Good morning. Happy Wednesday. Happy Fed Day.

The Asian/Pacific markets closed with a lean to the upside. China, Australia and Indonesia rallied more than 1%; Hong Kong and Singapore also did well. New Zealand fell 0.6%. Europe is currently mostly down. France, Netherlands, Sweden, Prague, Greece, Denmark and Finland are down more than 1%; Poland, Germany, Switzerland, Italy, Spain, Portugal and Belgium are down notably. Futures here in the States point towards a slight up open for the cash market.

Follow my public list at stockcharts.com.

The dollar is down. Oil is up a buck; copper is up. Gold and silver are down. Bonds are down.

Today has finally come. Today is the Fed meeting that was pinpointed last fall as the meeting interest rates could possibly be raised. But things have changed, both in the world and statements the Fed has made. This changes have everyone believing there is virtually no chance the Fed raises rates right now. In fact they probably won’t raise until at least September and likely later. At first the Fed talked about the unemployment rate getting under 6.5% and inflation. Then they gave themselves lots of leeway by adding statements about world events, etc. Given the heightened debt concerns in Europe, the Fed is well within their prior guidelines to keep rates right where they are.

After the Fed statement is issued, Janet Yellen with do her quarterly press conference. Wall St. expects dovishness, so she may slip and say something. It’s a good day to sit on your hands. Sudden moves could take place at any time…moves that have nothing to do with the technicals.

Then Wall St. will focus on Friday’s quad witching. It shouldn’t affect anything. Maybe we get a little intraday move here or there, but overall, options expiration has become an irrelevant day.

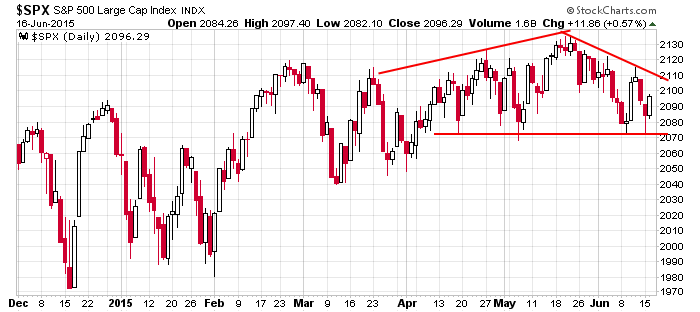

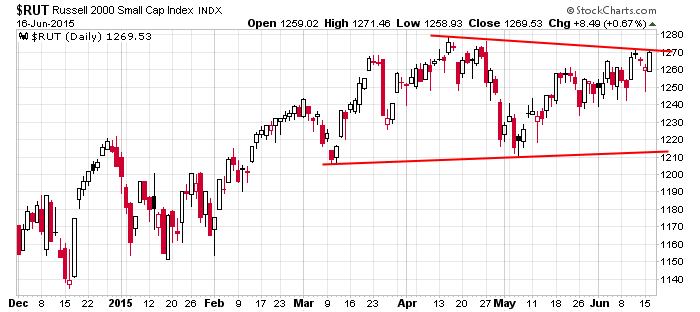

Here are the daily SPX and RUT charts. The large caps are range bound and neutral, and I don’t see any levels that are extremely important. The small caps look very good; they’re near resistance and are one big day from registering a new all-time high.

Keep trades short term. We don’t have a strong enough trend to ride positions with loose stops.

Stock headlines from barchart.com…

FedEx (FDX -0.29%) reported Q4 adjusted EPS of $2.66, stronger than the consensus of $2.43. FedEx FY16 guidance of adjusted EPS of $10.60-$11.10 was in line with the consensus of $10.88.

Allergan (AGN -1.11%) agreed to acquire KYTHERA (KYTH) for $75 per share or approximately $2.1 billion.

Hill-Rom (HRC -0.27%) will acquire Welch Allyn for about $2.05 billion in cash and stock.

Celgene (CELG +0.10%) announced an additional $4 billion share repurchase authorization.

Deutsche Telekom and Comcast are in talks over possible T-Mobile sale, according to a Reuters report.

UBS added Cigna (CI +0.35%) to its Most Preferred List and raised its target to $175.

British American Tobacco (BTI +2.85%) was upgraded to ‘Neutral’ from ‘Sell’ at Goldman Sachs.

NovaBay (NBY -10.96%) filed to sell 16.34 million shares of common stock for holders.

La-Z-Boy (LZB +1.76%) reported Q4 adjusted EPS of 38 cents, right on consensus, although Q4 revenue of $374.94 million was weaker than consensus of $379.13 million.

Adobe (ADBE +1.32%) dropped over 1.5% in after-hours trading after it reported Q2 EPS of 48 cents, higher than consensus of 45 cents, but then lowered guidance on fiscal 2015 revenue estimate to $4.845 billion, below consensus of $4.880 billion.

Bob Evans (BOBE -0.73%) rose 4% in after-hours trading after it reported Q4 EPS of 56 cents, much better than consensus of 41 cents.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

10:30 EIA Petroleum Inventories

2:00 PM FOMC Announcement

2:00 PM FOMC Forecast

2:00 PM Chairman Press Conference

Notable earnings before today’s open: ATU, FDX

Notable earnings after today’s close: CLC, JBL, ORCL, PIR

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 17)”

Leave a Reply

You must be logged in to post a comment.

From one direction to no direction. American equities are neutralizing with technical indicators showing diverging signals indicating either sideways congestion or a minor/major pullback. Negative catalyst: Possible China bubble,Grexit,Fed’s interest rate hike,continued US/Russian tension, not to mention seasonal weaknesss. Food for thought.

the market is in daytrading mode