Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. China dropped 2.2%, Singapore 1.1% and South Korea 0.9%. Taiwan rallied 1%, and Australia moved up 0.8%. Europe is currently mostly up, but there aren’t many big movers. Turkey, Finland, Norway, Portugal, London, France, Netherlands and Russia are doing well. Poland and Spain are lagging. Futures here in the States point towards a down open for the cash market.

Join our email list to get reports and videos sent directly to you.

The dollar is up. Oil is up, copper is down. Gold and silver are down. Bonds are down.

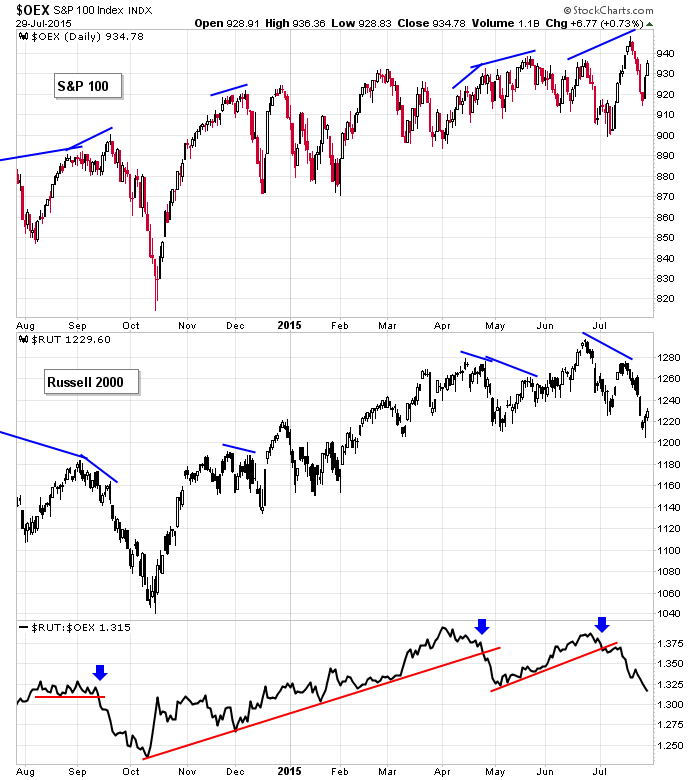

The market has moved up two consecutive days. The rally from the large caps is much more impressive than the rally from the small caps and Nasdaq. This has been the case all month…it’s one of the things that helped us a top last week. Here’s a chart relating the S&P 100 and Russell 2000.

Many indicators have moved off their lows but haven’t surged or moved robustly. It’s a first step, but it has to continue for there to be any more upside.

Overall I lean to the downside. Rallies keep getting sold and dips keep getting bought, but while this is taking place, the internals suggest some internal deterioration. The participation rate is low, so despite some of the indexes doing fine, it’s a small number of stocks that are doing the heavy lifting. Unless we see broad-based improvement, no rally will last long or go far.

Today is a post-Fed day. In the past the market has often reversed its FOMC move. It’s as if the knee-jerk reaction was wrong, and then everything reversed the following day. Be on the look out for this.

All trades continue to be short term. They don’t have to be day trades, but I do think it’s wise to have a defensive posture. Take the money when offered. More after the open.

Stock headlines from barchart.com…

Positive SPX earnings reports this morning include: ConocoPhillips (COP +1.26%) ($0.07 vs consensus of $0.04), Air Products (APD +0.99%) (1.65 vs 1.58), Cigna (CI -0.32%) (2.55 vs 2.25), Helmerich & Payne (HP +3.51%) (0.27 vs 0.12), Stanley Black & Decker (SWK +1.88%) (1.49 vs 1.44), Allegion (ALLE +2.18%) (0.71 vs 0.706), Alexion Pharma (ALXN -2.35%) (1.44 vs 1.39), Starwood Hotels (HOT +2.42%) (0.84 vs 0.74), Pitney Bowes (PBI +0.87%) (0.45 vs 0.44), Procter & Gamble (PG +0.49%) (1.00 vs 0.95), Cardinal Health (CAH +0.80%) (1.00 vs 0.99), DENTSPLY (XRAY +2.21%) (0.73 vs 0.68), Sealed Air (AEE +0.79%) (0.60 vs 0.53), CME Group (CME +0.88%) (0.97 vs 0.92), Delphi Automotive (DLPH +1.36%) (1.34 vs 1.339), Valero (VLO +1.49%) (2.66 vs 2.42), Coca-Cola (CCE +1.90%) (0.79 vs 0.76), SCANA (SCG +1.03%) (0.69 vs 0.67), Invesco (IVZ +1.18%) (0.62 vs 0.618).

