Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. China got crushed; it fell 6.5%. Hong Kong dropped 2.2%. The rest of the region closed without much net movement. Europe is currently mixed, but there aren’t many standout movers. Germany, France, Italy, Austria and Greece are down. Prague and Russia are up. Futures here in the States point towards a down open for the cash market.

Leavitt Brothers Special Offer

The dollar is up. Oil is flat, copper is down. Gold and silver are flat. Bonds are up.

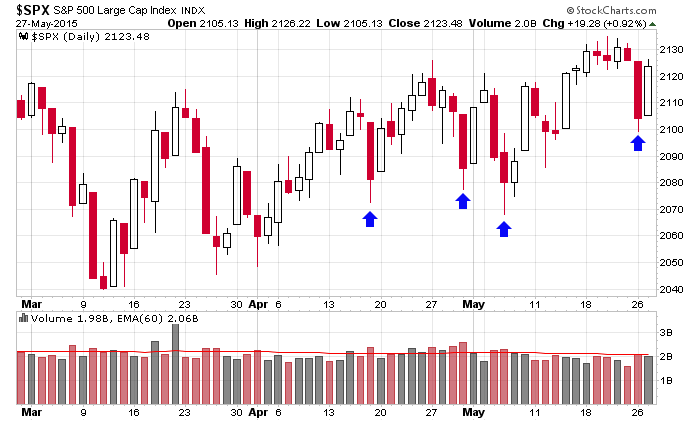

Depending on which index you follow, yesterday either completely recovered or almost recovered the loss from the previous day. Here’s an update of the daily S&P chart. Yesterday’s reversal, while not necessarily predictable, certainly wasn’t a surprise given other similar occurrences the last couple months.

The market continues to be manic depressant. Up, down, up, down. No move lasts long. Nothing sticks. No consistency. We’ve gotten some good trades off, but in most cases our holding time is less than a week. It is what it is. We’ve been getting good pops, and then a week or so later prices drift back. Trade the market you’re given, not the market you want. Little wins add up.

Nothing else to say right now. For any move up to sustain itself, we need the small caps to catch up and the breadth indicators to improve a bunch. Absent these improvements the upside is limited. More after the open.

Stock headlines from barchart.com…

Flowers Foods (FLO +0.65%) reported Q1 EPS of 29 cents, below consensus of 30 cents.

Chipotle (CMG -1.55%) was upgraded to ‘Buy’ from ‘Hold’ at Miller Tabak who raised their price target on the stock to $725 from $715.

The Fresh Market (TFM +0.09%) was downgraded to ‘Neutral’ from ‘Overweight’ at JPMorgan Chase.

Genworth (GNW +1.31%) was upgraded to ‘Equal Weight’ from ‘Underweight’ at Morgan Stanley.

Molson Coors (TAP -0.92%) was upgraded to ‘Overweight’ from ‘Equal Weight’ at Morgan Stanley.

Tech Data (TECD +2.31%) reported Q1 non-GAAP EPS of 80 cents, higher than consensus of 71 cents.

Avago Technologies Ltd. (AVGO +7.76%) reported Q2 EPS of $2.13, better than consensus of $2.00.

Actavis (ACT +2.24%) announced that its VIBERZI drug was approved by the FDA as a twice-daily, oral treatment for adults suffering from irritable bowel syndrome with diarrhea.

Transocean (RIG -0.05%) reports that CFO Esa Ikaheimonen is stepping down as Executive Vice President and CFO effective immediately.

Amerco (UHAL +0.16%) reported Q4 EPS of $2.43, below consensus of $2.48.

RetailMeNot (SALE -0.73%) was initiated with a ‘Buy’ at Topeka with a price target of $28.

Aegean Marine (ANW +0.58%) reported Q1 EPS of 25 cents, higher than consensus of 24 cents, although the company said Q1 revenue was $1.02 billion, below consensus of $1.37 billion “due to the drop in the price of oil.”

Rally Software (RALY -1.03%) surged over 40% in after-hours trading after CA Technologies ({=CA agreed to acquire the company for $19.50 per share or about $480 million.

EnerSys (ENS +2.23%) reported Q4 EPS ex-items of $1.15, better than consensus of $1.14, but Q4 revenue of $629.9 million was below consensus of $635.06 million.

Pier 1 Imports (PIR -2.23%) was initiated with a ‘Buy’ at Cantor with a price target of $17.

SpartanNash (SPTN +0.06%) reported Q1 EPS of 44 cents, better than consensus of 41 cents, although Q1 revenue of $2.31 billion was below consensus of $2.32 billion.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Initial Jobless Claims

9:45 Bloomberg Consumer Comfort Index

10:00 Pending Home Sales

10:30 EIA Natural Gas Inventory

11:00 EIA Petroleum Inventories

11:30 Results of $13B, 2-Year FRN Auction

1:00 PM Results of $29B, 7-Year Note Auction

3:00 PM Farm Prices

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: AMSC, ANF, DANG, EXPR, FLO, FRED, IKGH, JKS, MOD, OA, RY, SAFM, SDRL, SIG, TD, TECD, TITN, XCRA

Notable earnings after today’s close: AVGO, BLOX, DECK, EXA, GME, OVTI, PSUN, SPLK, ULTA, VEEV

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 28)”

Leave a Reply

You must be logged in to post a comment.

Little wins add up… Yes great QB’s have all had games where they nickled and dimed the defense into submission.