Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up. China rallied more than 2%; Australia, South Korea and Japan moved up more than 1%; Honk Kong and Singapore also did well. Europe is currently mostly up. Greece is up 4.5%; Portugal is up more than 2%; London, Germany, France, Amsterdam, Stockholm, Switzerland and Belgium are up more than 1%. Futures here in the States point towards a moderate gap up open for the cash market.

Follow my public list at stockcharts.com.

The US dollar is up almost a buck. Oil is down, copper is up. Gold and silver are down. Bonds are down.

The standoff between Greece and its creditors is somewhat in control of the market right now. Wall St. wants peace, it wants Greece to stay in EU, regardless of whether that’s good or bad long term. It just doesn’t want the uncertainty hovering over the market. Yesterday we got a big gap up, and after a push higher, a close near the open. Today, on news Greece has been given an extra 48 hours, the market is up again.

Greece by itself doesn’t matter much, but Spain, Italy and Portugal do, and if Greece leaves the euro, it’ll pave the way for others to do the same. This is the real fear. It’s not Greece. It’s other much large economies.

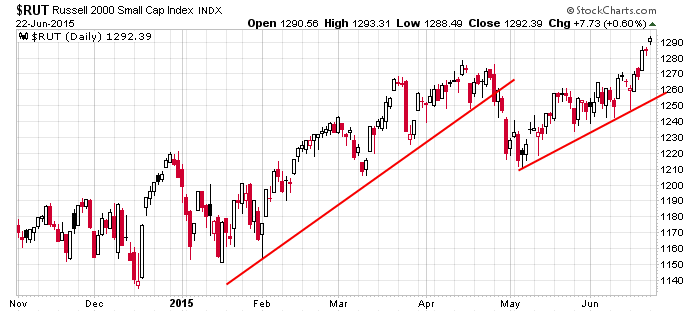

Despite the ups and downs, lack of staying power and some lagging internals, the small caps have very quietly put in a very good directional move the last two months and are now sitting at an all-time high.

I like the market, but it still can’t seem to get out of its own way. You never know. Maybe we’ll get several more months of the current action. Trade the market as it is, not the market you want. More after the open.

Stock headlines from barchart.com…

Darden Restaurants (DRI +0.74%) reported Q4 EPS of $1.08, stronger than consensus of 93 cents, and then raised guidance on fiscal 2016 adjusted EPS to $3.05-$3.20, well above consensus of $2.88.

American Airlines (AAL +3.54%) was downgraded to ‘Equal Weight’ from ‘Overweight’ at Morgan Stanley.

BlackBerry (BBRY +3.25%) reported a Q1 EPS los of -5 cents, a wider loss than consensus of -3 cents.

Newmont Mining (NEM -2.84%) was reinstated with an ‘Outperform’ at Credit Suisse with a price target of $30.

GrubHub (GRUB -1.05%) was initiated with a ‘Buy’ at Topeka with a price target of $44.

AMC Networks (AMCX +1.65%) was downgraded to ‘Hold’ from ‘Buy’ at Topeka.

Team Health (TMH +0.76%) was upgraded to ‘Overweight’ from ‘Sector Weight’ at KeyBanc.

AT&T (T +0.14%) was upgraded to ‘Buy’ from ‘Neutral’ at UBS.

Transocean Ltd. (RIG +1.74%) is up nearly 2% in pre-market trading after it said it received about $109 million of new contracts since its last report

Coca-Cola reported a 16.7% stake in Monster Beverage (MNST -0.16%).

Wexford Capital reported a 19.03% stake in Famous Dave’s (DAVE -1.67%).

Green Dot (GDOT +0.39%) surged over 20% in after-hours trading after it announced that it had entered into a new, long-term agreement with Walmart.

D. E. Shaw reported a 5% passive stake in Allison Transmission (ALSN +0.36%).

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Durable Goods

8:55 Redbook Chain Store Sales

9:00 FHFA House Price Index

9:45 PMI Manufacturing Index Flash

10:00 Richmond Fed Mfg.

10:00 New Home Sales

1:00 PM Results of $26B, 2-Year Note Auction

Notable earnings before today’s open: BBRY, CCL, DRI, IHS

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers