Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly up, but only China (up 2.5%) gained much ground. Europe is currently mostly down. Greece is down 3.8%; Germany, Portugal and Austria are down more than 1%; Stockholm, Prague, Spain, Italy and Russia are down noticeably. Turkey is up more than 1%. Futures here in the States point towards a moderate gap down for the cash market.

Follow my public list at stockcharts.com.

The dollar is down. Oil is flat, copper is up. Gold is flat, silver is up. Bonds are up.

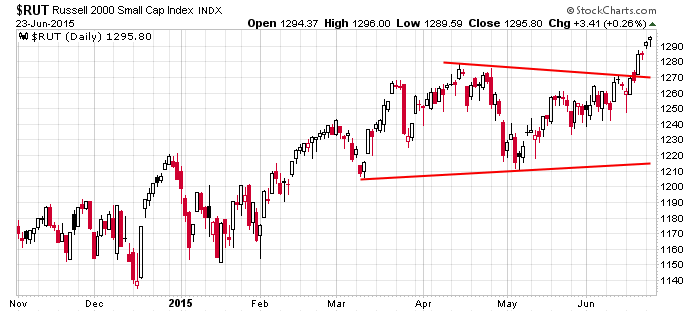

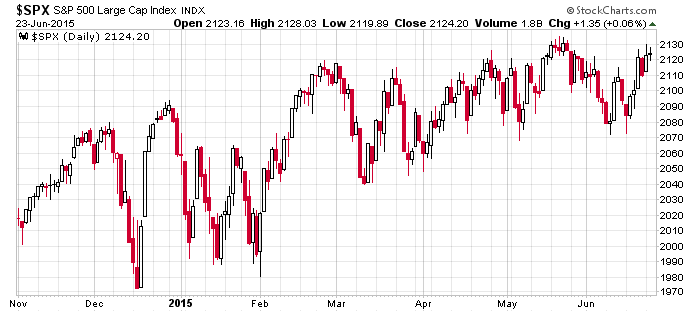

Yesterday was a slow day that saw the small caps hit another all-time high and the large caps trade quietly in a range.

The Russell has followed through nicely from its breakout last week.

The S&P, on the other hand, is trading near the top of its range…but is still range bound.

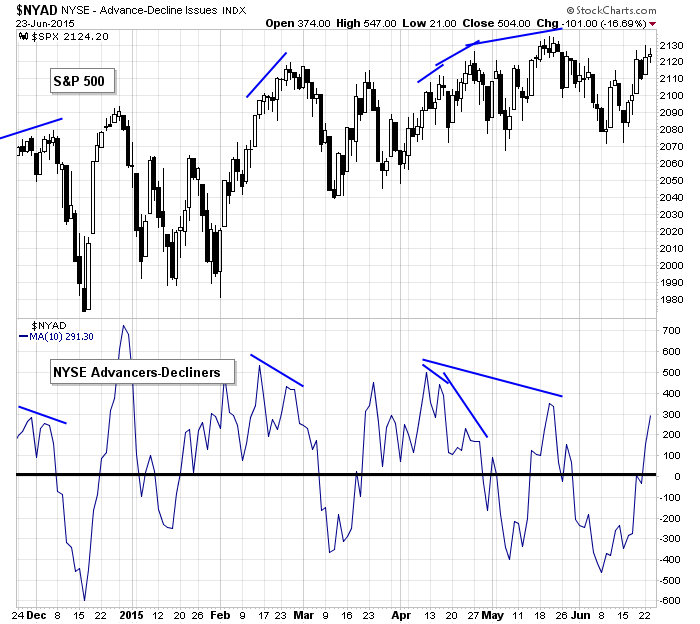

Several indicators, such as the 10-day MA of the NYSE AD line, have improved, so I continue to like the market. I don’t love it, but I like it and consider it tradeable for short term trades.

Go with the flow…but be open-minded. There are no guarantees here. More after the open.

Stock headlines from barchart.com…

Citigroup (C +0.77%) and Goldman Sachs (GS +0.87%) were both downgraded to ‘Hold’ from ‘Buy’ at Deutsche Bank.

McCormick (MKC +0.06%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Bernstein.

Electronic Arts (EA -0.06%) was upgraded to ‘Buy’ from ‘Hold’ at Jefferies with a price target of $80.

Anthem (ANTM -0.61%) was initiated with an ‘Outperform’ at RBC Capital with a price target of $222.

UnitedHealth (UNH +2.07%) was initiated with an ‘Outperform’ at RBC Capital with a price target of $159.

Comerica (CMA +1.10%) was upgraded to ‘Buy’ from ‘Neutral’ at BofA/Merril Lynch.

BHP Billiton (BHP +1.48%) was upgraded to ‘Neutral’ from ‘Underperform’ at Credit Suisse.

Lennar (LEN -1.01%) reported Q2 EPS of 79 cents, better than consensus of 64 cents.

Sysco (SYY -0.03%) dropped nearly 3% in after-hours trading after a federal judge blocked its bid to acquire U.S. Foods.

Ford (F +1.06%) was upgraded to ‘Buy’ from ‘Neutral’ at Goldman Sachs.

General Motors (GM +0.30%) was downgraded to ‘Neutral’ from ‘Buy’ at Goldman Sachs.

Columbia Pipeline Group (CPGX) will replace Allegheny Technologies (ATI +3.22%) in the S&P 500 as of the close of trading on July 1.

Netflix (NFLX +0.93%) rose nearly 3% in after-hours trading after it announced a seven-for-one stock split.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

8:30 GDP Q1

8:30 Corporate Profits

10:30 EIA Petroleum Inventories

11:30 Results of $13B, 2-Year FRN Auction

1:00 PM Results of $35B, 5-Year Note Auction

Notable earnings before today’s open: LEN, MON

Notable earnings after today’s close: APOG, BBBY, FUL, MLHR, SCS, WOR

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 24)”

Leave a Reply

You must be logged in to post a comment.

greece wants its cake and eat it to

it should default on all its debt inc usa [imf] and return to the drackmar currency

sack all public servants inc politicaians ,police.doctors judges and make coruption punishable by stoning to death–it should only reward producers and not pensioners

oops but greece is to enter a new europe/asian trade group—–the great silk road from china yanksee river to germany—buy the great china railroad to germany,buy china steel

greece to prosper from the rushian oil line to china

china and rushia to advance greece royalties and trade,whilst greece economy booms from tourisum

greece to be run by computers from mars

Hate this market… Jan 6 was my last buy signal of any significance. This is a dull market.