe is currently mostly down. Russia is down 1.8%, followed by Germany (down 1.3%), Stockholm (down 1.1%) and France (down 1%). Belgium, Amsterdam and Spain are also weak. Greece is up 0.9%. Futures here in the States point towards a down open for the cash market.

My podcast with Chat With Traders.

The dollar is down. Oil and copper are up. Gold and silver are up. Bonds are up.

After up days Monday and Wednesday and a down day Tuesday, the indexes are posting a solid gain for the week and are in good shape. But resistance is just overhead in many cases.

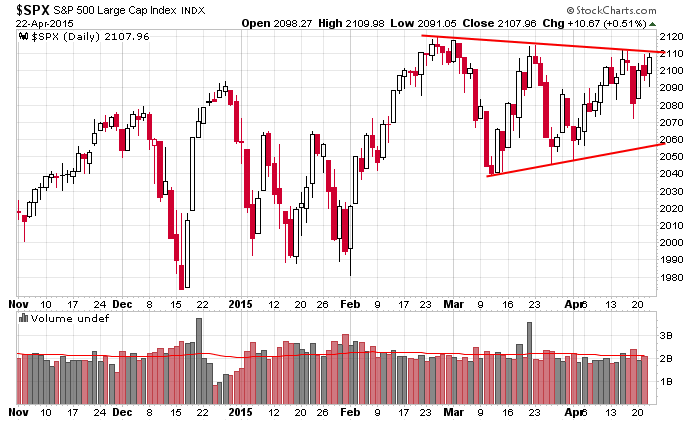

The S&P has gotten rejected by the 2110 – 2120 zone three times in the last two months. Yesterday’s close was at 2107, so the index is either going to make a valid attempt to break through or it’ll get rejected again. It doesn’t have to do anything. The market can trade range bound for many more months, but it does get more interesting when we so close to one of the boundaries.

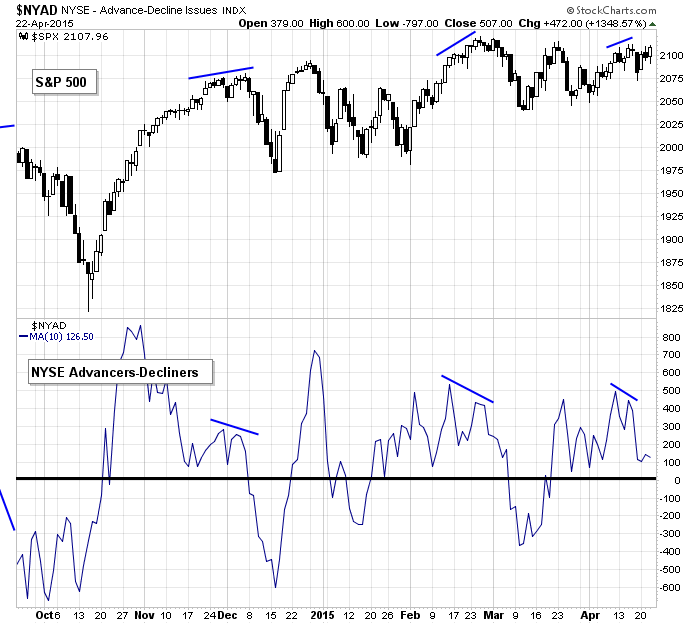

The breadth indicators have improved some and are positioned to support the market if it wished to attempt a breakout. Here’s the 10-day of the NYSE AD line. It has cycled down and is sitting near a 1-month low. If the market moves up, it needs to surge.

The quality and quantity of trading set ups has improved lately, but by no means do we have a great list of stocks to trade work from and being earnings season puts a damper on things. My top set up heading into today was CAT, but because of earnings the stock is going to gap up and I’m not going to be able to play it. Oh well.

Stock headlines from barchart.com…

Texas Instruments (TXN +0.98%) slipped 5% in after-hours trading after it reported Q1 EPS of 61 cents, below consensus of 62 cents.

Eli Lilly (LLY +0.12%) reported Q1 EPS of 87 cents, higher than consensus of 76 cents.

Valmont (VMI -0.31%) reported Q1 EPS of $1.28, well below consensus of $1.49.

