Good morning. Happy Friday.

The Asian/Pacific markets closed mostly up. China and Singapore dropped more than 1%; India, Indonesia and Malaysia rallied more than 1%. Europe is currently mixed, but there aren’t many big movers. Turkey is up more than 1%. Poland and Denmark also doing well. Norway, Spain and Portugal are down the most. Futures here in the States point towards a down open for the cash market.

July Archives

The dollar is down. Oil and copper are down. Gold and silver are down. Bonds are down.

It’s the last day of the week and month. The indexes are near their highs of the week, but with today’s gap down open, it’ll take a little work to close near the high. The S&P is up about 29 points (1.4%). Not bad.

Here’s the weekly chart. Big alternating candles the last three weeks. Momentum is not able to sustain itself for more than a few days. Rallies get sold, dips get bought. Repeat, repeat, repeat. The indicators have been helpful hinting at reversals, but unfortunately for swing traders, moves haven’t lasted long. It is what it is. You make adjustments or you die.

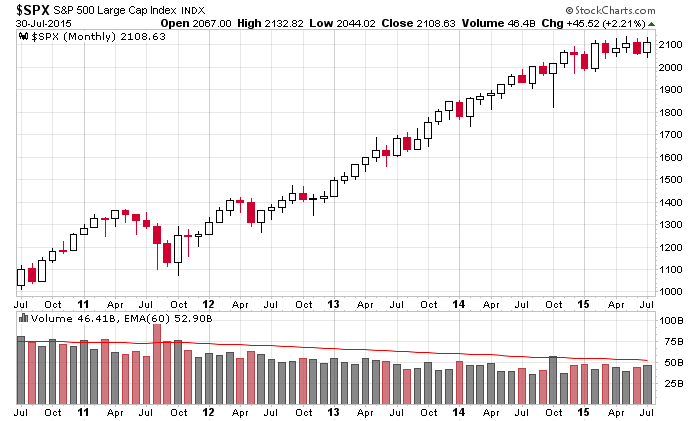

Backing up, here’s the monthly. Other than a brief correction in October that only lasted two weeks, there has not been a noticeable pullback in four years. You cannot be anything but bullish on a long time frame. I don’t trade off this monthly chart, but it does give us perspective. Despite all the stuff going on in the world, our market is simply in a little consolidation phase within a steady uptrend.

Shorter term the internals are still a concern. That monthly chart above isn’t going to bust out until breadth improves…and if it doesn’t improve, the lows of the range will be tested. Probably sooner than later. More after the open.

Stock headlines from barchart.com…

SPX earnings reports this morning have all been positive thus far: Weyerhaeuser (WY +0.53%) (0.26 vs 0.20 consensus), Tyco (TYC +0.38%) (0.59 vs 0.56), Aon (AON +0.06%) (1.31 vs 1.29), Newell Rubbermaid (NWL +1.16%) (0.64 vs 0.62), Legg Mason (LM +1.16%) (0.84 vs 0.83).

Amgen (AMGN +0.13%) is up +1% in pre-market trading after reporting favorable earnings of 2.57 (vs 2.43).

LinkedIn (LNKD -2.09%) fell 4% as concerns arose about slowing core growth.

SPX earnings reports late yesterday afternoon were mostly positive: Electronic Arts (EA +0.17%) (0.15 vs 0.03), Western Union (WU -0.11%) (0.41 vs 0.39), Apartment Investment (AIV -0.53%) (0.56 vs 0.54), Hanesbrands (HBI +1.19%) (0.50 vs 0.499), Flowserve (FLS +0.28%) (0.80 vs 0.79), Eversource Energy (ES +0.99%) (0.66 vs 0.56), KLA-Tencor (KLAC +0.62%) (0.99 vs 0.92), FirstEnergy (FE +1.07%) (0.53 vs 0.47), PerkinElmer (PKI +1.32%) (0.60 vs 0.59), Expedia (EXPE +0.69%) (1.02 vs 0.87), Universal Health Services (UHS -0.61%) (1.85 vs 1.65).

Negative SPX earnings reports late yesterday included: Leggett & Platt (LEG +0.86%) (0.53 vs 0.538), Broadcom (BRCM -0.89%) (0.72 vs 0.75), Fluor (FLR +1.01%) (1.00 vs 1.06).

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Employment Cost Index

9:45 Chicago PMI

10:00 Reuters/UofM Consumer Sentiment

Notable earnings before today’s open: AEE, AON, AXL, BERY, BPL, CBOE, CVX, DSX, ENB, GIL, HMC, HPY, IMGN, IMS, ITT, KCG, LM, LPNT, MGI, MOD, MOG.A, MT, NJR, NWL, PEG, PNM, PSX, PSXP, RCL, RLGY, RUTH, STX, SWC, TDS, TNP, TRP, TYC, USM, VRTS, WETF, WMC, WY, XOM

Notable earnings after today’s close: none

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 31)”

Leave a Reply

You must be logged in to post a comment.

things change fast in this fairy floss market,lead by central bank intervention world wide to prevent a crash

but the tide is turning on these criminals and every one is getting to know their perverse game to save their own skins—not the economy

interday this looks like a wave 2 corrective and should not hit new all time highs–but who knows

dow is the weakest and may top at 17800-18000

spx the strongest and 2119 today may see the end of this 4 day event

ndx looks like top could be in

the only ones winning out of this are the instos running stops and getting set short on their massive derivitives plays–when they have had enough they will let the markets fall

I will Be invested for a while into Sept, but not too much. Just indexes. Humble investors know they don’t know and will not attempt to talk themselves into anything. What does Sept hold. Rate increase?

Right now Porta Rica is due to make a payment on its debts. This one can be a sticker, the US Treasury is the bank of last resort.

Big move in treasury notes this morning. Euro moves up. Gold is acting oddly. German bunds are moving up. So maybe short US treasury bonds? The annouced low wages in the US economy was a surpise, not.