Good morning. Happy Monday. Hope you had a great weekend.

The Asian/Pacific markets closed mostly down. China dropped 8.5%, Hong Kong more than 3%, Taiwan more than 2% and India, Indonesia, Singapore and Japan 1% or more. Europe is currently down across-the-board. France, Italy and Germany are down 2%. Austria, Belgium, Netherlands, Norway, Sweden, Switzerland, Denmark, Turkey, Finland, Spain and Portugal are down more than 1%. Futures here in the States point towards a moderate gap down open for the cash market.

Join our email list to get reports and videos sent directly to you.

The dollar is down. Oil is down, copper is down. Gold and silver are up. Bonds are up.

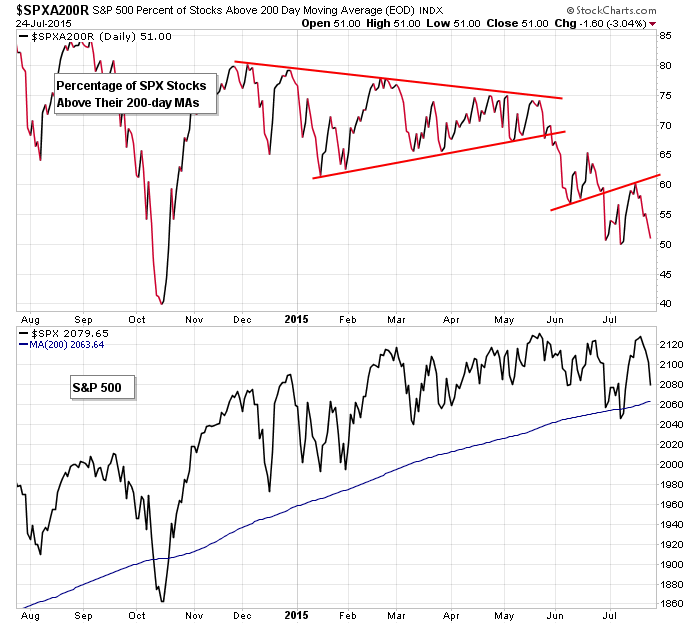

We enter this new week with the market in bad shape. Besides last week’s big drop, which wasn’t that much different than several other drops that have played out the last couple months, market breadth continues to deteriorate. In the near term anything goes, but when breadth weakens, the market will not be able to sustain a move up. It’s just not mathematically possible. Here’s an example.

The top pane of the chart below is the percentage of S&P stocks above their 200-day MA. The chart broke down at the beginning of June and then again at the end of June, and then two weeks ago it got rejected by a former support line. How can the market move up while the percentage of SPX stocks trading above their 200-day MAs declines? It can in the short term – anything goes in the short term – but over time it’s just not possible. A small number of stocks can do the heavy lifting for some time, but that just can’t last. That’s like asking the five starters of a basketball team to play the entire game. It’s fine once in a while, but eventually they’ll get worn out.

After rallying about 25% in just over two weeks, China fell 8.5%, so suddenly the government controls are not working. The US market wasn’t largely unaffected by China’s big June/July drop, so I think the bigger influence here relates to the Fed. The Fed has stated that besides inflation and employment, if there are concerns going on in the world, they’ll hold off raising rates. A crashing Chinese market certainly qualifies as a concern. The next FOMC meeting is Wednesday.

After being close for a month, the Greek stock market may open tomorrow. Who knows where it may gap to.

Bias remains to the downside. More after the open.

Stock headlines from barchart.com…

Teva Pharmaceuticals (TEVA -1.06%) is up more than 5% in pre-market trading and Allergan (AGN -2.14%) is up more than +6% after Teva agreed to buy the generic drug business of Allergan for about $40 billion. Separately, Teva withdrew its hostile bid to buy Mylan NV.

McGraw Hill Financial (MHFI -0.86%) will acquire SNL Financial for $2.2 billion.

McGraw Hill Financial (MHFI -0.86%) reported Q2 adjusted EPS at $1.21, better than the consensus of $1.13.

Beacon Roofing (BECN -0.56%) will acquire Roofing Supply Group for approximately $1.1 billion from investment firm Clayton, Dubilier & Rice.

Roper Technologies (ROP -0.98%) reported Q2 adjusted EPS of $1.70, better than the consensus of $1.64.

Signet Jewelers (SIG -1.98%) will replace DirecTV (DTV +1.48%) in the S&P 500 as of the close of trading on Tuesday, July 28.

Pinnacle Entertainment reported a 21.3% stake in Gaming and Leisure Properties (GLPI -1.14%).

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Durable Goods

10:30 Dallas Fed Manufacturing Outlook

Notable earnings before today’s open: ACW, AVX, BOH, CYOU, HAE, LECO, MGLN, NSC, ONB, PHG, POL, QSR, ROP, RPM, SOHU, WAL, XCO

Notable earnings after today’s close: ACC, AGNC, AHL, ALSN, AMKR, ARE, AVB, BIDU, BRX, CDNS, CKEC, CMP, CNL, CR, EMN, GIG, HIG, HLIT, IPHS, JJSF, KN, MSTR, OMI, PCL, PLT, PRE, RCII, RE, SIMO, SWFT, SWN, TMK, UDR, WCN, WRB

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 27)”

Leave a Reply

You must be logged in to post a comment.

The durable goods are saying something OK then after a correction for inflation it appears autos are not attractive.. Confusing since the buyers are not paying for the cars, but using on average 7-10yr notes.

Hold on besides China, we have issues on internals and it could get worse. Short via puts eod if market indexs are down.

i like futures contracts as ai can be more interactive

ym for me

i think the future is that the bull is dead from eating to much bearomite

most to expect is corrective rig a mortis

id say ur right…bulls are far and few between..

Got a buy signal… First since early January. It might only be a two day bounce but take what the market gives you. I look for weakness early today and looking for a bounce until Wed.

large commodity hedge funds have been margin called and have to sell everything

instos with their high frequency machines viewing everything have run the bulls stops

and with what looks like successfull retest of todays lows a 2 day rally is possible

but intraday i want to see a break above a lower high–its trying to

official dow with the break under 17465 is now a big grand bear