Good morning. Happy Tuesday.

The Asian/Pacific markets closed with a lean to the upside. Japan, Hong Kong, China, Malaysia and South Korea each rallied more than 0.5%. India fell 0.8%. Europe is currently split, and very few markets have moved much. Finland, Portugal and Switzerland are down; Hungary is up. Futures here in the States point towards a flat open for the cash market.

VIDEO: Leavitt Brothers Overview

The dollar is down. Oil is flat, copper is up. Gold and silver are up. Bonds are mixed.

The disparity between the large caps and the rest of the market is growing. For a short period of time it’s fine, but eventually it matters.

And a few indicators are starting to not support the market’s attempt to move up.

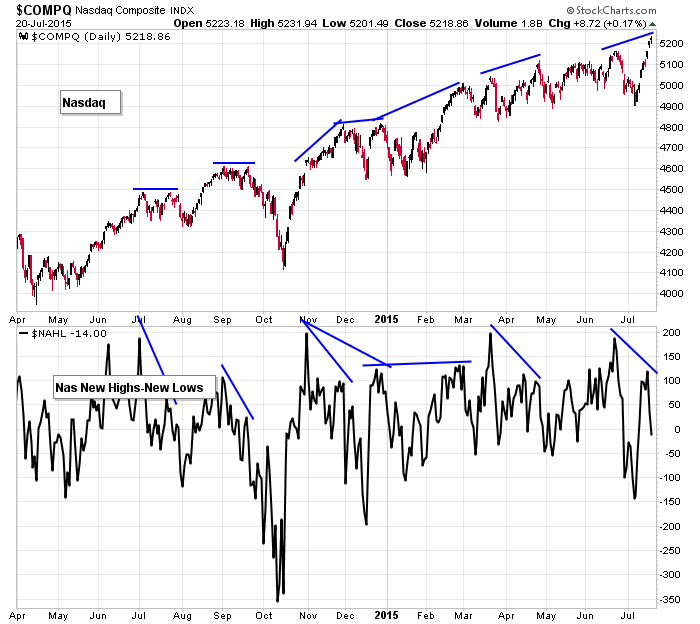

Here’s one. The Nasdaq (top pane) vs. Nasdaq New Highs – New Lows. The Nas hit another new high yesterday, but new highs – new lows clocked in at -14. Why aren’t more individual stocks hitting new highs? Or why are so many falling to new lows? It doesn’t make sense given the trend and current Nasdaq level.

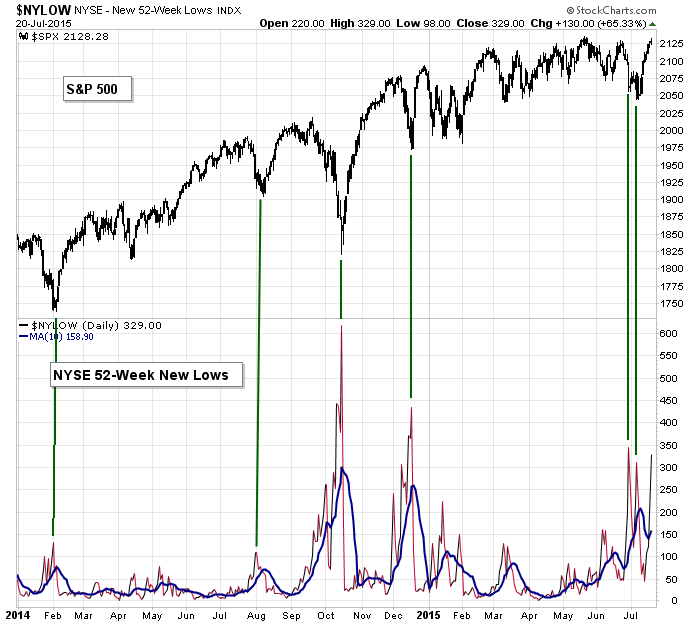

Here’s another. The S&P 500 (top) vs. 52-week lows at the NYSE. Why are new lows expanding while the market moves up? The S&P is about 85 points off its low, and the number of stocks falling to new lows is increasing?

I need to look deeper into these charts. At the very least we need “operating companies only” versions. Or perhaps the high number of new lows is commodities such as gold, silver, copper, etc and not anything we need to be overly concerned with.

The trend is up, but I want to see better support.

Stock headlines from barchart.com…

The Travelers Cos. (TRV -0.32%) reported Q2 EPS of $2.52, well above consensus of $2.12.

Verizon Communications (VZ +1.07%) reported Q2 EPS of $1.04, higher than consensus of $1.01.

Coca-Cola (KO +0.32%) was initiated with a ‘Buy’ at Sterne Agee CRT with price target of $46 and Dr Pepper Snapple (DPS +0.61%) was initiated with a ‘Buy’ at Sterne Agee CRT with a price target of $88.

Harley-Davidson (HOG -0.04%) reported Q2 EPS of $1.44, better than consensus of $1.39.

AB InBev (BUD +0.01%) was initiated with a ‘Buy’ at Sterne Agee CRT with a price target of $147.

PepsiCo (PEP +0.55%) was initiated with a ‘Buy’ at Sterne Agee CRT with a price target of $108.

Colgate-Palmolive (CL +0.44%) was initiated with a ‘Buy’ at Sterne Agee CRT with a price target of $75.

AvalonBay (AVB +0.11%) was initiated with a ‘Buy’ at SunTrust wit a price target of $191.

eBay (EBAY -56.90%) was downgraded to ‘Hold’ from ‘Buy’ at Stifel.

PayPal (PYPL +5.42%) climbed 3% in pre-market trading after it was initiated with a ‘Buy’ at BTIG with a price target of $48.

Woodward (WWD -0.30%) reported Q3 EPS of 66 cents, below consensus of 71 cents.

Monster Beverage (MNST +1.92%) was initiated with a ‘Buy’ at Sterne Agee CRT with a price target of $160.

Hexcel (HXL +1.30%) reported Q2 EPS of 63 cents, above consensus of 61 cents.

Sanmina (SANM +0.53%) jumped 8% in after-hours trading after it reported Q3 adjusted EPS of 53 cents, higher than consensus of 49 cents.

International Business Machines (IBM +0.41%) slid 5% in after-hours trading after it reported Q2 EPS of $3.84, better than consensus of $3.78, but Q2 revenue of $20.8 billion was less than expectations of $20.95 billion as sales declined for a thirteenth quarter.

Werner (WERN +0.36%) reported Q2 EPS of 44 cents, above consensus of 42 cents. although Q2 revenue of $534.64 million wsa below consensus of $539.65 million.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:55 Redbook Chain Store Sales

Notable earnings before today’s open: ABG, AMTD, ATI, BHI, BK, CFG, CP, DOV, EDU, FITB, HOG, INFY, LXK, MAN, MDSO, NEOG, NVR, NVS, OMC, PLD, PNR, RF, SAP, SBNY, SNV, TRV, TTS, UTX, VZ, WSO, WWW

Notable earnings after today’s close: AAPL, ACE, CMG, CMRE, CNMD, FTI, FULT, GPRO, HAWK, HTS, HUBG, IBKR, ILMN, IRBT, ISRG, KALU, LLTC, MANH, MSFT, NAVI, PKG, VASC, VMW, YHOO, ZIXI

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers