Good morning. Happy Tuesday.

The Asian/Pacific markets closed with a lean to the downside. China dropped 3.5%, followed by Hong Kong (down 1.1%), Singapore (down 0.75%), South Korea (down 0.7%), Japan (down 0.6%) and Taiwan (down 0.5%). Indonesia rallied 0.7%. Europe, Africa and the Middle East are mixed. Greece is down more than 4%; South African is down more than 1%; Belgium, Hungary, Spain, Italy and Portugal are also weak. Turkey is up more than 1%; Switzerland and Prague are also doing well. Futures here in the States point towards a moderate gap down open for the cash market.

Follow my public list at stockcharts.com.

The dollar is up. Oil is up, copper is down. Gold and silver are down. Bonds are up.

Greece moved one step closer to defaulting on its loans. The finance minister has stated the country doesn’t plan to present any new proposals at the Eurogroup meeting on Thursday. They are done making concessions.

Bond yields of other vulnerable eurozone countries (Italy, Spain, Portugal) are moving up at a rate not seen in two years.

Given how the June FOMC meeting (tomorrow) was billed last fall as the meeting the Fed may start to raise rates, you wouldn’t think it’d be trumped by overseas news. Yet it has. There’s much more talk of Greece than the Fed. That’s fine. There’s virtually no chance the Fed raises rates tomorrow or at the next meeting. It’s off the table for now. The Fed has given themselves enough wiggle room to avoid a move.

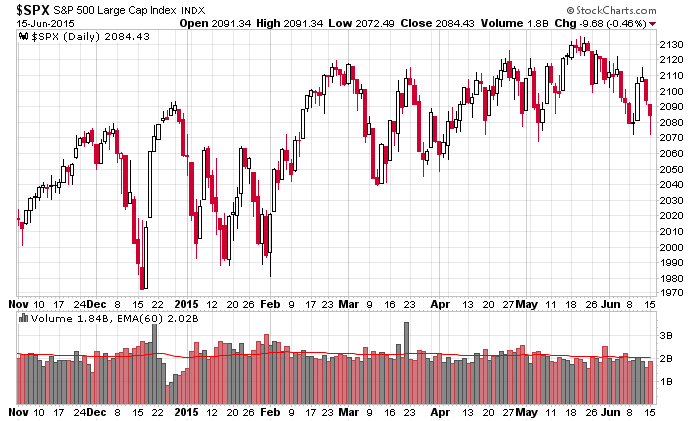

Here’s the daily S&P 500. It’s a big sloppy mess, so I’m not going to attempt to draw trendlines. I don’t think there are obvious support and resistance levels. Simply connecting highs and lows is not sufficient. I want lines drawn that have the potential to act as inflection points, and I don’t see them. For now, rallies, get sold, dips get bought. We need to keep trades short term. Period.

Stock headlines from barchart.com…

Oshkosh (OSK -2.95%) cut its fiscal 2015 adjusted EPS view to $3.75-$4.00 from $4.00-$4.25, below consensus of $4.04.

AIG (AIG +1.10%) was downgraded to ‘Hold’ from ‘Buy’ at Deutsche Bank.

Barrick Gold (ABX +1.77%) was initiated with an ‘Outperform’ at BMO Capital with a price target of $16.

FreightCar America (RAIL -0.09%) was upgraded to ‘Buy’ from ‘Hold’ at Stifel.

Ryland Group (RYL +5.21%) was upgraded to ‘Neutral’ from ‘Underperform’ at Credit Suisse.

Twitter (TWTR -3.43%) was downgraded to ‘Neutral’ from ‘Buy’ at MKM Partners.

Greenbrier (GBX -0.58%) was downgraded to ‘Hold’ from ‘Buy’ at Stifel.

The WSJ reported that Aetna (AET +4.44%) was approached by UnitedHealth (UNH +1.13%) about a merger.

MSD Partners reported a 5.5% passive stake in NorthStar Asset Management (NSAM -1.43%) .

Glenhill Advisors reported a 6.2% passive stake in Pep Boys (PBY -1.76%) .

Goldman Sachs reported a 11.6% passive stake in Enviva (EVA +0.68%) .

Kevin Plank reported a 16.6% stake in Under Armour (UA -0.12%) Class A shares.

AK Steel (AKS -3.75%) announced that it will increase current spot market base prices for all carbon flat-rolled steel products by a minimum of $20 per ton, effective immediately with new orders.

Gap (GPS -0.21%) climbed over 1% in after-hours trading after it announced it will close 175 stores in North America in an attempt to position it for improved business performance.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

FOMC meeting begins

8:30 Housing Starts

8:55 Redbook Chain Store Sales

Notable earnings before today’s open: FDS, JW.A

Notable earnings after today’s close: ADBE, BOBE, LZB

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers