Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. Taiwan (down 1.2%) and Japan (down 1%) led to the downside; Malaysia and South Korea closed up. Half of Europe was closed today. Greece, France, Germany and Amsterdam did well. Prague did not. Futures here in the States point towards a relatively big gap up for the cash market.

Thanks for your votes on my public list at stockcharts.com. Keep ’em coming.

The dollar is down. Oil is up, copper is down. Gold is down, silver is up. Bonds are up.

Tuesday the market was weak early but then rallied back and closed in the upper half of its intraday range. Wednesday the market was strong early but then it trended down and closed in the bottom half of its range. The ping pong match continues. Today the market will open near yesterday’s high.

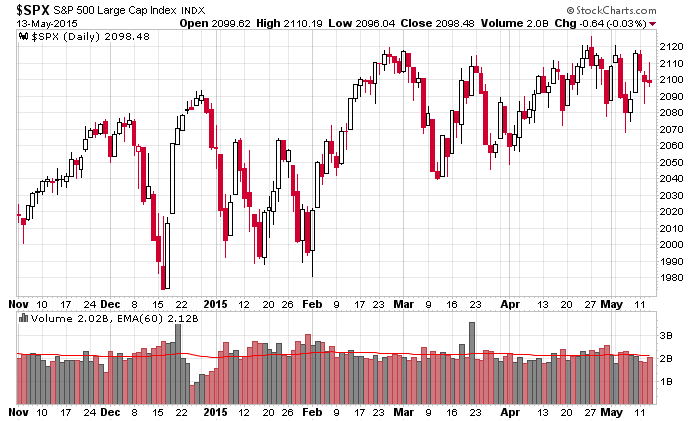

The S&P 500 is a sloppy mess. There’s no sense drawing trendlines here because I don’t think there’s a magical level that will suddenly induce lots of buying or selling. At the current level, there’s lots of chopping and churning. The next mini trend may not start until a new high is hit – and then the market either follows through or quickly reverses – or falls to the March low – where we’ll either get more downside follow through or a quick reversal and rally. So we need either a move up or down to set up the next mini trend.

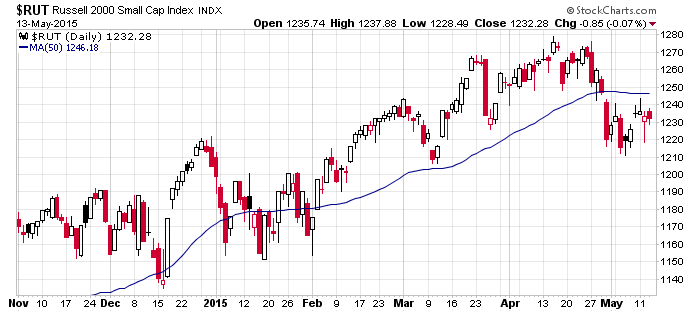

The Russell 2000 fell below its 50-day two weeks ago and is now consolidating below the moving average. This is a major problem for the bulls – not just that it’s below its 50, also that it’s far from its high and not likely to match a new high from the S&P. Any move up will stall unless the small caps participate.

No big bets right now.

Options expire tomorrow.

More after the open.

Stock headlines from barchart.com…

Kohl’s (KSS +0.28%) reported Q1 EPS of 63 cents, better than consensus of 55 cents.

Urban Outfitters (URBN -0.27%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Telsey Advisory.

DuPont (DD -7.37%) was upgraded to ‘Neutral’ from ‘Underperform’ at BofA/Merrill Lynch.

J.B. Hunt (JBHT -0.61%) and Ingersoll-Rand (IR +0.89%) were both upgraded to ‘Overweight’ from ‘Sector Weight’ at KeyBanc.

Citigroup keeps a ‘Buy’ rating on Global Payments (GPN +1.23%) and raises its price target on the stock to $118.50 from $110.

CarMax (KMX -0.22%) was initiated with a ‘Buy’ at Sterne Agee CRT with a price target of $87.

Teekay (TK -0.62%) reported Q1 adjusted EPS of 22 cents, below consensus of 29 cents.

AOL (AOL +0.49%) was downgraded to ‘Neutral’ from ‘Buy’ at UBS.

Superior Energy (SPN -0.37%) was upgraded to ‘Outperform’ from ‘Perform’ at Oppenheimer.

Duke Energy (DUK -2.44%) was downgraded to ‘Neutral’ from ‘Outperform’ at Credit Suisse.

J.C. Penney (JCP -1.91%) reported a Q1 EPS loss of -57 cents, a smaller loss than consensus of -77 cents.

Vipshop (VIPS +3.41%) reported Q1 adjusted EPS of 13 cents, above consensus of 10 cents.

Cisco (CSCO +0.41%) reported Q3 EPS of 54 cents, higher than consensus of 53 cents.

Jack in the Box (JACK -0.05%) reported Q2 operating EPS of 69 cents, better than consensus of 67 cents.

Roundy’s (RNDY -1.51%) reported a Q1 EPS loss of -1 cent, a smaller loss than consensus of -3 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Initial Jobless Claims

8:30 Producer Price Index

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

1:00 PM Results of $16B, 30-Year Note Auction

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: CSTM, GIL, HIMX, KSS, MANU, MMYT, PBH, PERY, PLCE, QIWI, TK, TNK

Notable earnings after today’s close: AMAT, ANET, DAR, EXP, HTHT, JWN, KING, LOCO, SANW, SINA, SYMC, WB

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 14)”

Leave a Reply

You must be logged in to post a comment.

the end of the universe is fast approaching and may start out of japan

why –central banks pension funds ponsi

they buy via eft’s every 2 or so days and any drop in price will increase a soverign debt default

this is why bond yeilds are going up and only daytrading index futures are possible

and trades of minutes only as irrational turns are common

broading ==jaws of death targets–spx 2150 dow 18500