O’Reilly Automotive (ORLY -0.18%) reported Q1 EPS of $2.06, better than consensus of $1.94.

Xilinx (XLNX +0.32%) slid 5% in after-hours trading after it reported Q4 EPS of 50 cents, right on consensus, but Q4 revenue of $567 million was less than consensus of $569.5 million.

Oceaneering (OII +3.66%) reported Q1 EPS of 70 cents, above consensus of 62 cents.

Ameriprise (AMP +0.99%) reported Q1 EPS of $2.18, weaker than consensus of $2.3.

United Stationers (USTR +0.36%) reported Q1 adjusted EPS of 52 cents, right on consensus, although Q1 revenue of $1.33 billion was below consensus of $1.35 billion.

eBay (EBAY +0.58%) rose over 5% in after-hours trading after it reported Q1 EPS of 77 cents, above consensus of 70 cents.

Equifax (EFX -0.31%) reported Q1 adjusted EPS of $1.07, higher than consensus of $1.02.

Las Vegas Sands (LVS +1.71%) fell nearly 3% in after-hours trading after it reported Q1 adjusted EPS of 66 cents, below consensus of 72 cents.

Skechers (SKX +1.38%) reported Q1 EPS of $1.10, higher than consensus of $1.01.

Plexus (PLXS -0.86%) reported Q2 EPS of 69 cents, right on consensus, although Q2 revenue of $651 million was above consensus of $645.45 million.

AT&T (T +0.61%) reported Q1 adjusted EPS of 63 cents, better than consensus of 62 cents.

Qualcomm (QCOM +0.54%) declined over 3% in after-hours trading after it reported Q2 EPS of $1.40, above consensus of $1.33, but then lowered guidance on fiscal 2015 EPS view to $4.60-$5.00 from $4.85-$5.05, at the low end of consensus at $5.00.

Facebook (FB +1.21%) fell over 1% in after-hours trading after reported Q1 EPS of 42 cents, higher than consensus of 40 cents, although Q1 revenue of $3.54 billion was below consensus of $3.56 billion.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Initial Jobless Claims

9:45 PMI Manufacturing Index Flash

9:45 Bloomberg Consumer Comfort Index

10:00 New Home Sales

10:30 EIA Natural Gas Inventory

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before Thursday’s open: ABBV, AEP, ALK, ALXN, ASPS, AVT, BAX, BBT, BCC, BEAV, BHE, BKU, BMS, BTU, CAB, CAM, CAT, CFX, CLFD, CLI, CMS, COL, COR, CSL, DAN, DGX, DHR, DLX, DNKN, DOW, DPS, DPZ, DST, EQM, EQT, ERIC, FAF, FCX, FNB, GM, GMT, GPK, GRA, HP, HSY, HUB.B, IQNT, IR, IVC, JAH, JCI, JNS, KKR, LAZ, LLY, LTM, LUV, MDP, MDSO, MHO, MJN, MMM, MO, MTH, NDAQ, NUE, NVS, NWE, ORI, PENN, PEP, PG, PHM, PII, PNK, PRLB, PTEN, RS, RTIX, RTN, SFE, SNA, SQNS, STC, SUI, SWK, SXC, SYNT, UAL, UNP, USG, UTEK, WBC, WCC, WNS

Notable earnings after Thursday’s close: ACTG, ALGN, ALTR, AMZN, AWAY, BAS, BCR, BGS, BJRI, BLDR, CB, CBI, COF, CPHD, CVTI, CYN, DGII, DV, EFII, ELY, ETFC, ETH, FET, FICO, FII, FR, FSL, GHL, GIMO, GOOG, HA, HBHC, HBI, HUBG, HWAY, JNPR, KLAC, KN, LSTR, MKTO, MMSI, MSCC, MSFT, MTSN, MXIM, MXWL, N, NEM, NTGR, P, PEB, PFG, QDEL, QLIK, RGA, RHI, RMD, RSG, SBAC, SBUX, SFG, SHOR, SIVB, SPNC, SRCL, SWN, SYA, SYNA, TRN, UIS, VCRA, VRSN, WIRE, WRE

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers