Good morning. Happy Friday. Sorry for my absence yesterday. I knew I’d be out most of the day, but I had full intentions of being here in the morning and at least making morning comments, but my internet access (I’m on the road) fell through and there wasn’t much I could do. Oh well.

The Asian/Pacific markets closed mostly up. Japan, Australia, India and Indonesia did well; China fell over 6%. Europe is mostly up. France and Amsterdam are up more than 1%; Austria, Stockholm, Prague, Greece, Denmark, Finland, Spain, Italy and Portugal are also doing well. Futures here in the States point towards a slight up open for the cash market.

Follow my public list at stockcharts.com.

The dollar is up. Oil and copper are down. Gold and silver are flat. Bonds are up.

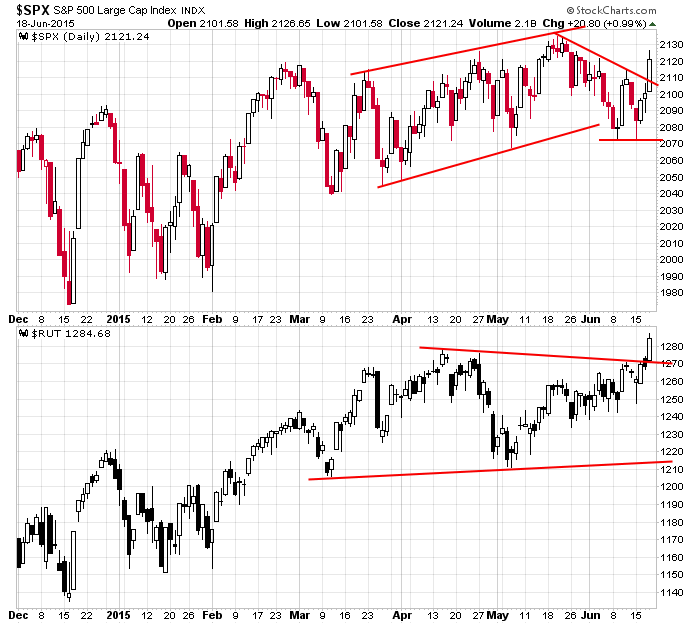

Yesterday was a huge up day. The Russell broke out and closed at a new all-time high. The S&P has a little more work to do but still put in a solid day. The Nas is also sitting at a new high.

The market has been in a funk for a long time. Rallies get sold, dips get bought. Lots of money has changed hands, but the net change has been nothing the last several months. But now we have an attempt to bust out, which makes things much more interesting.

When the market sits in the middle of a range, both the bulls and bears have a cushion on both side sides, so nothing is imminent. Nobody has their back against the wall. But now that the indexes are at or near new highs, everything is important. Do we get follow through? Do the bulls use the high prices as a chance to take profits, leading to a false breakout. Things matter now much more than they did just a couple days ago.

Bias remains to the upside. Besides the indexes moving up and several indicators improving, a possible Greece solution – albeit temporary – may be in the works. More after the open.

Stock headlines from barchart.com…

Micron (MU -0.04%) was upgraded to ‘Buy’ from ‘Hold’ at Topeka.

RE/MAX Holdings (RMAX +0.50%) was initiated with an ‘Overweight’ at Stephens with a price target of $41.

Fiserv (FISV +2.17%) was upgraded to ‘Outperform’ from ‘Perform’ at Oppenheimer witha price target of $95.

Consolidated Edison (ED +1.65%) was upgraded to ‘Hold’ from ‘Sell’ at Evercore ISI.

Public Storage (PSA +1.90%) was downgraded to ‘Hold’ from ‘Buy’ at Cantor Fitzgerald.

Energy Transfer Partners (ETP +1.37%) and NuStar Energy (NS -0.03%) were both upgraded to ‘Buy’ from ‘Neutral’ at BofA/Merrill Lynch.

BioMarin (BMRN +12.18%) was downgraded to ‘Neutral’ from ‘Outperform’ at Baird.

EP Energy (EPE -1.35%) was upgraded to ‘Buy’ from ‘Neutral’ at SunTrust.

British Petroleum (BP +0.12%) was downgraded to ‘Sector Perform’ from ‘Outperform’ at RBC Capital.

Oshkosh Defense (OSK -0.99%) was awarded a $780.4 million government contract to recapitalize 1,363 Heavy Expanded Mobility Tactical Trucks, or HEMTTs, and 435 palletized load systems, or PLS, as well as 1,022 new palletized load system trailers.

Comcast (CMCSA +1.44%) filed to sell 2.66 million shares of Class A common stock for holders.

Gabelli reports a 5.94% stake in Rally Software (RALY -0.05%) .

Red Hat (RHT +0.29%) reported Q1 EPS of 44 cents, higher than consensus of 41 cents, and then raised guidance on fiscal 2016 EPS view to $1.81-$1.84 from $1.79-$1.82, better than consensus $1.81.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

10:00 Atlanta Fed’s Business Inflation Expectations

Notable earnings before today’s open: KBH, KMX

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers