Good morning. Happy Friday. I hope it’s been a good week for you so far.

The Asian/Pacific markets closed mixed. Australia and Taiwan rallied more than 1%; Hong Kong and Malaysia also did very well. India dropped 1.1%; Japan and South Korea were also weak. Europe is currently mostly up. Greece is up more than 2%; Italy and Russia are up more than 1%; Spain and Belgium are also doing well. Futures here in the States point towards an up open for the cash market.

My podcast with Chat With Traders.

The dollar is down. Oil is down, copper is up. Gold and silver are down. Bonds are down.

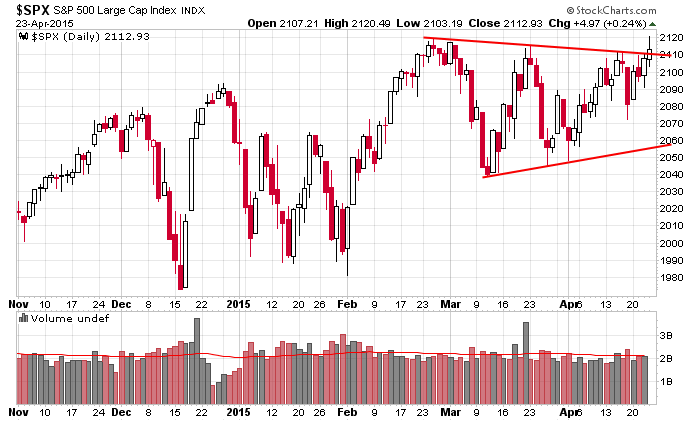

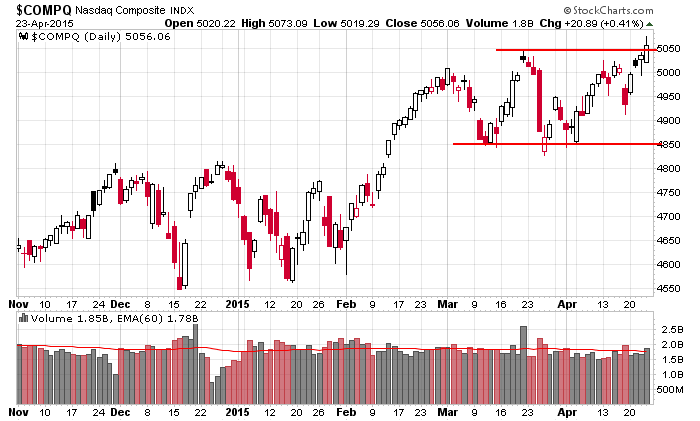

Yesterday the S&P 500 pushed to a new all-time high but then fell back into its range. The Nas broke out, and although it too closed off its high, it closed at a new high (but still about 75 points off its all-time high hit in 2000). Here are the dailies…

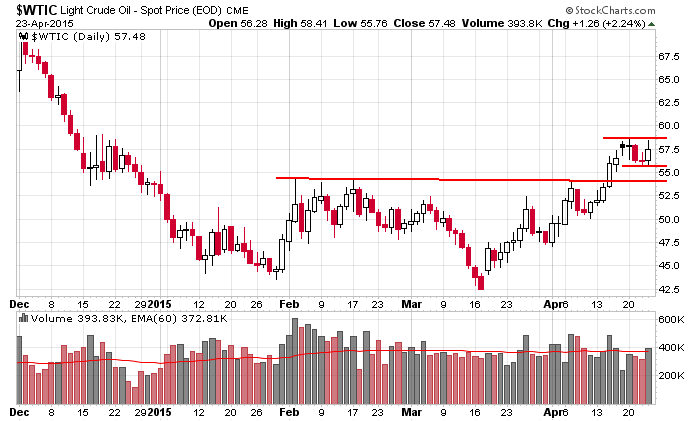

Oil continues to trade constructively. It broke out two weeks ago and has been resting in a little flag pattern this week. Purely from a technical standpoint, I continue to like the action.

Things get very interesting right now. When the indexes are stuck in the middle of their ranges, not much matters. They can move up or down without much notice. But now that they’re near their highs or the tops of their ranges, everyone takes note because odds favor some follow through or a move back into the ranges. Something should happen (actually nothing has to happen, but odds favor something meaningful taking place). We’ll either head into the weekend with clean breakouts or scratching our heads wondering how long this sideways range will last. More after the open.

Stock headlines from barchart.com…

State Street (STT +0.33%) reported Q1 EPS of $1.17, above consensus of $1.05.

Biogen (BIIB +1.58%) reported Q1 EPS of $3.82, less than consensus of $3.88.

Juniper (JNPR -1.60%) reported preliminary Q1 adjusted EPS of 32 cents, better than consensus of 31 cents.

Unisys (UIS +0.99%) reported a Q1 EPSloss of -87 cents, a smaller loss than consensus of -92 cents.

Reinsurance Group (RGA -0.30%) reported Q1 operating EPS of $1.77, less than consensus of $1.83.

Hanesbrands (HBI +1.35%) reported Q1 adjusted EPS of 22 cents, below consensus of 23 cents.

C.R. Bard (BCR +0.66%) reported Q1 adjusted EPS of $2.10, better than consensus of $2.07.

Robert Half (RHI -0.34%) reported Q1 EPS of 58 cents, stronger than consensus of 56 cents.

Chicago Bridge & Iron (CBI +2.98%) reported Q1 EPS of $1.21, above consensus of $1.14.

Newmont Mining (NEM +2.99%) reported Q1 adjusted EPS of 46 cents, double consensus of 23 cents.

Hawaiian Holdings (HA -2.36%) reported Q1 EPS of 38 cents, higher than consensus of 33 cents.

Chubb (CB +0.49%) reported Q1 operating EPS of $1.57, better than consensus of $1.52.

Principal Financial Group (PFG -0.81%) reported Q1 EPS of $1.09, above consensus of $1.05, although Q1 revenue of $2.54 billion was below consensus of $2.57 billion.

Capital One (COF +0.12%) reported Q1 EPS of $2.00, higher than consensus $1.88, but Q1 revenue of $5.6 billion was below consensus of $5.7 billion.

Microsoft (MSFT +0.81%) climbed 3% in after-hours trading after it reported Q3 EPS ex-items of 62 cents, well above consensus of 51 cents.

Starbucks (SBUX +2.28%) reported Q2 EPS of 33 cents, right on consensus, although Q2 revenue of $4.60 billion was higher than consensus of $4.53 billion.

Amazon.com (AMZN +0.05%) jumped over 5% in after-hours trading after it reported a Q1 EPS loss of -12 cents, a smaller loss than consensus of -13 cents.

Google (GOOG +1.42%) reported Q1 EPS of $6.57, weaker than consensus of $6.60.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Durable Goods

Notable earnings before today’s open: AAL, AAN, AJG, AOS, AVX, AZN, B, BIIB, COG, DTE, EHTH, FLIR, FNFG, IMGN, IMS, INFY, IPG, LEA, LYB, OFG, PB, SHOO, SPG, STT, TYC, VTR, XRX

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Apr 24)”

Leave a Reply

You must be logged in to post a comment.

Just listened to your podcast and I found it very encouraging. I have been trading for ten years and found a lot of similarities with your experiences and mine. We seem to be headed in the same direction. Thanks for all your effort with your website.

Bill

You’re welcome Bill. Glad you got something out of it. Good luck.

Jason