Good morning. Happy Wednesday.

The Asian/Pacific markets closed with a lean to the downside. Japan, Hong Kong and Australia fell more than 1%; South Korea and Taiwan also dropped noticeably. India and New Zealand did well. Europe, African and the Middle East are mostly down. Poland, South Africa and London are down more than 1%; Turkey, France, Germany, Finland, Switzerland, Norway, Israel, Hungary, Austria and Sweden are also posting sizable losses. Futures here in the States point towards a moderate gap down open for the cash market.

VIDEO: Leavitt Brothers Overview

The dollar is up. Oil and copper are down. Gold and silver are down. Bonds are up.

Earnings season was good for stocks last week. Netflix, Google and Facebook all jumped to new all-time highs. In fact Google added more market cap in a single day than any company in history.

This week is a different story, and it will be highlighted by Apple which did well but then guided slightly below expectations. The stock then dropped about 11 bucks in after-hour trading and is currently down about 9 in pre-market trading. Microsoft and Yahoo also reported and are down. This comes on top of big losses from United Technologies and IBM.

Other warnings are becoming more obvious.

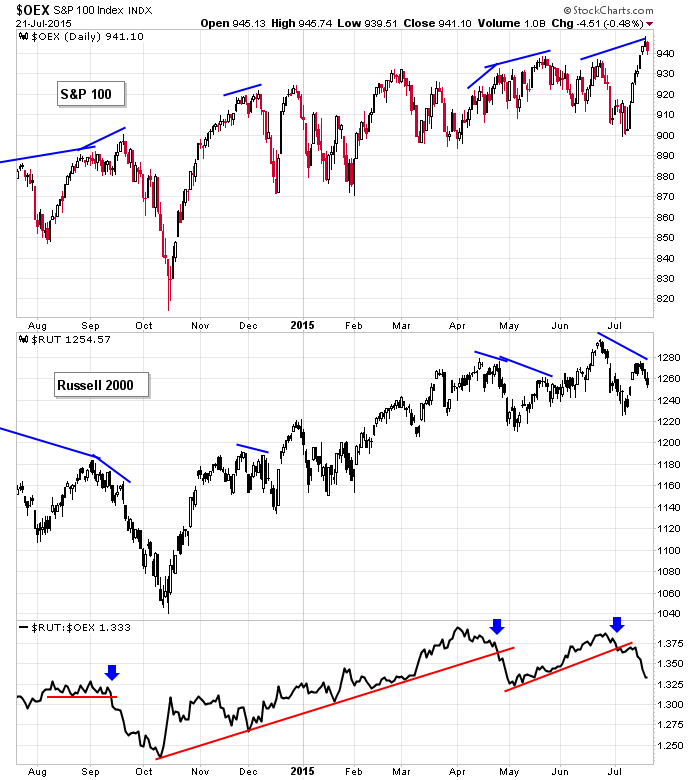

The small caps continue to lag and have put in obvious lower high while the large caps surged to a new high (see below).

New highs are registering, but so have new lows. In fact we gotten nearly equal number of new highs and new lows the last two days – a very odd development given last week’s huge rally. Why are so many stocks near new lows? Is is a warning? In my eyes, yes? It shouldn’t be the case.

The Nas bullish percent chart has put in a lower high. The S&P bullish percent chart didn’t move up last week and now continues to trend down.

I don’t like it. These aren’t the conditions I want in place for the market at attempt an across-the-board run to new highs followed by enough separation to confirm the long term uptrend remains in place.

I’m in bull-neutral mode. The means the big picture trend is up, but in the near term I’m neutral. Things can certainly change, but for now, despite last week’s rally, I don’t see good enough indications there’s much support for it to continue in the near term.

Here’s the large caps vs. small caps.

Stock headlines from barchart.com…

Apple (AAPL -1.00%) fell 5% in after-hours trading after it reported Q3 EPS of $1.85, higher than consensus of $1.81, but then lowered guidance on Q4 revenue to $49 billion-$51 billion, below consensus of $51.05 billion. The stock was then downgraded to ‘Market Perform’ from ‘Outperform’ at Cowen.

