Good morning. Happy Friday. Happy Options Expiration Day.

The Asian/Pacific markets closed with a lean to the upside. Hong Kong led with a 2% gain, followed by Japan (up 0.8%) and Australia (up 0.7%). China dropped 1.6%, and South Korea fell 0.7%. Europe is mostly up. Austria and Switzerland are up more than 1%; Amsterdam, Stockholm, Russia and Italy are also doing well. Greece is down 1.3%. Futures here in the States point towards a slight up open for the cash market.

Thanks for your votes on my public list at stockcharts.com. Keep ’em coming.

The dollar is up. Oil and copper are down. Gold and silver are down. Bonds are up.

Options expire today. I don’t expect any type of crazy intraday volatility, but the day can act as a turning point for the entire market – something to watch out for early next week.

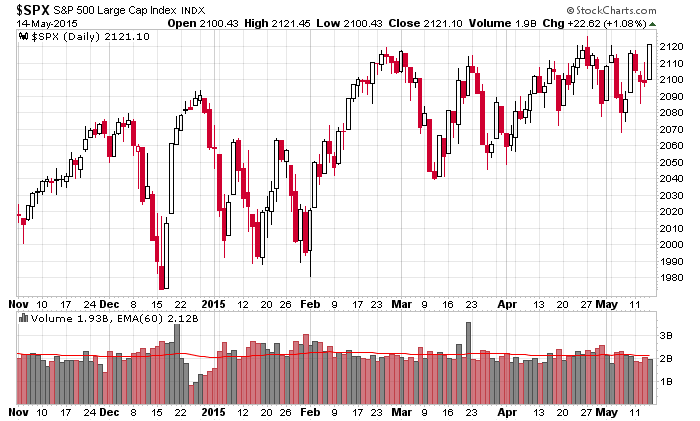

Yesterday’s S&P 500 close was the highest close ever. The index has traded at this level before but always sold off during the day to leave an upper wick on the daily candles. Not yesterday. It’s at that level again where it could bust out with force and run or get beat back down into its sloppy range.

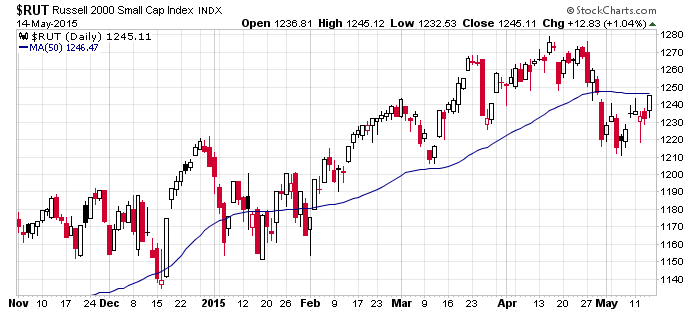

The Russell 2000 had a great day yesterday too but has a ton of work to do. The 50-day is right overhead, and then there’s a block of resistance between 1250 and 1270. If the large caps bust out, the small caps will need to slice through these levels and come along for the ride. Otherwise the market’s upside will be limited. The S&P can run a little on its own, but eventually (days, not weeks) participation will need to be broad-based.

This is a key time. When the market trades in the middle of a range, very little can happen that’s interesting. But when it travels to either the top or bottom of the range, everyone takes note and gets ready. The possibility of a new high that motivates money to come off the sidelines gets everyone’s attention. Perhaps we get follow through buying. Perhaps follow through buying gets fade. Maybe there won’t be a new high. Have a plan, have a plan B. You never know what’s going to happen, but you can contemplate “if-then” scenarios to get yourself ready. More after the open.

Stock headlines from barchart.com…

Yum! Brands (YUM +0.13%) was upgraded to ‘Overweight’ from ‘Neutral’ at JPMorgan Chase.

JPMorgan Chase (JPM +0.81%) reported April Net Credit Losses of 2.34% vs. 2.61% last month and April delinquencies of 1.18% vs. 1.23% last month.

Gabelli reported a 7.22% stake in Borderfree (BRDR unch) .

Voya Financial (VOYA +0.33%) was initiated with a ‘Conviction Buy’ at Goldman Sachs with a price target of $50.

United Parcel Service (UPS +1.25%) climbed 1% in pre-market trading after Goldman Sachs upgraded the stock to ‘Buy’ from ‘Hold.’

Hertz (HTZ +0.20%) reported Q1 revenue of $2.44 billion, below consensus of $2.53 billion.

Darling (DAR +1.00%) reported Q1 adjusted EPS of 9 cents, above consensus of 7 cents.

Dillard’s (DDS -1.85%) reported Q1 EPS of $2.66, weaker than consensus of $2.78.

King Digital (KING -4.34%) reported Q1 adjusted EPS of 61 cents, higher than consensus of 53 cents.

Mosaic (MOS +0.31%) rose over 1% in after-hours trading after it announced a new $1.5 billion share repurchase authorization and also increased its dividend to 27.5 cents from 25 cents.

Nordstrom (JWN -2.65%) reported Q1 EPS of 66 cents, weaker than consensus of 71 cents, and then lowered guidance in fiscal 2015 EPS to $3.65-$3.80, at the low end of consensus of $3.79.

Applied Materials (AMAT -0.35%) reported Q2 EPS of 29 cents, above consensus of 28 cents.

Symantec (SYMC +2.29%) reported Q4 adjusted EPS of 43 cents, below consensus of 44 cents, and then lowered guidance on fiscal 2016 EPS to $1.80-$1.90, below consensus of $1.90.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Empire State Mfg Survey

9:15 Industrial Production

10:00 Reuters/UofM Consumer Sentiment

10:00 E-Commerce Retail Sales

4:00 PM Treasury International Capital

Notable earnings before today’s open: FLML, GSI, HGG, LOCM, SVA

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers