Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly down. Indonesia dropped 1.6%, followed by India (down 1.3%), Australia (down 0.9%), South Korea (down 0.7%) and Taiwan (down 0.6%). Hong Kong rallied 0.7%, and Malaysia gained 0.5%. Europe is currently mostly up. Greece is up 4%; Germany, France and Amsterdam are up more than 1%; London, Austria, Norway, Stockholm, Switzerland, Italy and Spain are also doing well. Futures here in the States point towards a relatively big gap up open for the cash market.

FREE ebook -> Powerful Stock Setups (I wrote one of the chapters)

The dollar is up. Oil is down, copper is up. Gold and silver are up. Bonds are down.

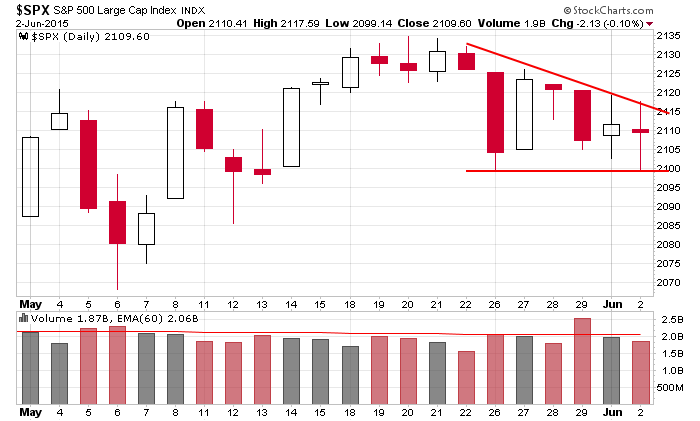

We’ve had lots of intraday movement the last week but virtually no net change. Here’s the 1-month daily S&P chart…two big down days, on big up day and two days where the range was big but closes were close to the opens. As of now, today’s open will be near 2120, so the 3-day high will be tested again. Sooner or later the market will get some traction, and either the longs or short will be trapped and have to scramble to exit.

Until the market breaks out of its funk, swing trading needs to be kept to a minimum. Without any directional momentum, the opportunity to sit back with a relatively loose stop and let setups play out are few and far between.

I’ve been pretty clear what I want to see if the market does attempt to run. The small caps need to catch up to the large caps, and several breadth indicators (AD line, AD volume line, new highs, percentage of stocks above 20-day MA, percentage of stocks at a 20-high) need to move up to suggest broad-based participation. Failure of these indicators to improve would constitute a lack of confirmation and most likely lead to a failed move.

Don’t guess. Let the market be your guide. More after the open.

Stock headlines from barchart.com…

Actavis (ACT -1.12%) was initiated with an ‘Outperform’ at Raymond James with a price target of $344.

Dean Foods (DF -0.43%) was downgraded to ‘Equal Weight’ from ‘Overweight’ at Morgan Stanley.

Humana (HUM -0.08%) was upgraded to ‘Neutral’ from ‘Underperform’ at Sterne Agee CRT.

Piper Jaffray reiterates an ‘Overweight’ rating on Amazon.com (AMZN +0.02%) and rasies the price target on the stock to $520 from $475.

Caterpillar (CAT +0.75%) was initiated with a ‘Buy’ at Societe Generale with a price target of $110.

Expedia (EXPE +0.17%) was initiated with an ‘Overweight’ at Barclays with a price target of $125.

Genesco (GCO +1.88%) was downgraded to ‘Sell’ from ‘Neutral’ at Goldman Sachs.

Charles Schwab (SCHW +0.60%) was initiated with an ‘Overweight’ at Piper Jaffray with a price target of $39.

Legg Mason (LM +0.06%) was initiated with an ‘Overweight’ at Piper Jaffray with a price target of $65.

CNBC reports that Hewlett-Packard’s (HPQ +0.36%) separation into HP Inc. and Hewlett-Packard Enterprise will be effective Nov 1.

Ciena (CIEN +0.62%) was initiated with a ‘Buy’ at Nomura with a price target of $29.

ABM Industries (ABM -0.34%) reports Q2 adjusted EPS of 37 cents, higher than consensus of 35 cents.

Guess (GES +6.21%) reported an unexpected Q1 EPS profit of 4 cents, better than consensus of a -5 cent loss, although Q1 revenue of $478.8 million was below consensus of $483.8 million.

Ascena Retail (ASNA -0.61%) reported Q3 EPS of 18 cents, weaker than consensus of 20 cents.

G-III Apparel (GIII +3.30%) climbed over 4% in after-hours trading after it reported Q1 EPS of 15 cents, more than double consensus of 7 cents, and then raised guidance on fiscal 2016 EPS view to $2.66-$2.76 from $2.53-$2.63, above consensus of $2.62.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

8:15 ADP Jobs Report

8:30 Gallup U.S. Job Creation Index

8:30 International Trade

9:45 PMI Services Index

10:00 ISM Non-Manufacturing Index

10:30 EIA Petroleum Inventories

2:00 PM Fed’s Beige Book

Notable earnings before today’s open: BF.B, VRA

Notable earnings after today’s close: FIVE, LF, VRNT

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 3)”

Leave a Reply

You must be logged in to post a comment.

This market is getting very hard to trade.

very few know how interday trades in current situation

insto bears full of bearomite for their high frequency trades can see all orders and stops

so they move the markets up and pinch/steal the short stops

sit back and let it fall

the reverse on the long side,stops are run constantly

high frequency trades made possible by bearomite a substance only found on mars

constitutes 73 %of all trades

become a marsian and trade interday untill we go into hibination and the swing traders take over

Markets have 3 trends. First one .. it trends up, second one.. it chops…, third one… it trends down. Right now we are in the chop mode. It fits certain trading modalities. Trade accordingly, or if this is not your cup of tea, do not drink from the cup.

Fred Simons