Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed. Hong Kong, New Zealand and South Korea were weak; India, Indonesia, Taiwan and Singapore did well. Europe, Africa and the Middle East are mostly up. Germany, France, Austria, Amsterdam, Stockholm, Switzerland, Prague, Poland, Turkey, Denmark, South Africa, Italy and Portugal are doing well; Greece is weak. Futures here in the States point towards a moderate gap up open for the cash market.

Follow my public list at stockcharts.com.

The dollar is down. Oil is up $1.56; copper is up. Gold and silver are up. Bonds are down.

After a couple days of selling, we got a Doji candle yesterday – that’s when the market opens and closes at nearly the same level, and the daily candles sport upper and lower tails. It’s a sign of indecision. The market moves in one direction but reverses back to the open. Then it moves in the other direction but again reverses back to the open. The movement isn’t always smooth or orderly, but the end result and meaning are the same. The market isn’t sure.

I’m still thinking we have an inflection point coming very soon – perhaps today, perhaps in the next couple days. The S&P is near support, and several indicators have cycled down. The ball is back in the bulls’ court. The stage is set for them to retake control and push prices up. If they fail or choose not to, the floor gets pulled out. One or the other. The scenario that would surprise me most is the market just sitting here without making any decent effort to do something.

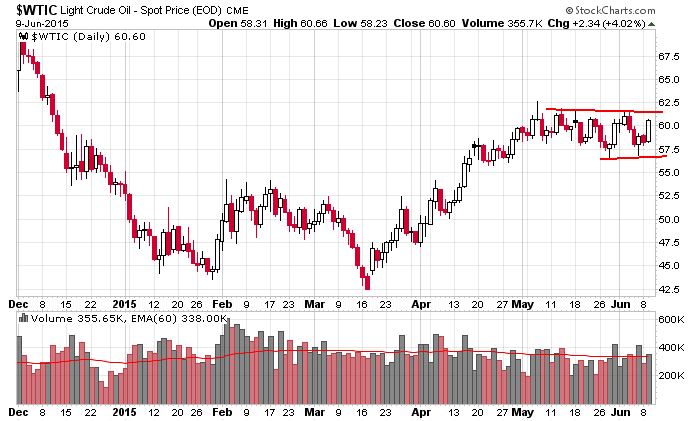

Oil rallied $2.34 yesterday and is up another $1.56 as of this writing. This puts crude right at resistance of its pattern.

Be ready for a directional move. It’s coming soon.

Stock headlines from barchart.com…

Dollar General (DG +0.77%) and NetApp (NTAP -0.18%) were both upgraded to ‘Outperform’ from ‘Sector Perform’ at RBC Capital.

NVIDIA (NVDA +0.51%) was downgraded to ‘Neutral’ from ‘Buy’ at Nomura.

H&R Block (HRB +2.27%) was downgraded to ‘Neutral’ from ‘Outperform’ at Credit Suisse.

Legg Mason (LM -0.54%) was downgraded to ‘Negative’ from ‘Neutral’ at Susquehanna.

Eaton Vance (EV -2.27%) was upgraded to ‘Neutral’ from ‘Negative’ at Susquehanna.

Community Health (CYH +2.08%) was initiated with an ‘Outperform’ at Wedbush with a price target of $65.

AOL (AOL -0.14%) was downgraded to ‘Hold’ from ‘Buy’ at Jefferies.

Colgate-Palmolive (CL +1.06%) was upgraded to ‘Hold’ from ‘Sell’ at Societe Generale.

Qorvo (QRVO -0.24%) will replace Lorillard (LO +0.41%) in the S&P 500 as of the close of trading on Jun 11.

Bloomberg reported that a U.S. judge told Trinity Industries (TRN -2.70%) , the maker of a guardrail safety system linked to numerous fatalities, to pay $663 million for defrauding the U.S. government.

GameStop (GME -0.35%) reported a 21.4% stake in Geeknet (GKNT -0.15%) .

Prudential (PRU +0.45%) authorized a $1 billion stock repurchase program.

Gulfport Energy (GPOR +0.62%) filed to sell 10 million shares of common stock.

Mattress Firm (MFRM +2.37%) dropped over 4% in after-hours trading after it reported Q1 adjusted EPS of 33 cents, weaker than consensus of 39 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

10:00 Quarterly Services Report

10:30 EIA Petroleum Inventories

1:00 PM Results of $21B, 10-Year Bond Auction

2:00 PM Treasury Budget

Notable earnings before today’s open: FRAN

Notable earnings after today’s close: BV, BOX, DDC, KKD, MW

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jan 10)”

Leave a Reply

You must be logged in to post a comment.

as ordered yesterday the bears took profits after running the bulls stops and stealing their possitions

now all bears are aggressive starving bulls that need fattering up

impationed me has just closed all world longs as todays move was to exciting for me but with the doji their and the vix moving back into bollonger bands after extreams,as well as nas and tick inds ,i will be eager to enter the bull trap a bit later and lower

the question is am i a bouncing dead cat counter trend 1 to 4 day yukky bull and maybe we trade against

todays spike for a few days before i return to my wonderfully bearish self

or am i a new high dedicated bull that will obviously bring in a new trend change to the downside