Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly down. China, Indonesia and Singapore dropped more than 1%. Europe is currently mostly up. Germany, France, Austria, Netherlands, Russia, Turkey, Denmark, Spain, Bulgaria and Italy are up more than 1%. Futures here in the States point towards a moderate gap up open for the cash market.

Join our email list to get reports and videos sent directly to you.

The dollar is up. Oil is flat, copper is up. Gold and silver are down. Bonds are down.

The market continued its slide yesterday. The S&P has now fallen 5 consecutive days, matching its longest losing streak of the year. But along with all this selling pressure comes indicators which are oversold.

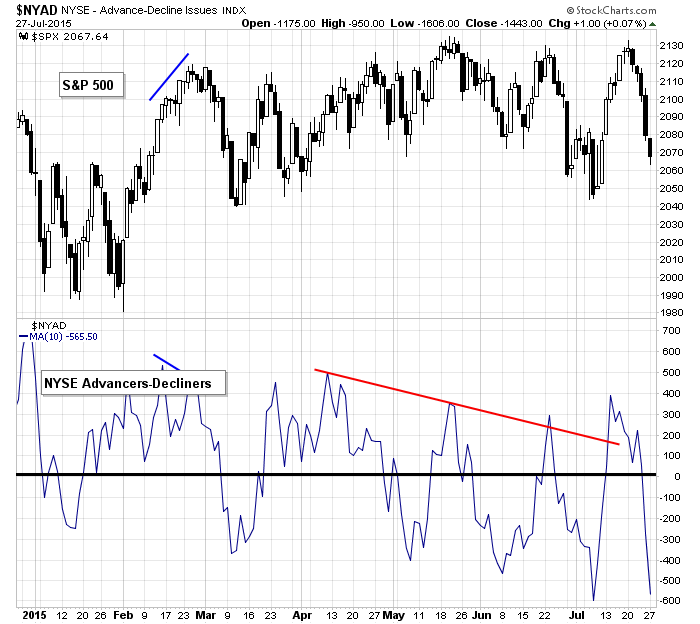

The AD line has pretty much matched its low of the year.

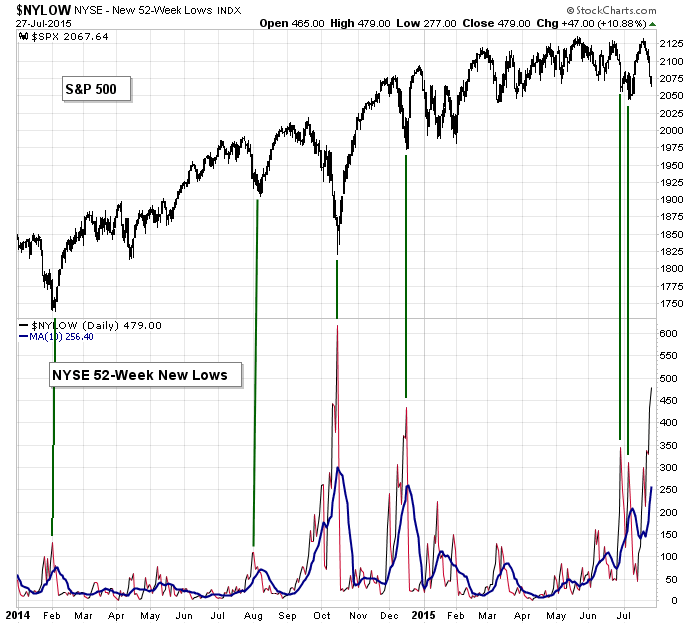

New lows have spiked.

Purely from a technical standpoint, these prints would support a pop in the near term. Throw in the FOMC announcement/statement, which is tomorrow, and we have a decent foundation for a bounce. How far it goes and how long it lasts is anyone’s guess, but at the very least a few criteria point in that direction.

Overall the market is still range bounce, so don’t get overly bullish/bearish on rallies/sell-offs. More after the open.

Stock headlines from barchart.com…

Baidu Inc (BIDU -4.16%) is down more than 7% in pre-market trading after the biggest Chinese search engine company missed its quarterly sales estimates. In addition, Deutsche bank today downgraded Baidu to Hold from Buy due to expectations for reduced profit margins on a “massive” increase in spending costs.

