Good morning. Happy Friday.

The Asian/Pacific markets closed mixed. Australia, New Zealand and India moved up more than 1%; Singapore, Indonesia and Malaysia moved down. Europe is currently mostly down. Germany, France, Amsterdam, Stockholm and Greece are down. Russia is up almost 1%. Futures here in the States point towards a down open for the cash market.

Leavitt Brothers Special Offer

The dollar is flat. Oil is up, copper is down. Gold and silver are flat. Bonds are mixed.

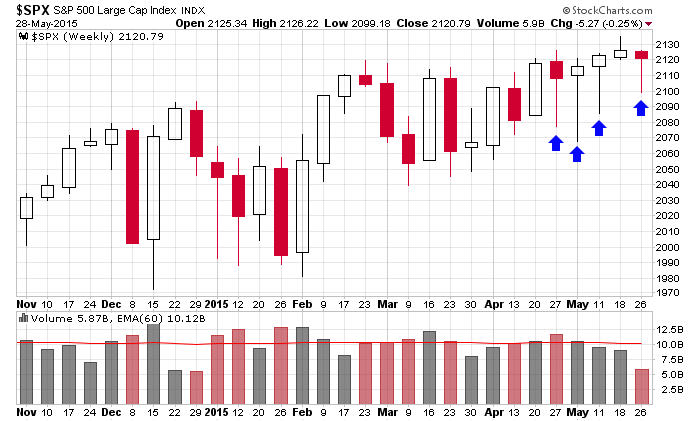

Barring a big move down today, which is certainly possible, we’re going to get another one of those weekly candles sporting a long lower tail and a close in the upper-third of the range. It hasn’t meant squat the last month, so it has no predictive value. I’m just pointing out the market’s recent tendency to be weak early in the week and strong later in the week. But there hasn’t been any follow through.

Today is the last trading day of May. Despite the month traditionally being a down month, all the indexes currently have solid gains. Historically June is the second-worst month of the year, behind September.

The long term trend is up. The intermediate term has been a sloppy mess with lots of ups and downs, lots of sudden reversals and almost no staying power from any mini move. Your trading style must fit the character of the market. Make appropriate adjustments or don’t trade. More after the open.

Stock headlines from barchart.com…

Genesco (GCO +0.34%) reported Q1 adjusted EPS of 51 cents, below consensus of 67 cents.

J.B. Hunt (JBHT -0.86%) and Knoght Transportation (KNX -0.30%) were both downgraded to ‘Neutral’ from ‘Buy’ at BofA/Merrill Lynch.

Abercrombie & Fitch (ANF +13.49%) was downgraded to ‘Sell’ from ‘Neutral’ at Janney Capital.

Transocean (RIG -1.50%) was initiated with an ‘Underweight’ at JPMorgan Chase with a price target of $16.

McDonald’s (MCD -2.21%) was initiated with a ‘Buy’ at Deutsche Bank with a price target of $120.

Schlumberger (SLB -0.38%) was initiated with an ‘Overweight’ at JPMorgan Chase with a price target of $101.

Halliburton (HAL -0.59%) was initiated with an ‘Overweight’ at JPMorgan Chase with a price target of $56.

Big Lots (BIG -0.49%) reported Q1 EPS of 60 cents, better than consensus of 59 cents.

The New York Post reports that Intel (INTC +0.89%) is near a deal to buy rival Altera (ALTR -1.86%) for about $15 billion or up to $54 per share.

ViaSat (VSAT +0.29%) was awarded a $478.6 million government contract for the production, development and sustainment of the Multifunctional Information Distribution System Joint Tactical Radio Systems terminals.

Broadcom (BRCM -1.57%) was downgraded to ‘Neutral’ from ‘Buy’ at Goldman Sachs.

Greif (GEF -1.35%) slumped over 12% in after-hours trading after it lowered guidance on fiscal 2015 adjusted EPS view to $1.65-$1.75 from $2.25-$2.35, well below consensus of $2.23.

GameStop (GME +3.67%) jumped nearly 4% in after-hours trading after it reported Q1 EPS of 68 cents, better than consensus of 59 cents.

Ulta Salon (ULTA +0.96%) rose nearly 2% in pre-market trading after it reported Q1 EPS of $1.04, higher than consensus of 93 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 GDP Q1

8:30 Corporate Profits

9:45 Chicago PMI

10:00 Reuters/UofM Consumer Sentiment

Notable earnings before today’s open: BIG, BNS, CCG, DXLG, FRO, GCO, GHM

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers