Good morning. Happy Friday.

The Asian/Pacific markets closed mixed; movement was small. China and Singapore moved up. Taiwan moved down. Europe is currently mostly up. Austria, Denmark, Finland, Italy and Sweden are up more than 1%; Netherlands, Switzerland, Prague, Germany, Spain, Portugal and France are also posting solid gains. Turkey and Russia are down more than 1%; Poland is also down. Futures here in the States point towards a small up open for the cash market.

VIDEO: Leavitt Brothers Overview

The dollar is flat. Oil is down, copper is down. Gold and silver are down. Bonds are down.

Last week was one of the market’s biggest up weeks of the year. A few indexes posted new highs; others got close. The mid caps lagged.

So far earnings season has been great for stocks. GOOGL, NFLX and others jumped to new highs after releasing their latest numbers.

Many technical indicators surged off extreme levels. Their movement confirmed the market strength.

All in all it was a great week. It was step one, but by no means is the 5-month consolidation pattern over. We need extreme bullish prints from the indicators and more new highs from the indexes…and some follow through and separation. You gotta start somewhere, so no complaints about last week…but it was only step one.

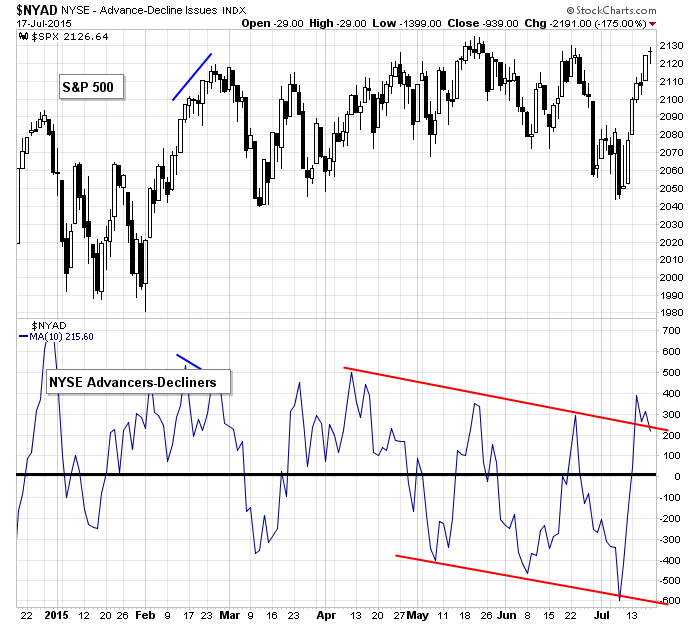

Here’s an example of an indicator that did great last week but is hardly in full-blown rally mode. The 10-day of the NYSE AD line. It surged off its lowest level of the year and then sat tight for a few days. We need two things. We need the indicator to stay above zero, and we will eventually need a high print. Last week was a good start, but we need more.

I switched my bias to “up” two weeks ago. So far, so good. I still favor the upside, but let’s not get cocky. The market can change quickly. As always, play good defense. More after the open.

Stock headlines from barchart.com…

Morgan Stanley (MS +0.73%) reported Q2 EPS of 79 cents, above consensus of 74 cents.

Halliburton (HAL -0.55%) reported Q2 EPS of 44 cents, higher than consensus of 29 cents.

Hasbro (HAS -0.22%) reported Q2 EPS of 33 cents, better than consensus of 29 cents.

Amazon.com (AMZN +1.58%) was upgraded to ‘Outperform’ from ‘Market Perform’ at Cowen.

Brocade (BRCD -1.02%) was downgraded to ‘Sell’ from ‘Neutral’ at UBS.

Hertz (HTZ +11.89%) was reinstated with an ‘Outperform’ at Credit Suisse with a price target of $23.

SanDisk (SNDK -1.12%) was upgraded to ‘Neutral’ from ‘Reduce’ at Nomura.

Dunkin’ Brands (DNKN -0.45%) was downgraded to ‘Underperform’ from ‘Outperform’ at CLSA.

Solera (SLH -1.96%) was downgraded to ‘Neutral’ from ‘Overweight’ at Piper Jaffray.

Zillow Group (Z -0.48%) was downgraded to ‘Underweight’ from ‘Equal Weight’ at Barclays.

Huntington Ingalls (HII -0.82%) was awarded a $106.2 million government contract for engineering, technical, design, configuration management, integrated logistics support, database management, research and development, modernization, and industrial support for Navy submarines.

Viking Global Investors reported a 5.2% passive stake in Ctrip.com (CTRP unch).

American Capital reported an 8.3% passive stake in WPCS International (WPCS -1.81%).

ESL Partners reported a 9.8% stake in Seritage Growth Properties (SRG +4.06%).

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

No events scheduled.

Notable earnings before today’s open: CALM, CBU, EXAS, GPC, HAL, HAS, LII, MS, PETS, SAH

Notable earnings after today’s close: BMI, BRO, BXS, CCK, CNI, EFII, ELS, HLX, HSTM, HXL, IBM, RLI, RMBS, SANM, STLD, WERN, WWD, ZION

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 20)”

Leave a Reply

You must be logged in to post a comment.

Much confusion after a hot weekend in the NW USA. Suspect that this week will be indeterminate – lost in the summer, but still convienced that Obama-Iran agreement means more crude oil and lower prices. Fed feels obligated show character, so expect something, .25 pt, before X-mas. The economy is behaving oddly, housing in particular. Consumer debt rising for no good reason. Be cautious consumer debt rising. The banks are making money trading. Feels very spotty into Oct when I will take a large position based on seasonality. Sticking to QQQ, VTI and avoiding gold in the meanwhile. Where does this end? Likely up, not much yet, but headed up. I will stay invested in market ETFs with stops. Have a good week if you can.

consumer debt mmmmm

what about the 600 trillion derivities debt off the 4 big usa insane banks

yes 600 trillion much larger than the gdp of the world

the usa has had it and will bring down the world ponsi

why did greece have to get fixed or was it sacrificed

usa is the most corupt country on earth

I sure am leery about being long. Looking at QQQ vs IWM makes me look at going short.