SPX earnings reports this morning have been a bit better than expected on balance. Positive reports include Corning (GLW -0.70%) ($0.38 vs consensus of $0.37), Airgas (ARG -1.72%) (1.16 vs 1.15), Textron (TXT -1.41%) (0.60 vs 0.59), Wyndham (WYN -1.76%) (1.32 vs 1.26), Nielsen (NLSN -0.82%) (0.66 vs 0.64), Reynolds American (RAI -0.45%) (1.02 vs 0.96), Ford (F +1.11%) (0.47 vs 0.37), Merck (MRK -0.73%) (0.86 vs 0.81), Pfizer (PFE +0.23%) (0.56 vs 0.52), DR Horton (DHI +0.04%) (0.63 vs 0.50), Waters (WAT -0.66%) (1.32 vs 1.27), National Oilwell Varco (NOV -1.35%) (0.77 vs 0.64), Cummins (CMI -0.47%) (2.62 vs 2.55).

Negative earnings reports this morning include: Precision Castparts (PCP -0.72%) (2.87 vs 3.00), du Pont (DD -0.37%) (1.18 vs 1.21), CONSOL Energy (CNX -1.64%) (-0.37 vs 0.0), Intersoll-Rand (IR -1.52%) (1.20 vs 1.23), Marsh & McLennan (MMC -0.31%) (0.79 vs 0.794), Lab Corp of America (LH -0.38%) (1.79 vs 2.03), Masco (MAS -0.90%) (0.31 vs 0.34).

GM (GM -0.03%) will spend $5 billion in global growth markets, according to the Financial Times.

Procter & Gamble (PG -0.40%) will name David Taylor as next CEO, according to Dow Jones.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

FOMC meeting begins

8:55 Redbook Chain Store Sales

9:00 S&P Case-Shiller Home Price Index

9:45 PMI Services Index Flash

10:00 Consumer Confidence

10:00 Richmond Fed Mfg.

10:00 State Street Investor Confidence Index

1:00 PM Results of $26B, 2-Year Note Auction

Notable earnings before today’s open: AGCO, AHGP, AIXG, AKS, ALLY, AMG, ARG, ARLP, ARW, AUDC, AUO, AXE, BP, BTU, CIT, CMI, CNC, CNX, COMM, CPLA, CRY, CVLT, CYNO, DD, DHI, DHX, ECL, F, FBC, FCH, FDP, FMER, FSS, GLW, GPN, GRUB, ICLR, IPGP, IPI, IR, JBLU, JEC, KEM, LH, LPT, LYB, MAS, MMC, MRK, MZOR, NCI, NLSN, NOV, NTLS, OAK, OFC, PCAR, PCH, PCP, PFE, POR, RAI, RDWR, SALT, SIR, SIRI, ST, SVU, TXT, UPS, UTHR, WAT, WDR, WYN

Notable earnings after today’s close: AFL, AIZ, AJG, AKAM, APC, ARI, ATML, ATR, ATRC, AXS, BBRG, BGFV, BLDP, BMR, BOOM, BWLD, BXMT, CALX, CAP, CEB, CHRW, CINF, CLMS, CTXS, CUZ, DHT, EEFT, EQR, ESRX, ETH, EW, EXAC, EXAM, GAS, GCA, GILD, GPRE, HA, HT, HURN, IACI, IPHI, KIM, LNDC, MTSI, NATI, NCR, NEU, NGD, NUVA, NVDQ, NVMI, OIS, PEI, PNRA, RGR, RNR, RPXC, RRC, RSYS, RUBI, SLCA, SM, SPWR, SSW, TSS, TWTR, ULTI, VDSI, VR, VRSK, VRTU, WNC, WRI, WSH, X, YELP

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 28)”

Leave a Reply

You must be logged in to post a comment.

Yes we are still range bound… Not quite enough washout to get the bulls on a stampede!

the decline will be in 5 waves take 10 years and end with stocks at zero as the debt implosion bankrupts all countries and banks

wave one will have 5 waves and end at dow 16000

sub wave one of one may have just finished but i was expecting dow 17200

wave 2 dead cat bounce may last 1-4 days and be a lower high

then yummy massive wave 3 possibly early august

as soverigns go belly up all over europe and germany will be on the hook for the bailouts–see dax

this will then spready to bankrupt japan

the the grossly bankrupt usa

goverments will act like caged animals and turn on its citezens and confiscate all their money