Good morning. Happy Tuesday.

The Asian/Pacific markets closed down across-the-board. Indonesia fell 2.3%; Japan, Hong Kong and Taiwan dropped more than 1%. Europe, Africa and the Middle East are currently mostly down. Greece is up more than 2%, and Turkey is up more than 1%. Belgium, Norway and Prague are down more than 1%; Germany, Saudi Arabia, Denmark, South Africa and Switzerland are down moderately. Futures here in the States point towards a down open for the cash market.

The dollar is flat. Oil is up a buck, copper is up. Gold and silver are up. Bonds are down.

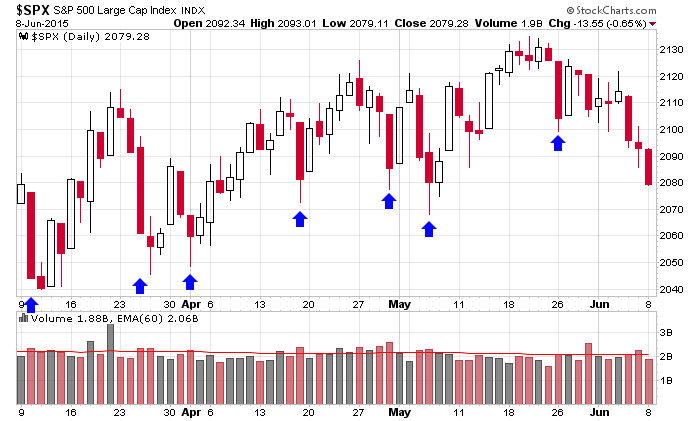

The market got hit pretty hard yesterday and is pretty close to what I’d consider an inflection point. Either the floor gets pulled out and it falls hard or the shorts find themselves trapped and it surges again.

Here’s a chart that serves as a reminder of instances in the last couple months when it seemed like things were going to fall apart, only for the market to right the ship quickly after and rally hard.

Several indicators are close to washout levels. They could signal a bounce today; they could signal a bounce in two days. There’s no specific day or time. I’m just saying the stage is being set for a bounce that is likely to take place in the next couple days, and failure to bounce could lead to the exact opposite – a big plunge.

The market will show us its true colors soon. Be ready. More after the open.

Stock headlines from barchart.com…

Burlington Stores (BURL -2.14%) reported Q1 EPS of 41 cents, right on consensus, although Q1 revenue of $1.18 billion was below consensus of $1.22 billion. Burlington then lowered guidance on fiscal 2015 adjusted EPS $to 2.15-$2.25, below consensus of 2.28.

Dollar General (DG -0.21%) was upgraded to ‘Strong Buy’ from ‘Market Perform’ at Raymond James.

General Electric (GE -0.18%) announced that it will sell its U.S. Sponsor Finance business and a $3 billion bank loan portfolio to Canada Pension Plan Investment Board in a transaction valued at approximately $12 billion.

Akamai (AKAM -0.47%) was downgraded to ‘Neutral’ from ‘Outperform’ at Macquarie.

HD Supply (HDS -2.35%) reported Q1 adjusted EPS of 33 cents, higher than consensus of 29 cents.

HSBC (HSBC +0.40%) said it will cut 50,000 jobs in a global business overhaul.

Lululemon Athletica (LULU -3.57%) rose nearly 3% in pre-market trading after it reported Q1 EPS of 34 cents, higher than consensus of 33 cents.

D. E. Shaw & Co reported a 5.1% passive stake in Tesoro (TSO -0.50%) .

FedEx (FDX -1.29%) raised its quarterly dividend 25% to 25 cents from 20 cents per share.

Newmont Mining (NEM -0.27%) filed to sell 29 million shares of common stock.

AMAG Pharmaceuticals (AMAG -2.54%) was initiated with a ‘Buy’ at Guggenheim with a price target of $85.

H&R Block (HRB -0.73%) reported fiscal 2015 EPS of $1.75, better than consensus of $1.73, although 2015 revenue of $3.079 billion, below consensus of $3.090 billion.

Casey’s General Stores (CASY -0.47%) reported Q4 EPS of $1.05, well above consensus of 85 cents.

United Natural Foods (UNFI -0.34%) slid 7% in after-hours trading after it reported Q3 EPS of 83 cents, below consensus of 85 cents, and then lowered guidance on fiscal 2015 adjusted EPS view to $2.84-$2.88 from $2.90-$2.99, weaker than consensus of $2.92.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:55 Redbook Chain Store Sales

9:00 NFIB Small Business Optimism Index

10:00 Job Openings and Labor Turnover Survey

10:00 Wholesale Trade

1:00 PM Results of $24B, 3-Year Note Auction

Notable earnings before today’s open: BURL, CMN, FGP, HDS, HOV, ISLE, LULU, SAIC, ZQK

Notable earnings after today’s close: GEF, LMNR, MFRM, SIGM, SURG

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 9)”

Leave a Reply

You must be logged in to post a comment.

Tuesday, Wed and Thurs are summer training days. Just watching, adding to dividend stocks biotechs, holding core indexes a little longer. Bond inverse etfs are doing a little better TMV and TBT. Over no longer thinking of Fed rate increase, but not ruling it out either. Longer run a correction is brewing. Maybe down a while. Think about municipal debt like Neveen nationals, maybe internationals. Be happy.

today is a 90 day Gann cycle and could indicate a reversal

90 through to 96 days has other Gann cycles

insto bears should take profits around here and cause a turn to a new high to take out all bear stops

they will be helped by jesabell leader of the guadwitches

17733 dow was a important previous close that was hit by futures earlier europe time

german dax needs to reverse for the nas 100 and would mean a turn in the apple

spx has been the strongest not yet hitting 2050

as leader of the bears i has decided all bears cash in their chips and buy closing out possitions

however i have had mutinies before where i have been disobeyed

we need to make nice fat bulls now so as we can short them

i think this is called swing trading