United Technologies (UTX -7.03%) was downgraded to ‘Neutral’ from ‘Overweight’ at Atlantic Equities.

AMC Entertainment (AMC -3.07%) was upgraded to ‘Buy’ from ‘Neutral’ at MKM Partners.

Thermo Fisher Scientific (TMO +0.22%) reported Q2 EPS of $1.84, higher than consensus of $1.78.

Whirlpool (WHR +1.88%) reported Q2 EPS of $2.70, above consensus of $2.62.

EMC (EMC -0.20%) reported Q2 adjusted EPS of 43 cents, above consensus of 41 cents.

Illumina (ILMN -1.03%) fell 9% in after-hours trading after it reported Q2 adjusted EPS of 80 cents, higher than consensus of 77 cents, although Q2 revenue of $539 million was less than consensus of $541.77 million.

Hub Group (HUBG +1.90%) reported Q2 EPS of 51 cents, above consensus of 43 cents.

Nuance (NUAN -0.12%) raised guidance on Q3 EPS to 31 cents-32 cents, better than consensus of 28 cents.

GoPro (GPRO +2.04%) reported Q2 adjusted EPS of 35 cents, higher than consensus of 26 cents.

Intuitive Surgical (ISRG +1.50%) moved up over 10% in after-hours trading after it reported Q2 EPS of $4.57, well above consensus of $3.98.

Yahoo (YHOO +0.48%) slid 3% in afrer-hours trading after it reported Q2 EPS of 16 cents, below consensus of 18 cents.

Microsoft (MSFT +0.77%) reported Q4 adjusted EPS of 62 cents, above consensus of 56 cents.

VMware (VMW -0.99%) reported Q2 EPS of 93 cents, better than consensus of 91 cents.

Chipotle (CMG -0.73%) reported Q2 EPS of $4.45, higher than consensus of $4.44.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

7:00 MBA Mortgage Applications

9:00 FHFA House Price Index

10:00 Existing Home Sales

10:30 EIA Petroleum Inventories

Notable earnings before today’s open: ABT, ACAT, AN, ANGI, APH, ARMH, BA, BABY, BEAV, CHKP, CLI, EMC, EVR, IPG, ITW, JAKK, KNX, KO, LAD, MKTX, NOR, NTRS, NYCB, OC, PII, RDN, SEIC, SILC, SIX, SLGN, STJ, TEL, TMO, TUP, WHR

Notable earnings after today’s close: AF, AFOP, AMP, AWH, AXP, BDN, BGS, CAKE, CCI, CLB, CRUS, CVA, CVTI, CYS, DFS, DLB, EFX, EGHT, FBHS, FFIV, FTK, FTNT, GGG, GLF, HNI, IBKC, IEX, INFN, LHO, LOGI, LVS, MKSI, MLNX, MOSY, MSA, NEM, OII, PLCM, PLXS, QCOM, QDEL, RJF, SCSS, SLG, SLM, SNDK, TCBI, TSCO, TXN, TYL, UCTT, URI, VMI, WFT, XLNX

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 22)”

Leave a Reply

You must be logged in to post a comment.

This morning 47% of stocks are below the prior day level based on TAZ analyizer at TFNN. The markets are having problems with earnings and political events. Not looking for much positive today. IBM seems to me to be in serious trouble. This may be spreading based on the more general economic reports. The Leavitt list of daily econ reports is a key part of my daily trading; no much planned for today but am concerned housing is in a fad. A few puts are my hedge. I am ignoring gold and bonds which seem to say that a depressive move may be under way before a later inflationary spiral. Out of my old Vanguard balanced fund. If it is not one damned thing its another.

Great work Jason!

You came to the same conclusion I did using different methodology.

I must say that I am not quite willing to go short but close.

I must say I am tempted to rework my models for the “new” market. Last time I did that was October 2000 when I got a buy signal…. I went back to the old models… And somewhat poorer.

this may not be the big down trend reversal crash just yet

but it is a warning

the first noticeable downtrend will come out of europe spread to japan then later to usa

but note usa markets are influenced by london and europe till high noon usa time

as the great debt imposion ponsi unfolds world govts will become like caged animals and turn on their people