Negative SPX earnings reports this morning include: TECO Energy (TE +0.51%) (0.26 vs 0.267), Ball Corp (BLL +1.61%) (0.89 vs 0.94), Time Warner (TWC +0.12%) (1.54 vs 1.80), Xcel Energy (XEL +0.42%) (0.39 vs 0.396), L-3 Communications (LLL +2.02%) (1.41 vs 1.71), Colgate-Palmolive (CL +0.79%) (0.70 vs 0.704), Occidental Petroleum (OXY +1.78%) (0.21 vs 0.225), Sigma-Aldrich (SIAL -0.04%) (1.01 vs 1.103), Marathon Petroleum (MPC +2.38%) (1.51 vs 1.75), Zimmer Biomet Holdings (ZBH +0.47%) (1.12 vs 1.57).

On positive earnings news late yesterday, Skechers (SKX +3.12%) rallied 10%, Teradyne (TER +0.27%) rallied 6%, and Lam Research (LRCX -0.10%) rallied +1.5%.

On negative earnings news late yesterday, Facebook (FB +1.78%) fell -3%, Whole Foods (WFM -0.29%) fell 11%, Lifelock (LOCK +11.15%) fell 7%, La Quinta (LQ +2.45%) fell 3%, and Whiting Petroleum (WLL +7.02%) fell 5%.

Earnings and Economic Numbers from seekingalpha.com…

Today’s economic calendar:

8:30 Initial Jobless Claims

8:30 GDP Q2

9:45 Bloomberg Consumer Comfort Index

10:30 EIA Natural Gas Inventory

1:00 PM Results of $29B, 7-Year Note Auction

3:00 PM Farm Prices

4:30 PM Money Supply

4:30 PM Fed Balance Sheet

Notable earnings before today’s open: AAWW, AB, ACI, ACIW, ACOR, ACRE, ADP, ALKS, ALLE, ALU, ALXN, AMRC, APD, AVP, AWI, AZN, BC, BCO, BG, BLL, BUD, BWA, BWEN, CAH, CBB, CBM, CBR, CCE, CCJ, CEVA, CI, CL, CME, COP, COT, CPN, CRL, CRR, CRS, CSH, CVE, CVI, CVRR, DBD, DCIX, DFT, DLPH, EDR, EME, ENTG, EPD, ERJ, ESI, EXLS, FCAU, FCN, FIG, FMS, GG, GHM, GLOP, GLPI, GNC, GOV, GTLS, GVA, HEES, HOT, HP, HST, I, IART, IDA, IDCC, IDXX, INGR, IRDM, IRM, IT, ITC, IVZ, KMT, LBY, LINE, LKQ, LLL, MD, MDLZ, MDP, MDXG, MMYT, MOBL, MPC, MPLX, MSCI, MTRN, MWW, NAVB, NICE, NMM, NNN, NOK, NTCT, ODFL, OSK, OXY, PBI, PCRX, PES, PF, PG, PNK, PNW, POT, PRFT, PWE, RDS.A, RFP, RTIX, RYAM, RYL, SC, SCG, SEE, SHOO, SHOP, SMP, SNE, SNMX, SSYS, SUI, SWK, TASR, TDY, TE, TEX, TFX, TKR, TMUS, TWC, TWI, UAN, UFS, UPL, VA, VG, VICL, VLO, VLY, WST, WWE, XEL, XRAY, XYL, YNDX, ZBH

Notable earnings after today’s close: AIV, AMCC, AMGN, ATEN, AUY, AVD, AXTI, BAS, BCOR, BCOV, BRCM, BVN, CALD, CATM, CLW, CMLS, COHR, COLM, CPSI, CPT, CRAY, CTRL, CXP, DCT, DECK, DGI, DLR, DTLK, EA, EEP, EGO, EIX, ELLI, ES, ESS, EVHC, EXPE, FE, FEIC, FEYE, FLR, FLS, FR, FRGI, GB, GMED, HBI, HK, HME, HTCH, IM, IMMR, INT, ISBC, KAMN, KLAC, LEG, LNKD, LRE, LSCC, MOH, MTD, MTSN, MWA, MXWL, NGVC, NR, NSR, OLN, OMCL, OUTR, PCCC, PDFS, PKI, PODD, PTCT, PXLW, QLGC, QTM, RGC, RMD, RNG, ROVI, SAM, SB, SGEN, SKYW, SPF, SPN, SYA, SYNA, SZYM, TCO, TEP, TMST, TNAV, TNDM, TPX, TSYS, TXTR, UHS, VCRA, VVUS, WAGE, WBMD, WU, WWWW, YRCW, ZLTQ

Other…

today’s upgrades/downgrades from briefing.com

this week’s Earnings

this week’s Economic Numbers