Good morning. Happy Monday. Hope you had a great weekend.

The Asian/Pacific markets closed with a lean to the downside. China rallied 2.2%; Indonesia fell 1.7% and India dropped 0.9%. Europe is currently mostly down. Turkey is down more than 6%. Austria, Denmark and Hungary are down more than 1%. Germany, France, Amsterdam and Spain are also weak. Futures here in the States point towards a flat open for the cash market.

S&P Select – Week in Review

The dollar is down. Oil is down, copper is down. Gold and silver are up. Bonds are flat.

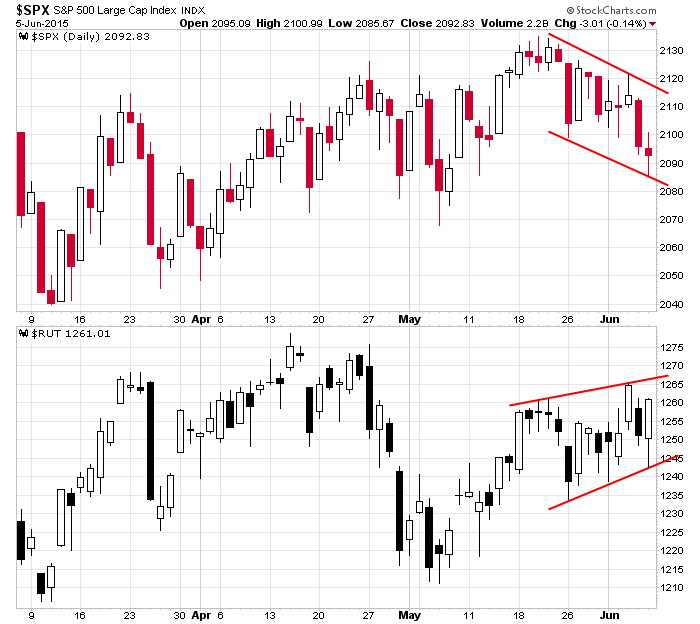

The market finished last week with on a down note for the Dow and S&P 500 and a solid up day for the Russell small caps. Here’s a 3-month daily chart of SPX and RUT.

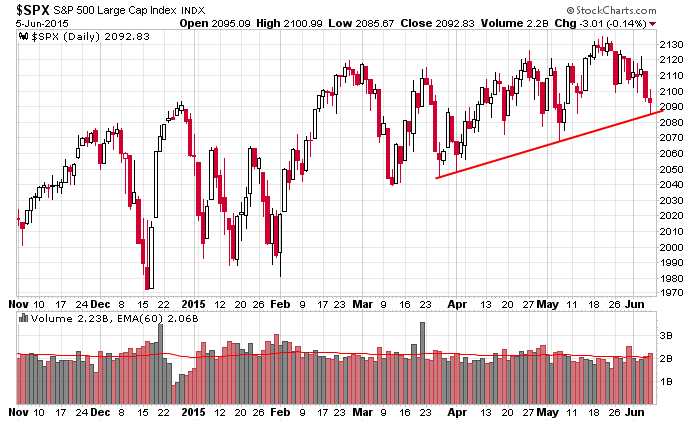

The breadth indicators have not improved, but they have moved closer to levels that have produced bottoms in the past. If you wanted to be very optimistic, you could argue the bears have had an opportunity to take over and pushed the market down, but they have mostly failed…and now the indicators have had a chance to cycle down and would be supportive of a rally. I’m not going all-in on the long side, but I am shifting my bias to neutral. Failure of the bears to fully take over has opened the door for the bulls to regain control. Here’s the daily S&P going back to November. There have been lots of ups and downs, lots of overlapping candles and very little progress, but there’s nothing terribly wrong with this chart (although it’s notable down volume has been stronger than up volume).

Don’t have a strong bias here. The market may surprise you. More after the open.

Stock headlines from barchart.com…

Delta Air Lines (DAL -0.05%) and United Continental (UAL -0.88%) were both downgraded to ‘Outperform’ from ‘Strong Buy’ at Raymond James.

CBOE Holdings (CBOE -0.64%) was upgraded to ‘Hold’ from ‘Sell’ at Evercore.

Wal-Mart (WMT -1.47%) was upgraded to ‘Strong Buy’ from ‘Outperform’ at Raymond James.

Affiliated Managers (AMG -0.39%) was initiated with a ‘Buy’ at Goldman Sachs with a price target of $258.

Franklin Resources (BEN +0.28%) was initiated with a ‘Sell’ at Goldman Sachs with a price target of $49.

BlackRock (BLK -0.70%) was initiated with a ‘Buy’ at Goldman Sachs with a price target of $421.

Home Depot (HD -0.98%) was initiated with an ‘Overweight’ at Atlantic Equities witha price target of $128.

Invesco (IVZ +0.05%) was upgraded to ‘Buy’ from ‘Neutral’ at UBS.

Energy Transfer Equity (ETE +2.43%) was reinstated with an ‘Overweight’ at Barclays with a price target of $92.

Energy Transfer Partners (ETP +0.66%) was reinstated with an ‘Overweight’ at Barclays with a price target of $70.

Huntington Ingalls (HII +0.24%) was awarded a $3.35 billion government contract for detail, design and construction of CVN 79, the aircraft carrier USS John F. Kennedy.

AB Value Partners reported a 6.61% stake in Image Sensing Systems (ISNS -0.96%).

Soros Fund reported a 5.19% passive stake in MaxLinear (MXL +0.66%).

Piedmont Natural Gas (PNY -0.91%) reported Q2 EPS of 84 cents, better than consensus of 79 cents, although Q2 revenue of $424.9 million was weaker than consensus of $488.8 million.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

10:00 Labor market condition index

12:30 PM TD Ameritrade IMX

Notable earnings before today’s open: BRLI, DATE, MTN, PRGN, SHLD

Notable earnings after today’s close: CASY, CBK, FCEL, HRB, HQY, KANG, LAYN, PBY, PLAY, SB, TPLM, UNFI

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers